Table of Contents

What if buying a fraction of a skyscraper or owning a share in a vintage car collection was as simple as trading stocks? Well, that’s the idea of real-world asset tokenization!

By turning physical assets into digital tokens on a blockchain, we are unlocking new ways to invest, trade, and access markets that were once out of reach.

And it’s not just hype. In 2024, the global market for tokenized assets was valued at approximately $865.5 billion, and it is projected to reach $1.24 trillion by the end of 2025.

So, are you looking to know what’s more here? Or what its future holds?

Here’s a blog for you. In this, we will discuss the key trends fueling this revolution and why it is relevant for investors and everyday people.

What is Real-World Asset Tokenization?

Basically, real-world assets or RWAs, refer to the tangible assets that exist outside the digital space. These can be bonds, real estate properties, commodities, machinery, and more. In the context of blockchain, it is all about digital tokens that represent these physical and financial assets. The tokenization of RWAs is witnessed as one of the largest market opportunities in this blockchain.

Tokenization is the process of converting real-world assets into digital tokens through blockchain technology. It enables fractional ownership and makes high-value assets more accessible to individuals by dividing these into smaller and more affordable units. Tokenized real-world assets tend to offer greater liquidity, transparency, and accessibility.

Current Market Insights of RWA Tokenization

- According to Forbes, the real-world asset tokenization market is currently estimated at around $24 Billion in on-chain tokenized assets.

- Over the past three years, the RWA tokenization market growth forecast has reached the skies. It has grown 380% and has reached around $24 billion this month. Isn’t that amazing?

- On platforms like RWA.xyz that track tokenized assets market, figures suggest total RWA value has exceeded $30 billion, with more than 412,000 asset holders and over 220 issuers.

- The most recent report from Coinlaw reveals that tokenized treasury and money market instruments have risen to an impressive USD 7.4 billion in 2025, marking an extraordinary 80% increase year-to-date.

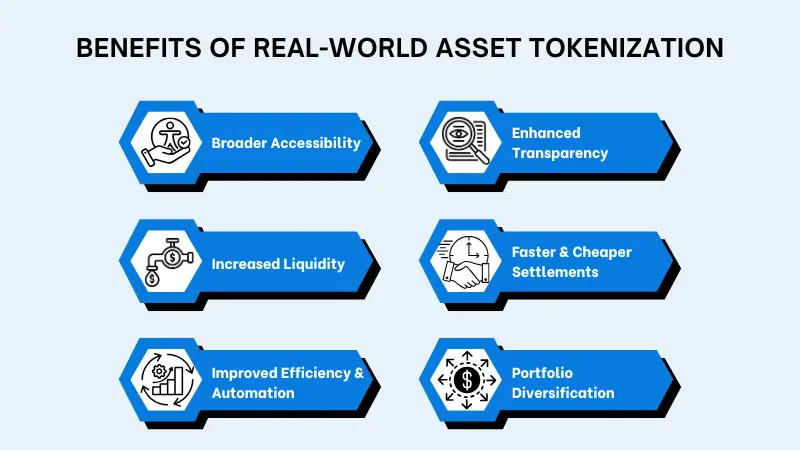

Key Benefits of Real-World Asset Tokenization

There are several potential benefits to tokenizing real-world assets (RWA) using blockchain technology, which include:

Broader Accessibility

RWA tokenization lowers entry barriers by enabling fractional ownership and global online access. Investors no longer need large capital to participate in high-value asset markets. This even opens up opportunities for retail investors worldwide.

Enhanced Transparency

Blockchain technology records all transactions on a public and immutable ledger. This ensures clear and tamper-proof records of asset ownership and transfer history. Transparency builds trust among stakeholders and reduces fraud risk.

Increased Liquidity

Tokenizing of real-world assets facilitates their easy purchase and sale on digital platforms. Specifically speaking, real estate tokenization converts property assets into digital tokens that can be traded on blockchain platforms. This boosts liquidity in a traditionally illiquid market by enabling fractional ownership.

Faster & Cheaper Settlements

Traditional asset transfers can take days and involve multiple intermediaries. Tokenized assets use blockchain and smart contracts to automate settlements in minutes or even seconds. This reduces costs, eliminates delays, and lowers the risk of settlement failures.

Improved Efficiency & Automation

Smart contracts automate key processes like compliance checks, dividend distribution, transfer restrictions, and regulation of real-world asset tokenization. This reduces reliance on manual workflows, lowers administrative costs, and minimizes human error.

Portfolio Diversification

Tokenization gives investors access to a wider range of assets, including real estate, private debt, and commodities. This allows for better diversification across asset classes, geographies, and risk profiles. A more diversified portfolio can help reduce overall investment risk and improve long-term returns.

Emerging RWA Tokenization Trends in 2025

Now, let’s take a look at the most important trends that are defining the future of asset tokenization!

Institutional Adoption of Tokenized Assets

Banks, asset managers, and financial institutions are increasingly exploring real-world asset (RWA) tokenization. This shift is driven by the potential for faster settlements, lower transaction costs, and enhanced transparency. Institutions are testing blockchain infrastructure for regulated financial instruments.

As confidence grows, we are likely to see increased institutional adoption of tokenized assets, and it will bridge the gap between traditional finance (TradFi) and blockchain.

Stablecoins Backed by RWAs

Stablecoins are backed by tangible real-world assets such as Treasury bills, commodities, and commercial debt. These offer more stability and real yield potential. They are increasingly used in decentralized finance (DeFi) protocols and treasury management strategies as they offer both liquidity and income generation.

This trend is reshaping the stablecoin space and is creating financial instruments that not only maintain price stability but also generate returns.

Real Estate Tokenization

Real estate tokenization services are evolving rapidly, which allows investors to buy fractions of commercial and residential properties through blockchain technology. This gives access to a traditionally illiquid and high-barrier market and enables global participation with lower capital requirements.

Tokens represent ownership or income rights and can be traded more easily than physical property. As regulation becomes clearer and platforms mature, real estate is expected to become one of the largest RWA tokenization sectors.

Luxury & Collectibles

High-value physical assets, such as fine art, rare wines, gold, luxury watches, and vintage cars are now being tokenized. This opens exclusive markets to a broader audience while also improving the liquidity and tradability of static assets.

Tokenization also helps preserve asset value while allowing partial liquidity. This trend is particularly appealing to younger investors who are constantly looking for tangible assets with cultural or historical significance.

Integration with DeFi

Tokenized RWAs are being used as collateral in DeFi platforms, which enables users to borrow or lend against tangible assets like real estate, invoices, or bonds. This integration brings off-chain value into blockchain ecosystems. It also diversifies collateral pools beyond volatile cryptocurrencies.

As legal structures and asset verifications improve, RWA-backed DeFi use cases are expected to grow. Also, it will unlock trillions in value from traditional assets for decentralized applications.

Regulatory Evolution

Governments and regulators worldwide are actively developing legal frameworks to address RWA tokenization regulations. These efforts focus on investor protection, asset classification, cross-border compliance, and the integration of on-chain assets with existing legal systems.

Some jurisdictions have launched regulatory sandboxes to test innovative products under supervision. As these frameworks evolve, compliant RWA products will likely rise.

Interoperability Solutions

For RWA tokenization to scale, assets must be operable across different blockchain networks. Some of the top blockchain ecosystem protocols and cross-chain token standards enable seamless movement and use of tokenized RWAs between platforms. This is important for building liquidity, ensuring consistent compliance, and improving user experience.

Interoperability also supports broader market access and integration with both centralized and decentralized ecosystems. As infrastructure improves, more flexible and interconnected RWA markets will emerge and will support greater adoption of tokenization in finance.

AI-Powered Compliance Automation

As tokenized assets grow, regulatory compliance becomes increasingly complex. AI-powered compliance automation is now emerging as an important tool to manage KYC, AML, GDPR, and ongoing monitoring requirements efficiently.

For RWA platforms, AI reduces operational costs, minimizes human error, and enhances trust among regulators and investors. This innovation is key to scaling compliant RWA markets without adding excessive administrative burden.

Tokenization of Carbon Credits

Carbon credit tokenization helps improve transparency, traceability, and market access in the voluntary and regulated carbon markets. It even addresses issues like double-counting and fraud by recording each credit’s lifecycle on-chain.

As demand for ESG-compliant assets rises, tokenized carbon credits are becoming a compelling use case. It links environmental sustainability with financial innovation through blockchain technology.

Wrapping Up

That brings us to the end of this blog!

Real-world asset tokenization is driving financial innovation by bridging traditional digital assets with blockchain technology. From liquidity and fractional ownership to AI-driven compliance and carbon credit markets, the ecosystem is expanding rapidly.

So, are you looking to stay ahead in this transformative space? If so, you need expert guidance and support every step of the way.

Technoloader offers end-to-end RWA tokenization solutions to help you leverage the full potential of this field. Get in touch with us and let’s talk about your RWA crypto projects!

FAQs

What are examples of real-world asset tokenization?

Some of the key examples include tokenized real estate properties, bonds, treasury bills, commodities like gold, luxury collectibles (art, wine), carbon credits, and private equity.

How does tokenization of assets work?

Tokenization converts ownership rights of a physical or financial asset into digital tokens on a blockchain. Each token represents a fraction of the asset and can be bought, sold, or traded.

Is RWA tokenization regulated?

Yes, regulatory frameworks vary by jurisdiction but are evolving rapidly. Many countries are working on clear guidelines to ensure investor protection, AML compliance, and integration with existing financial laws.

What are the challenges of RWA tokenization?

Some of the challenges that RWA tokenization faces are legal and regulatory uncertainty, interoperability between blockchains, auditing of underlying assets, custody and security concerns, and the need for robust identity verification.

How secure is investing in tokenized assets?

Security depends on the blockchain platform, smart contract auditing, and custody solutions used. When built on reputable networks with proper protection, tokenized assets offer transparent and tamper-proof ownership records.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com