STO Development Company

Launching an STO isn't just about creating a token. It's about meeting regulations, building trust, and keeping everything secure. That's where Technoloader comes in! We handle everything – tech, security, and legal frameworks – so your fundraising process is smooth and seamless.

9+ Years

Experience in Blockchain

80%

Blockchain Expert

450+

Project Completed

150+

Client Worldwide

Security Token Offering (STO) – What's the Big Deal?

A Security Token Offering (STO) is a regulated way to raise funds using blockchain technology. Unlike ICOs and IDO, STOs offer tokens backed by real-world assets, such as equity, real estate, or revenue, which makes them more secure and legally compliant. They merge the benefits of blockchain with traditional finance and give both companies and investors a smarter way to transact.

At Technoloader, we specialize in end-to-end STO development that aligns with global regulatory standards. From regulated token creation to smart contracts and compliance frameworks, we handle it all. Our team ensures your STO is not only technically sound but also legally ready to launch. As a leading security token offering development company, we help you raise capital with confidence, security, and full transparency.

Different Types of Security Tokens We Develop

STOs can take different forms, which depend on your goals and compliance needs. Let's have a look at the types and understand how each type supports a smarter and more secure way to raise capital!

Equity Tokens

Equity tokens represent ownership in a company. Holders may receive dividends and voting rights, which makes them perfect for businesses looking to raise capital while offering investor participation.

Asset Tokens

Asset tokens are backed by real-world assets like real estate, gold, or commodities. They provide a way to digitize ownership and make it more accessible, tradable, and liquid.

Debt Tokens

Debt tokens function like digital loans or bonds. Investors lend money in exchange for interest over time. They are ideal for projects seeking funding with predefined repayment terms and regulatory compliance.

Next-Gen STO Development Services We Provide

The blockchain space is ever-evolving, and so are we. Our security token offering development services are built to match today's compliance standards and tomorrow's tech demands. Curious how we can support your project? Let's have a look at what we bring to the table!

Security Token Development

A strong and compliant token builds investor confidence and trust. We develop custom secure security tokens tailored to meet regulatory standards and your project's needs and goals.

STO Exchange Platform

Looking for a secure platform to trade your tokens? We build powerful security token exchange platforms with features like real-time trading, wallet integration, and regulatory compliance.

Tokenized Asset Offering Development

Turn physical assets into liquid and tradable digital tokens. We help build tokenized securities platforms for real estate, commodities, and more, which makes ownership transparent and accessible.

Investor Outreach & Marketing for STOs

Do you want to reach the right investors and grow trust? Our STO launch services can help you increase visibility, build credibility, and attract investment interest through targeted marketing campaigns.

STO Whitepaper Development

A clear whitepaper helps build investor trust and interest. We write comprehensive and easy-to-understand whitepapers that explain your project, technology, and token structure.

Community Support Management

Strong communities help create long-lasting project success. We manage engagement and support, which further helps keep your STO investors informed, involved, and even confident.

Business Benefits of Security Token Offerings

Security Token Offerings (STOs) are changing how businesses raise capital and are offering a modern way of fundraising. They are gaining widespread popularity. And if you are wondering what makes them so appealing, let's take a look at the benefits!

Enhanced Liquidity

Reduced Costs

Regulatory Adherence

Streamlined Processes

Continuous Market Access

Global Investor Access

Asset Backing

Fractional Ownership

Transparency & Security

Our Security Token Offering Development Process

Launching a Security Token Offering might seem complex, but with the right process, it becomes a smooth and strategic journey. We guide you every step of the way, from planning to execution. Let's explore how it all works!

Why Choose Technoloader as Your STO Development Partner?

To gain success, your STO needs a proper strategy, compliance, and innovation. That's where Technoloader comes in! We have helped businesses worldwide navigate STO development with confidence. Take a look at what makes us the preferred partner!

End-to-End STO Development

We handle everything from strategy and smart contracts to investor dashboards and exchange listings. With us, you get a complete STO solution; no need to juggle multiple platforms.

KYC/AML Integration

We seamlessly integrate secure KYC/AML protocols to verify investors and meet compliance standards. This ensures your STO is protected from fraud while building trust with regulators and users.

Regulatory Expertise

Compliance isn't optional; it's important. Our team understands securities laws and helps you structure your STO to meet the legal requirements of your jurisdiction with full confidence.

Transparent Communication

We keep things crisp, clear, and collaborative with our clients. This way, you will always know where your project stands with regular updates, honest feedback, and direct communication.

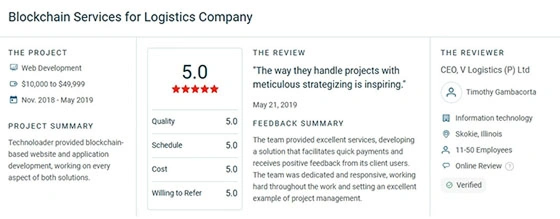

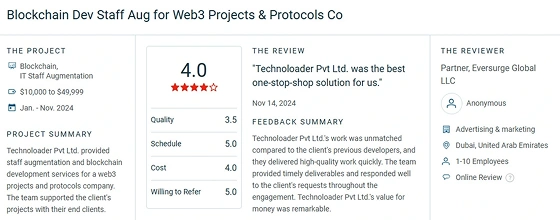

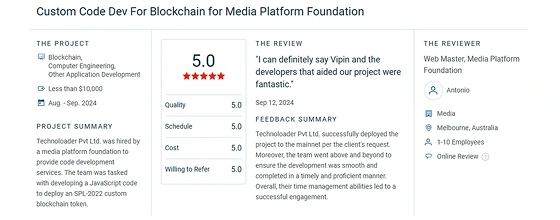

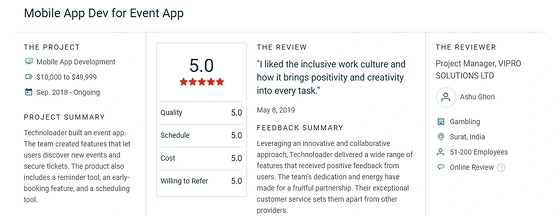

Proven Track Record

With successful STOs delivered across multiple industries, we know what works. Clients trust us because we bring real-world experience, technical depth, and measurable results to the table.

Post-Launch Maintenance

Our support doesn't stop at the launch of your STO. We provide complete updates, troubleshoot issues, and ensure your STO continues to run smoothly, seamlessly, securely, and in compliance.

Frequently Asked Questions

An STO is a fundraising method where digital tokens represent ownership or asset rights. These are usually backed by real-world assets and are fully compliant with securities regulations.

The timeline to launch an STO legally and securely basically varies based on complexity, but it typically takes between 8 and 16 weeks. This includes planning, token development, legal compliance, platform setup, and investor onboarding.

The cost of STO blockchain solutions basically depends on project scope, regulatory requirements, and features needed. For a quote for your blockchain-based STO project, reach out to us!

STOs offer legally compliant and transparent fundraising, which gives businesses access to a wider pool of investors while reducing risks associated with traditional methods. They also increase liquidity and trust through blockchain technology.

STOs provide regulatory compliance, investor protection, fractional ownership, increased liquidity, and global reach. They also reduce third parties and lower fundraising costs as compared to traditional securities offerings.

Some of the features that can be included in an STO are smart contracts, KYC/AML compliance, investor dashboards, secure wallets, token issuance, dividend distribution, voting rights, and audit trails.

We integrate updated legal frameworks into token design, implement KYC/AML checks, partner with legal experts, and build smart contracts that enforce compliance automatically throughout the token's lifecycle.

Connect

on Whatsapp

Connect

on Whatsapp  Talk To Our Experts

Talk To Our Experts