Table of Contents

Dubai has always been quick to adopt what’s next, and that too with clarity and long-term vision. The city ensures that new technologies are implemented responsibly and at enterprise scale.

As a result, blockchain adoption in Dubai has moved beyond experimentation and into real and regulated business use. Some use cases include real estate tokenization, enterprise payments, supply chain transparency, digital identity, and financial infrastructure.

But building these solutions isn’t just about choosing the right blockchain network or writing smart contracts. It’s about understanding how the Virtual Assets Regulatory Authority (VARA) views compliance, governance, security, and risk.

That’s where most of the enterprises feel uncertain.

- Do you need a license?

- What activities fall under VARA’s scope?

- How do you design blockchain systems that meet regulatory expectations?

Well, this guide contains all the answers to the questions that you might have about VARA. This is a roadmap that will help you use blockchain confidently in Dubai while staying compliant, scalable, and future-ready.

Let’s check it out!

Understanding VARA

VARA, the acronym for Virtual Assets Regulatory Authority, is the central authority established by the Dubai World Trade Centre Authority for the licensing, supervision, and oversight of virtual assets, such as cryptocurrency and blockchain. It even covers the Special Development Zones and Free Zones in Dubai, but it excludes the Dubai International Financial Centre.

VARA is the first independent regulator of virtual assets in the world, and it aims to position the Emirate of Dubai as a regional and international hub for virtual assets. Other than that, VARA strives to increase awareness about the investment in virtual assets, which helps protect businesses from illicit activities and builds a comprehensive framework for compliance.

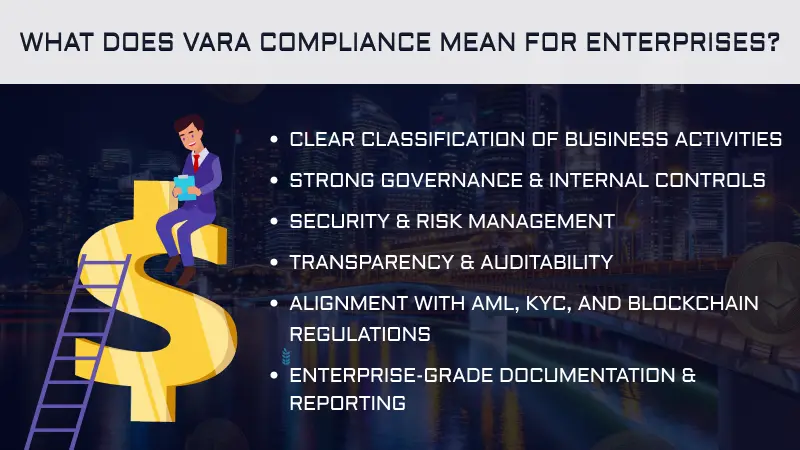

What Does VARA Compliance Mean for Enterprises?

For enterprises operating in Dubai, VARA compliance helps define how blockchain and virtual asset solutions should be designed, operated, and governed from day one. Let’s understand what VARA compliance actually means for enterprises!

Clear Classification of Business Activities

Enterprises must first understand what part of their blockchain activity falls under VARA’s scope. Not every blockchain use case requires licensing, but activities that involve virtual assets, token issuance, crypto exchange, or financial transactions often do.

Strong Governance & Internal Controls

VARA expects enterprises to operate with defined governance structures, which include clear ownership, decision-making authority, and compliance oversight. This ensures that blockchain systems are not only technically sound but also managed responsibly at an organizational level.

Security & Risk Management

Compliance requires enterprises to manage risks related to cybersecurity, smart contracts, and crypto wallets. Systems must be built with security-first principles, which include access controls, monitoring, and regular audits.

Transparency & Auditability

VARA-compliant solutions even focus on traceability and audit readiness. Enterprises must be able to demonstrate how transactions occur, how assets move, and how controls are enforced. This is especially important for tokenized assets, payment, and financial workflows.

Alignment with AML, KYC, and Blockchain Regulations

Blockchain enterprises operating in Dubai must integrate AML and KYC mechanisms. This ensures the lawful handling of user data and follows UAE data protection requirements.

Enterprise-Grade Documentation & Reporting

VARA compliance also means maintaining clear documentation, which includes system architecture, operational processes, risk assessments, and compliance reports. This documentation supports regulatory reviews and builds trust with partners, investors, and customers.

Who Needs a VARA License?

Not every blockchain project in Dubai requires a VARA license. It is important to understand whether your business requires a license for launching or scaling a blockchain solution.

Here are the categories of businesses that require a VARA license:

Crypto Exchanges & Trading Platforms

Businesses that operate crypto exchanges or trading platforms, be it is centralized, decentralized, or hybrid, require VARA approval. This includes platforms that allow users to buy, sell, trade, or swap virtual assets. Even if trading is limited to specific tokens or user groups, licensing is required due to the financial and market risk involved.

Token & NFT Issuance

Companies issuing tokens or NFTs for fundraising, investment, access, or utility purposes may require a VARA license, depending on the token’s structure and use case. If a token represents value, ownership, or financial rights, regulatory oversight applies. Enterprises must clearly define token utility, governance, and lifecycle to determine licensing requirements.

Crypto Investment & Advisory Services

Any business that offers investment advice, portfolio management, or advisory services related to crypto or virtual assets must comply with VARA regulations. This includes platforms, consultants, and managed services that influence investment decisions or handle customer funds.

Digital Asset Custody & Wallets

Providing custodial wallet services or asset safekeeping triggers licensing requirements. If a business holds, manages, or controls private keys on behalf of users, VARA considers this a regulated activity. Strong security, governance, and risk controls are mandatory for such services.

DeFi Platforms & Lending Services

DeFi platforms that offer lending, borrowing, staking, or yield-generating services may fall under VARA’s scope, especially when they are accessible to the public or involve pooled user funds. Even decentralized protocols often require a compliant operating entity when deployed in a regulated market like Dubai.

Payment & Remittance Services

Crypto payment gateways, remittance platforms, and settlement services that enable the transfer of virtual assets or crypto-based value require licensing. These services are closely monitored due to AML, fraud prevention, and financial stability considerations.

Blockchain Governance & Project Management

Entities responsible for governance, protocol management, or decision-making of blockchain projects may also require VARA approval. If a company controls upgrades, treasury, or operational direction of a virtual asset project, it is considered part of the regulated ecosystem.

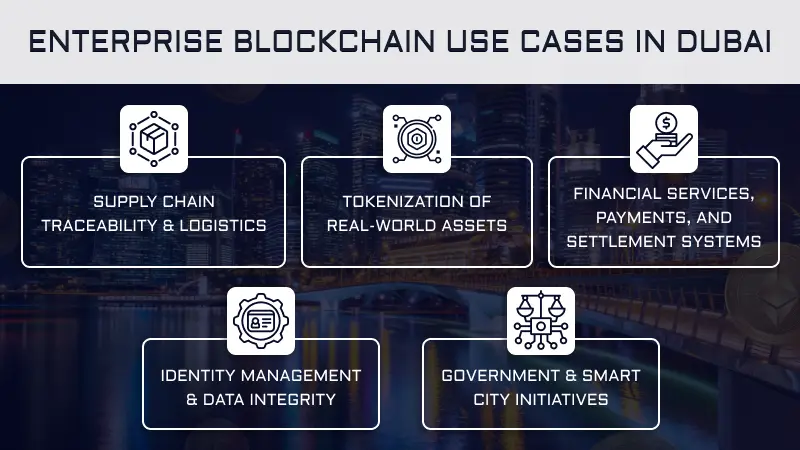

Enterprise Blockchain Use Cases in Dubai

Enterprises across sectors are using blockchain to improve transparency, efficiency, and trust while remaining aligned with regulatory expectations. Let’s take a look at the key uses of blockchain for enterprises in Dubai!

Supply Chain Traceability & Logistics

Blockchain enables enterprises to track goods across every stage of the supply chain. In Dubai’s logistics-driven economy, this improves transparency, reduces fraud, and ensures real-time visibility for all stakeholders. Blockchain also ensures immutable records, which help enterprises verify authenticity, monitor compliance, and streamline audits.

Tokenization of Real-World Assets

Dubai is emerging as a leader in real-world asset tokenization, particularly in real estate and commodities. Blockchain allows enterprises to convert physical assets into digital tokens, which enables fractional ownership, improved liquidity, and faster settlement. When designed correctly, tokenization models can align with VARA regulations.

Financial Services, Payments, and Settlement Systems

Enterprises are using blockchain to build secure, faster, and more transparent payment and settlement systems. This includes cross-border payments, internal treasury management, and on-chain settlement layers that reduce reliance on intermediaries. Blockchain-based financial systems help improve operational efficiency while maintaining strong compliance controls.

Identity Management & Data Integrity

Blockchain offers enterprises a reliable way to manage digital identities and sensitive data. By using decentralized or permissioned identity systems, organizations can improve data security, prevent tampering, and ensure controlled access. This is especially valuable for sectors handling regulated data, such as finance, healthcare, and enterprise platforms.

Government & Smart City Initiatives

Dubai’s government and public sector continue to adopt blockchain for smart city and digital governance initiatives. Enterprises working with government bodies use blockchain for document verification, licensing, record management, and service automation. These initiatives strengthen trust, reduce paperwork, and support Dubai’s long-term digital transformation goals.

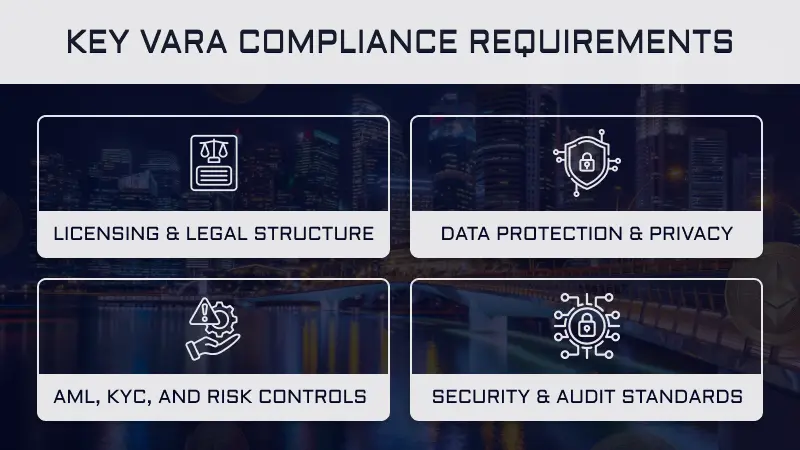

Key VARA Compliance Requirements for Blockchain Solutions

For enterprises building or deploying blockchain solutions in Dubai, VARA compliance sets clear expectations around legal structure, data handling, risk controls, and security standards. These requirements ensure that blockchain systems are safe, transparent, and suitable for enterprise and regulatory oversight.

Licensing & Legal Structure

Not all blockchain use cases require a VARA license. However, obtaining a license becomes mandatory when a solution involves virtual assets, such as token issuance, custody, brokerage, or payments. Enterprises must carefully assess whether their blockchain activity falls under VARA’s regulated scope before going live.

VARA expects enterprises to operate through clearly defined legal entities with transparent ownership, governance, and accountability. This includes having designated compliance officers, defined roles and responsibilities, and documented operational processes.

Data Protection & Privacy

Enterprises must understand where data is stored, processed, and accessed. In many cases, VARA-aligned solutions are expected to follow UAE data residency and localization expectations, especially when handling sensitive user, financial, or identity-related data.

Blockchain solutions must align with applicable UAE data protection regulations, which ensure lawful data collection, storage, and processing. Enterprises need mechanisms for data access control, consent management, and privacy protection, especially when enterprise-sensitive information is involved.

AML, KYC, and Risk Controls

VARA-compliant platforms must implement robust transaction monitoring systems to detect suspicious activity, fraud, or misuse. This includes real-time monitoring, risk scoring, and reporting mechanisms that allow enterprises to identify and respond to compliance issues promptly.

Where users are involved, enterprises must apply KYC and identity verification processes. Wallets interacting with the system must be assessed for risk, and access should be restricted or monitored based on compliance policies. This helps prevent money laundering and illicit activity.

Security & Audit Standards

All smart contracts used in regulated blockchain solutions should undergo security audits. Audits help identify vulnerabilities, logic flaws, and potential attack vectors before deployment. VARA places strong emphasis on auditability to ensure system integrity and user protection.

Beyond smart contracts, enterprises must secure the entire technology stack. This includes key management, role-based access controls, infrastructure hardening, monitoring, and incident response plans. This shows that the platform can operate safely at enterprise scale.

The End Note

That’s it for this blog!

Navigating VARA-compliant blockchain solutions in Dubai can feel complex at first, especially when technology and regulation need to move in sync. It’s not just building using blockchain technology; it’s more about building it the right way, with a clear understanding of regulatory expectations, risk controls, and enterprise readiness.

And that’s where having the right partner makes all the difference. At Technoloader, we work closely with businesses at every stage of their blockchain journey. Our team combines deep blockchain expertise with a strong understanding of Dubai’s regulatory landscape. We even help enterprises build VARA-compliant solutions that are secure, scalable, and future-ready.

So, get in touch with us now!

FAQs

What is VARA compliance?

VARA compliance refers to meeting the regulatory requirements set by the Virtual Assets Regulatory Authority (VARA) for businesses involved in blockchain and virtual asset activities in Dubai. It defines how virtual assets should be issued, managed, secured, and governed to ensure transparency, security, and risk control.

Which country does VARA compliance apply to?

VARA compliance applies specifically to Dubai, United Arab Emirates. Any business operating from Dubai or offering virtual asset services within Dubai’s jurisdiction must comply with VARA regulations.

What are the key requirements of VARA compliance?

Some of the most important requirements of VARA include:

- Proper licensing and legal structure

- Strong governance and compliance oversight

- AML and KYC controls

- Secure data handling and infrastructure

- Regular security audits and risk management

The exact requirements depend on the nature of the business activity. Get in touch with us to discuss specifically for your project!

How does VARA compliance benefit enterprises?

VARA compliance builds regulatory trust, operational credibility, and long-term scalability. Compliant enterprises can operate confidently in Dubai, attract enterprise partners, reduce legal risk, and position themselves as trustworthy and reliable players in the blockchain ecosystem.

What happens if a company fails to comply with VARA regulations?

Non-compliance can result in penalties, operational restrictions, license suspension, or enforcement actions. In serious cases, businesses may be forced to halt operations in Dubai.

Does every blockchain project require a VARA license?

No! Not all blockchain projects require licensing. Projects involving virtual assets, public users, financial services, or custody are more likely to fall under VARA’s scope. If you are still confused, get in touch with our experts. We’ll be happy to assist you!

How can a company achieve VARA compliance?

Achieving VARA compliance starts with:

- Identifying whether licensing is required

- Designing blockchain architecture with compliance in mind

- Implementing governance, security, and AML controls

- Preparing proper documentation and audits

Working with an experienced blockchain and compliance partner like Technoloader can help simplify this process.

How can Technoloader help with VARA compliance?

Technoloader helps enterprises design and build VARA-compliant blockchain solutions. We combine deep technical expertise with regulatory understanding to support businesses at every stage of their blockchain journey in Dubai.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com