Table of Contents

Over time, technology has gained some mind-blowing achievements!

What we have never expected to be online is now turning digital – from real estate to gold and even company shares. Well, all this is possible with blockchain technology!

This is a user-centric concept that has transferred ownership faster than ever. This transformation is made possible through tokenization, a process that converts physical and digital assets into secure, tradeable tokens on a blockchain.

Whether you’re looking forward to buying a luxury apartment or to investing in tokenized stocks, through tokenization you will be able to manage everything from anywhere in the world.

Let’s break down in-depth information about tokenization in blockchain and its leading real-world use cases correspondingly.

What is Tokenization?

Tokenization is the process of transforming ownership rights of an asset into digital tokens on a blockchain. Whether your assets are physical or digital, through this process, you will easily be able to divide, transfer, and store your assets digitally.

Further, this process is noteworthy: In 2025, its global projection has been projected at $1,244.18 billion and is predicted to surge to $5,254.63 billion by 2029. Further, discussing tokenized treasury and money market funds, they’ve reached $7.4 billion, real estate reached $20 billion, and so forth.

Meanwhile, the concept of tokenization is not new; it has been traced back to early advancements in digital currency and blockchain. This complete foundation is ingrained in blockchain technology, ensuring that digital assets can be securely exchanged.

In contrast to this, you might be wondering how tokenization works. So, let’s understand it with an example:

Imagine there is a famous painting whose worth is $5 million. Normally, only museums or ultra-wealthy collectors could own it. Isn’t it? So, here comes the role of tokenization! With the help of this, the painting is divided into numerous digital tokens, with each token valued at $100.

- First, the artwork is selected for tokenization.

- Next, the ownership rights are legally tied to a smart contract, which typically leads to compliance.

- Then, for token generation, suppose 50,000 tokens are minted on the blockchain, with each token representing a tiny fraction of ownership.

- Once they’re stored on a blockchain ledger, they guarantee transparency and authenticity.

- Thus, the painting leads to trading worldwide, and if it is sold or earns exhibition fees, then the token holders receive proportional payouts.

This is what tokenization is all about; it simply digitalizes the real-world assets into digital tokens, making them accessible, tradeable, and available for everyone, regardless of their location or financial background.

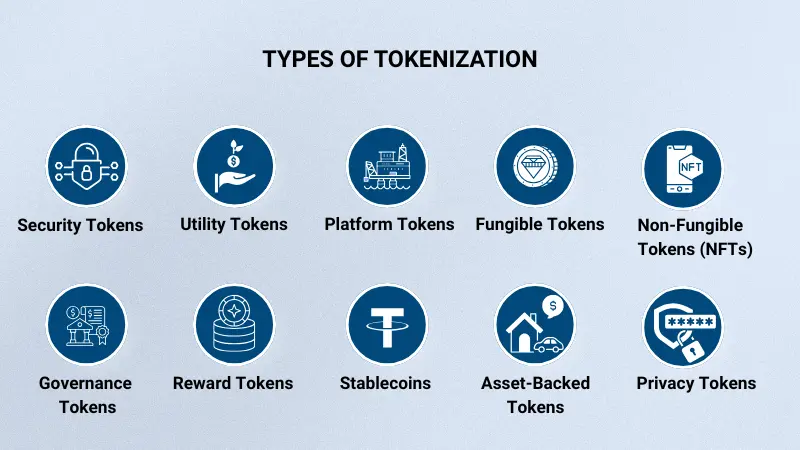

Types of Tokenization

Once you’re clear on what tokenization actually is, it’s time to uncover its types. Since tokenization is reshaping the ownership of assets and data security, based on these factors, here are the available types of tokenization:

Security Tokens:

These are digital assets on blockchain that typically demonstrate ownership or rights to real-world assets, like stocks, bonds, etc. These tokens operate similarly to traditional securities, delivering legal rights and investor protections, and are generally traded on specialized exchanges after compliance with blockchain development solutions.

Utility Tokens:

Also known as user tokens or app coins, these are the digital tokens allocated through a blockchain network. With the help of this token, users can take advantage of early coin offerings, exchange offers, or other token generation events. Unlike traditional currencies, utility tokens are developed to serve a particular purpose within a decentralized platform. Through this, users can often access a wide range of services or features, typically functioning as a sort of digital key.

Platform Tokens:

These tokens are user-specific tokens that permit users to interact with the platform services within the realms of their license. They generally provide support for smart contracts in real estate and other industries that depend on safe, transparent operations. Moreover, with abilities like staking and governance, platform tokens authorize community-driven enhancements while assuring decentralized integrity.

Fungible Tokens:

These tokens are all the same in value and can be easily swapped with each other; the primary examples include Bitcoin and Ethereum, providing a stable medium across blockchain systems. However, their value generally remains the same because they’re perfect for payments and trading, help money move smoothly, and are reliable in decentralized networks.

Non-Fungible Tokens (NFTs):

Non-Fungible Tokens generally represent ownership of digital or physical assets and give holders special rights on blockchain platforms. Unlike fungible tokens, NFTs are not interchangeable because each one of them has its own unique traits. They’re especially popular in art, collectibles, and virtual property. With the help of these tokens, users are getting the benefits of secure and transparent ownership transfers, protecting authenticity, and opening up new ways for investors to make a profit from their work.

Governance Tokens:

Within decentralized projects or DAOs, these tokens offer holders the power to make important decisions. This means they allow users to make decisions on protocol changes, new features, or how funds are used. By enabling community-driven decision-making, governance tokens further create a more democratic and transparent blockchain ecosystem.

Reward Tokens:

Reward tokens are often given as incentives to users participating in activities like staking, providing liquidity, or joining loyalty programs. They normally encourage users to stay engaged with the platform and support the blockchain ecosystem. Moreover, these tokens are widely used in DeFi for staking rewards, loyalty points, and participation bonuses, helping build user loyalty and grow active communities across different blockchain networks.

Stablecoins:

Stablecoins are digital tokens tied to stable assets like fiat currencies, designed to reduce price volatility in blockchain transactions. They’re widely used in payment systems and banking tokenization, providing a reliable medium for transactions and remittance. Through linking traditional finance with DeFi, stablecoin offers a safe and stable currency for daily use and helps protect against market swings.

Asset-Backed Tokens:

This token represents ownership of physical assets such as real estate, commodities, or art through fractional tokens on a blockchain. They generally make high-value investments more accessible, allowing more people to participate in real estate or commodity tokenizations.

Privacy Tokens:

Privacy tokens focus on keeping users’ transactions and data confidential on blockchain platforms, all while ensuring security and anonymity. As more financial activities move to public blockchains, privacy tokens play a key role in protecting user information, offering enhanced security for both personal and financial privacy.

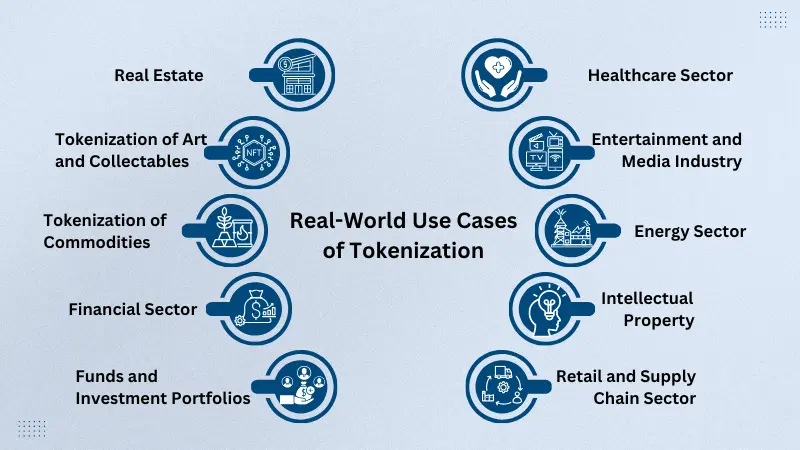

Real-World Use Cases of Tokenization

Tokenization is reshaping traditional asset ownership by enabling fractional, secure ownership of real-world assets through blockchain technology. From real estate and art to commodities and securities, tokenization boosts liquidity, improves accessibility, and enhances transparency across diverse industries by transforming the way of investment.

Among all, here are some ideal real-world use cases of tokenization that are widely using blockchain to revolutionize asset management and ownership.

Tokenization in Real Estate:

Among all the cases, real estate is denoted as one of the most beneficial applications of tokenization. With the help of this, people are getting the benefits of fractional ownership and easy access to real estate investments. Earlier, due to high rates, people who were unable to invest in properties are now taking advantage of tokenization in real estate.

Benefits:

- Investors are offered enhanced liquidity, unlike traditional property investment.

- Lower entry barriers are making real estate investment accessible to a wider audience.

Tokenization of Art and Collectables:

If you’re the one who loves art and collectables, then tokenization often allows you to invest in rare art and collectables without purchasing them entirely. Through tokenizing them, owners generate digital tokens that indicate fractional ownership, which can be traded on blockchain platforms.

Benefits:

- Art tokenization promotes partial ownership, permitting art lovers and investors to diversify their investments.

- Blockchain ensures clarity in origin and authenticity.

Tokenization of Commodities:

Tokenization of commodities like gold, oil, and agricultural products allows investors to buy and trade fractional shares of these assets. This makes commodity investing more flexible and accessible, opening the door for retail investors to participate in markets once reserved for large institutions.

Benefits:

- Tokenization of commodities enables partial ownership while diminishing entry costs and increasing liquidity.

- Investors can buy, sell, or redeem their tokens for physical commodities.

Tokenization in the Financial Sector:

In the financial sector, tokenization has a wide range of applications, from securities to funds and debt instruments. Through this, users are getting the advantages of enhanced liquidity and accessibility while ensuring regulatory compliance and adhering to relevant securities laws.

Benefits:

- People can now trade more freely, which makes it easier and safer for investors to buy and sell financial assets.

- By using blockchain, financial institutions provide transparent records of ownership and automate compliance processes through smart contracts.

Tokenization of Funds and Investment Portfolios:

Tokenization is transforming fund management by enabling fractionalization of private equity, venture capital, and mutual funds. This means investors can access diverse portfolios and asset classes with much smaller capital contributions, making high-value investments more inclusive and globally accessible.

Benefits:

- Tokenized funds can easily be traded on blockchain platforms, providing increased liquidity and flexibility for fund managers and investors.

- It simplifies the investment process and attracts a larger pool of investors without committing large amounts of capital.

Tokenization in the Healthcare Sector:

Tokenization in the healthcare sector involves tokenizing patient data, medical records, and healthcare services effectively. This approach guides the safe securing of the patient’s sensitive information, making it accessible only to authorized users, while ensuring data integrity and reducing fraud and error in medical information.

Benefits:

- It protects patient privacy and improves data security by restricting access to unauthorized users.

- It enables seamless data sharing between healthcare providers, improving collaboration and reducing administrative burdens.

Tokenization in the Entertainment and Media Industry:

Tokenization is transforming the entertainment industry by enabling creators and producers to tokenize their content, delivering audiences with ownership interests. This tokenized model lets fans uphold their favorite artists and benefit from their achievements, while artists gain a new source of income.

Benefits:

- Helps creators earn money from their content without relying on traditional intermediaries.

- Fans can hold tokens of their content and perhaps profit as its value appreciates.

Tokenization in the Energy Sector:

Through tokenization, the energy sector aims to facilitate peer-to-peer energy trading and renewable energy investment. By tokenizing energy assets, companies enable investors to own certain portions of renewable projects, such as solar or wind farms, fostering sustainable development.

Benefits:

- Empower individuals to participate in green projects.

- Enhance liquidity in energy investments, as tokens can be traded on exchanges.

Tokenization of Intellectual Property:

In intellectual property, tokenization enables creators to manage and trade ownership stakes in patents, copyrights, and trademarks on blockchain platforms. Tokenized IP allows creators to license their content directly and receive royalties without intermediaries.

Benefits:

- It creates new revenue streams for creators while enhancing transparency in royalty payments.

- Blockchain’s immutability ensures that IP ownership records are secure, protecting creators from infringement issues.

Tokenization in the Retail and Supply Chain Sector:

From manufacturing to delivery, tokenization supply chains provide transparency in tracking goods. It further enables real-time data visibility, enabling companies and consumers to verify the authenticity of products and reduce counterfeiting.

Benefits:

- Allowing companies to seamlessly monitor every step of the supply chain.

- Tokenization simplifies auditing processes and ensures product authenticity, especially in luxury goods and pharmaceuticals.

Conclusion

In this comprehensive guide, we have shared in-depth information regarding tokenization in blockchain and its real-world use cases.

Tokenization in blockchain is no longer just a futuristic concept; it is already transforming how we own, trade, and invest in assets. By enabling fractional ownership, improving liquidity, and ensuring secure and transparent transactions, tokenization bridges the gap between traditional finance and DeFi while opening up global opportunities for investors.

From real estate tokenization and art tokenization to tokenized funds, commodities, and intellectual property, this innovation allows anyone to participate in previously inaccessible markets with lower entry barriers.

Lastly, if you’re planning to develop a tokenization platform or explore blockchain tokenization solutions for your business, partnering with a reliable blockchain development company like Technoloader can help you build secure, scalable, and compliant platforms, empowering you to lead in this rapidly growing digital economy.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com