Table of Contents

Regarding investment, people prefer to invest in real estate over other types of investments. Historically, or even today, this industry is seen as the most dependable investment choice. However, despite being one of the most rapidly growing and emerging industries for decades, the way of investing remains unchanged.

This results in people requiring high capital, low liquidity, high transaction costs, and complex management. But thanks to real estate tokenization, which transforms physical assets into digital tokens on the blockchain. It has completely changed the way people invest.

Now, investors can benefit from lower entry barriers, increased liquidity, and enhanced transparency. Making a traditionally exclusive and illiquid asset class more accessible and efficient.

In this guide, we will discuss the step-by-step process of tokenizing real estate assets. Helping you understand how this innovative approach works and how you can leverage it to unlock new investment opportunities.

Understanding Real Estate Tokenization

Real estate tokenization means creating digital tokens that represent shares of a real property. In simple terms, a property is divided into multiple small virtual pieces, and each piece is a token that someone can own. This process builds on blockchain technology, ensuring each token is secure and transactions are transparent. Every token can be bought, sold, or traded, giving the token holder a partial ownership stake in the property’s value or rights.

With the help of this tokenization, investing in property becomes more accessible. Instead of investing a huge amount, investors can buy just a tiny fraction.

For example, if there is a property worth $10 million, it could be split into 1,000,000 tokens, each representing a $10 stake in that property. So, if someone chooses to invest even $100, then they’ll be effectively co-owning a portion of the property.

However, another great advantage of investing in real estate tokenization is blockchain technology. It keeps a tamper-proof record of token owners and their ownership stake, so there would not be any disputes or confusion regarding who owns what, even as tokens are traded or transferred over time.

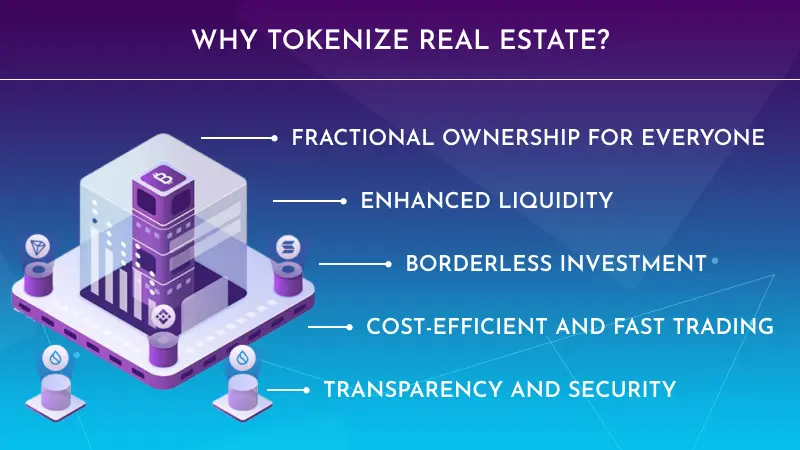

Why Tokenize Real Estate?

Over the traditional real estate investment, tokenizing real estate offers numerous advantages, which include:

1. Fractional Ownership for Everyone:

Tokenization enables investors to own a certain portion of a valuable property, instead of one buyer owning the whole thing.

This makes it easier to get started. Even investors with lower capital can invest in tokens representing a building and an opportunity that didn’t exist before.

This democratizes real estate investment by letting regular people participate in deals that used to be open only to wealthy investors or institutions.

2. Enhanced Liquidity

Real estate is highly illiquid; it’s hard to quickly sell a building for cash. Tokenization can change that.

When property is represented by tokens, those tokens can easily be traded on secondary markets much faster, almost like selling stocks.

An investor isn’t required to find a potential buyer; thus, they can sell just their token stake to someone else, making ownership far more flexible than the traditional all-or-nothing approach.

3. Borderless Investment

For instance, if you’re someone from India likely to buy property in the USA, then it will be complicated to make it possible.

But tokenization has made it possible. Anyone with an internet connection can potentially buy tokens of properties in other countries with a few clicks.

Blockchain-based tokens move across borders easily, making them open to global investors, which can increase demand for properties and give developers access to more capital from around the world.

4. Cost-Efficient and Fast Trading

Traditional real estate deals involve a lot of paperwork, legal fees, and middlemen, which take too much time and money. But tokenization streamlines this process.

Through a smart contract, the process has become automated, cutting down transaction fees and streamlining transactions much faster than the weeks or months a normal property sale used to take.

To implement such automated and cost-effective transactions, businesses often rely on real estate tokenization solutions that leverage blockchain technology for faster and more efficient property trading.

5. Transparency and Security

The digital ledger of blockchain technology is transparent and extremely difficult. A clear record of who owned what and when is produced by recording every token transaction.

Blockchain reduces errors and fraud; investors can rely on the safe recording and verification of their ownership stake. Additionally, smart contracts add another level of security to the process by automatically enforcing rules and compliance.

The Process of Tokenizing Real Estate

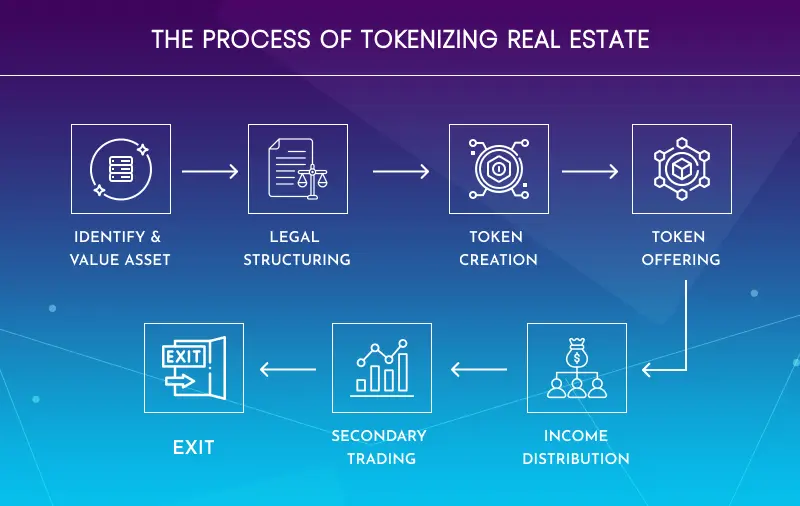

Since you’ve understood what real estate tokenization is and why it’s needed, now let’s dive into how a real estate tokenization company manages the process of transforming real estate assets into digital tokens:

Step 1: Identify & Value Asset

The process of tokenizing real estate begins with the property selection. A professional appraiser identifies the property’s current market value; this valuation helps set a fair price for the tokens and lets investors understand the real worth of the property they’re buying.

Step 2: Legal Structuring

Next, create a legal entity like an LLC or SPV to officially own the property. This protects the asset and investors by ensuring compliance with local laws and regulations, providing clear ownership rights, and separating the investment from other business risks.

Step 3: Token Creation

Digital tokens representing small ownership shares are created on a blockchain using smart contracts. These tokens make it easy for many people to own parts of the property securely, transparently, and without complicated paperwork or middlemen.

Step 4: Token Offering

Tokens are then offered for sale on a regulated platform to investors. This process enables individuals to easily buy fractions of the property, much like purchasing shares in a company, making real estate investment accessible to more people.

Step 5: Income Distribution

When the property earns income, such as rent or profits, this money is shared with token holders. Each investor receives payments proportional to the number of tokens they own, creating a passive income stream tied directly to the property’s performance.

Step 6: Secondary Trading

Investors can resell their tokens on digital marketplaces if they wish. This secondary market creates liquidity, allowing token holders to buy and sell their shares anytime without waiting for the entire property to be sold or transferred.

Step 7: Exit

When the property is eventually sold, the sale proceeds are distributed among token holders according to their ownership percentage. This final step lets investors cash out and realize their returns, completing the lifecycle of the tokenized real estate investment.

Future of Real Estate Tokenization

Talking about the future of real estate tokenization, you must be aware that this industry is continuously booming. According to CoinLaw, by the middle of 2025, it was part of $412 billion in total tokenized assets globally and is projected to reach $3 trillion by 2030, potentially representing 15% of global property AUM.

This growth is making property investing more accessible worldwide. With blockchain technology, investors can enjoy increased liquidity, faster transactions, and fractional ownership. As regulations become clearer and adoption rises, tokenized real estate could reshape the way people buy, sell, and manage properties globally.

Conclusion

Real estate tokenization is changing the way we invest in property. Instead of needing huge amounts of money, anyone can buy small shares of a building through digital tokens.

This makes investing more accessible, flexible, and even global so that people can participate from anywhere. In this, blockchain technology ensures every token is secure, transparent, and easy to trade, while smart contracts make transactions faster and safer.

As more people adopt this approach, tokenized real estate could make property investment simpler, fairer, and more open to everyone, with platforms and solutions developed by Technoloader supporting this growing ecosystem.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com