Table of Contents

What if you could borrow, lend, trade, or earn interest without going to a bank or handling any paperwork? It certainly gives off a futuristic vibe, doesn’t it? This is exactly what Decentralized Finance (DeFi) is making possible today, bringing future technology to the present.

From removing middlemen to giving people full control over their assets, DeFi is reshaping how we think about money. As of mid-2025, there are already about 14.2 million active wallets around the world, which is a huge jump from just 4.28 million at the end of 2021. This shows that more and more people are getting into DeFi.

In this beginner’s guide, we will explain what DeFi is, how DeFi is changing traditional finance, and how this new digital financial system actually works.

What is DeFi?

Decentralized finance (DeFi) is a new financial system that uses blockchain and cryptocurrencies for direct transactions between individuals and businesses. They do so by eliminating intermediaries like banks and automating transactions with the help of smart contracts.

DeFi development aims to reduce costs and accelerate the processes of money transfers and carrying out financial activities. It transforms finance by allowing people to transact directly with each other, eliminating the need for intermediaries.

Understanding the Mechanics of DeFi

DeFi leverages advancements in security protocols, connectivity, software, and hardware through peer-to-peer financial networks. This system eliminates intermediaries like banks and other financial service companies. These companies charge businesses and customers for their essential services, which are necessary for the system to function. DeFi uses blockchain technology to reduce the need for these intermediaries. Let’s break it down step by step:

Blockchain Infrastructure

DeFi is built on public blockchain networks like Ethereum, Solana, Avalanche, and Polygon. These blockchains serve as digital ledgers, recording every transaction transparently and securely. Since no single authority controls them, they enable decentralized access and operation.

Smart Contracts as the Core Engine

At the heart of DeFi are smart contracts, which are self-executing codes that automatically enforce the financial agreements. So, if you decide to lend your tokens on a platform like Aave, the smart contract makes sure you get interest based on some set rules. This cuts out the middlemen, which speeds things up and saves you some cash on transactions.

Tokenization of Assets

DeFi allows both digital and real-world assets to be tokenized and represented as tradable tokens on the blockchain. Stablecoins (like USDT, USDC, and DAI) represent stable value, usually pegged to the U.S. dollar. Synthetic assets can basically copy the prices of stocks, which opens up a lot more investment choices for people.

Liquidity Pools and Peer-to-Peer Markets

In the world of DeFi, users contribute their assets to liquidity pools, which are shared funds managed by smart contracts. Decentralized exchanges (DEXs), powered by these pools, allow users to instantly swap tokens. Liquidity providers make money from fees and sometimes get extra rewards through yield farming, which encourages more people to join in.

Wallets as the Gateway

Users access DeFi through non-custodial wallets like MetaMask, Trust Wallet, or Coinbase Wallet. With this setup, you actually get to keep your keys and have full control over your money. These wallets act as passports to the DeFi ecosystem, enabling lending, borrowing, trading, or staking.

Permissionless and Interoperable Ecosystem

DeFi protocols are permissionless, meaning anyone with internet and a wallet can use them, without credit checks, IDs, or geographical restrictions. They are also interoperable and are designed like building blocks. Developers can combine various protocols, such as taking out a loan on one platform and then trading on another, to create innovative financial products.

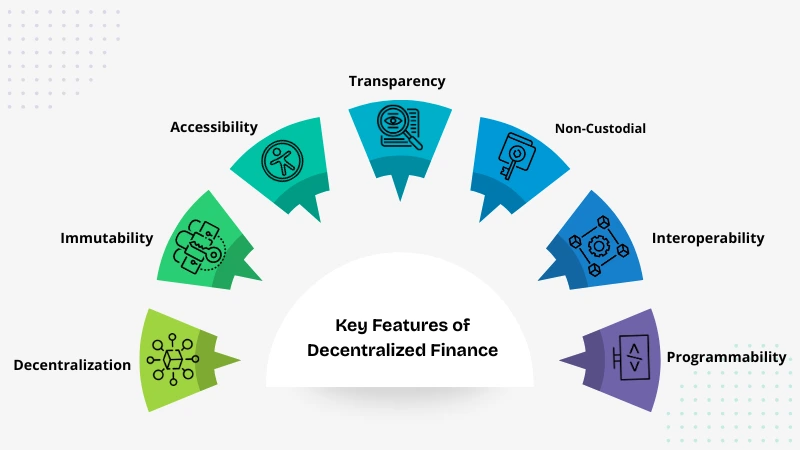

Key Features of Decentralized Finance

The DeFi ecosystem consists of several vital elements that collaborate to deliver a diverse array of financial services. Let’s take a closer look at each of them, providing a brief overview:

Decentralization

Decentralization in DeFi allows financial systems to run on blockchain networks with smart contracts, removing intermediaries like banks. This gives users the ability to manage and have direct control over their assets through digital wallets.

Immutability

Immutability in DeFi allows the systems to be secured, private, and transparent. It is defined as the ability of a blockchain ledger to remain unchanged, unaltered, and tamper-proof. Here, each block of info is carried with the help of a cryptographic principle or hash value.

Accessibility

DeFi is accessible to anyone with an internet connection and a wallet, as the majority of decentralized applications (dApps) do not require KYC verification. Being able to access things globally means we don’t have to rely on middlemen like banks or brokers anymore.

Transparency

DeFi ensures complete transparency and auditability by publicly noting all transactions on the blockchain. In contrast to conventional finance, which often lacks transparency, DeFi provides a financial ecosystem that is both open and verifiable.

Non-Custodial

The fact that customers keep absolute control over their assets and personal data. Utilizing Web3 wallets such as Metamask empowers users to engage seamlessly with permissionless protocols.

Interoperability

In DeFi, Interoperability means that different protocols and apps can seamlessly connect and work together like building blocks. Ethereum’s composable design allows developers to build new features on top of existing ones, enabling flexibility and innovation.

Programmability

Programmability in Decentralized Finance (DeFi) is enabled by smart contracts, which are self-executing digital agreements stored and run on a blockchain. This main feature lets you automate your financial stuff without needing any middlemen.

To know about the top features that one should include in their DeFi project, you may refer to this blog: Top 10 Must-Have Features in a DeFi Platform For Startups.

Risks and Challenges of DeFi

While Decentralized Finance is offering some mind-blowing changes to the traditional financial system, it often presents several significant risks and challenges. This includes:

Smart Contract Vulnerabilities:

DeFi platforms are powered by smart contracts that typically function on blockchain networks. Although they eliminate the need for intermediaries, smart contracts are prone to bugs, coding errors, or logic issues that can lead to security breaches and financial losses.

Rug Pulls and Scams

The openness and permissionlessness of DeFi allow everyone to develop and launch a project. While this encourages innovation, it also creates opportunities for malicious actors. Some projects are created with the intent to deceive users and withdraw liquidity without warning. These kinds of scams, often referred to as rug pulls, can lead to the complete loss of user funds.

Regulatory Uncertainty

Another challenge users have to face is the regulatory landscape for DeFi. Many jurisdictions have yet to define clear rules or a framework for decentralized financial applications. This lack of regulatory transparency can result in future restrictions, legal challenges, or enforcement actions against certain platforms and even ecosystems.

Market Volatility

DeFi heavily depends on crypto assets, which are inherently volatile. Even sudden and intense price fluctuations can affect the stability of DeFi protocols, especially those involving lending, borrowing, or collateralized assets. This volatility can further affect liquidity and pose additional risk to participants.

Conclusion

Decentralized Finance (DeFi) is not just a passing trend; it’s a revolutionary movement transforming our perceptions and management of money. DeFi makes it super easy for people to borrow, lend, trade, and earn interest on their assets without needing middlemen.

Naturally, like any emerging technology, DeFi carries risks such as price volatility, security flaws, and regulatory uncertainty. Yet its ability to make finance more inclusive, efficient, and global is undeniable.

If you’re venturing into DeFi for the first time, embrace it with both curiosity and caution. Begin with small steps, and stick to trusted platforms such as Technoloader. We make sure to keep security in mind while building your DeFi.

Contact us today to get started with your DeFi journey!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com