Table of Contents

Real estate tokenization is the process of converting the value of a physical property into blockchain-based digital tokens, where each token represents fractional ownership of the asset. This allows investors to buy, sell, and trade portions of real estate with lower capital requirements, improved liquidity, and transparent ownership records secured by smart contracts. By using blockchain, real estate tokenization makes property investment more accessible, efficient, and globally scalable compared to traditional real estate models.

Real estate is widely considered one of the most reliable investment options!

What if we say owning a piece of luxury property without buying the entire building? Sounds mesmerizing, right? Welcome to the world of real estate tokenization.

Curious what it is? So, with the use of blockchain technology, this is a cutting-edge approach that has turned physical properties into digital tokens while making property investment more reliable, accessible, and transparent.

Whether you’re just a beginner or a seasoned investor, understanding how real estate tokenization works will open a wide range of new opportunities and reshape your way of investing in real estate.

So, without looking further, let’s break down all the in-depth information related to real estate tokenization.

Let’s start!

What is Real Estate Tokenization?

Started appearing around 2017-18, real estate tokenization is a modern way of investing in property. It is a process that typically transforms the real value of a physical property into a digital token, and an interesting part is that you can easily sell, purchase, and trade them on a blockchain platform.

These tokens are developed using blockchain technology. Each of them represents a small share of property, and multiple people can invest in the same asset.

Let’s understand this with an example:

Imagine a property that’s worth around $20 million; so here, with the help of tokenization, it is divided into thousands of tokens. Now, as this property is divided into multiple digital tokens, you can choose to buy them instead of purchasing the whole property.

Meanwhile, talking about its development, as of mid-2025, real estate tokens are part of the $412 billion total tokenized assets globally. Over the past three years, the RWA tokenization market has grown by 308% and has surpassed the $24 billion milestone.

Furthermore, in terms of its reach, it is projected that global tokenization will surpass $3 trillion by 2030, with a potential 15% of the world’s global property AUM.

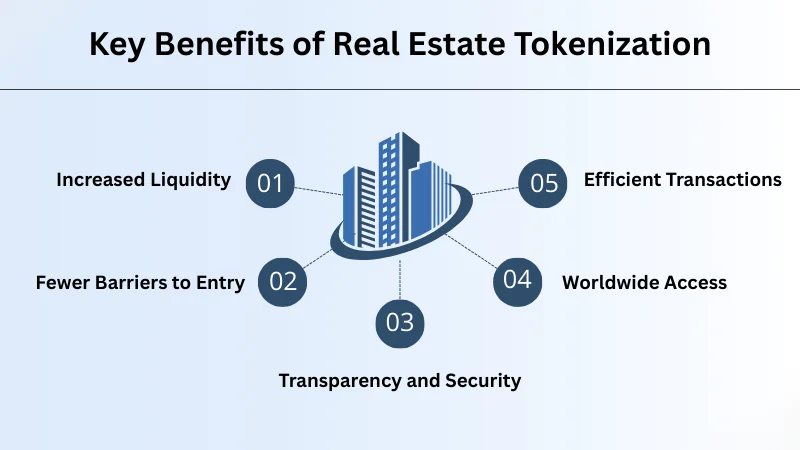

Key Benefits of Real Estate Tokenization:

After understanding what real estate tokenization is, you might be wondering about its benefits. If so, let’s break down its core benefits specifically:

Increased Liquidity:

One of the leading benefits of tokenization of real estate is an increase in liquidity. Unlike traditional real estate, where investors are often required to have significant capital to buy a property and also face certain difficulties selling it. Tokenization has completely changed the game. Now, investors are able to buy and sell fractional shares, which makes it easier to enter and exit investments.

Fewer Barriers to Entry:

Since traditional real estate requires thousands and lakhs of rupees for investment, tokenization has completely transformed the context. With the help of this, investors with minimal investments can invest in real estate. This often opens the market for a wide range of investors.

Transparency and Security:

Almost every industry acknowledges that blockchain is a great way to maximize transparency. Coming to the real estate sector, then, with the help of blockchain technology, users will get the benefits of true ownership and transactions more safely and transparently.

Worldwide Access:

Tokenized real estate is easily accessible to investors worldwide. This enables investors to diversify their investments and facilitates cross-border transactions. With the global investment market expected to exceed $3 trillion, this can significantly open up a substantial portion of that market internationally.

Efficient Transactions:

Comparatively, token transactions are more affordable and usually increase efficiency by efficiently accelerating the purchase and sale of real estate.

How Does Real Estate Tokenization Work?

By comprehending the step-by-step process, you can streamline the sophistication of blockchain-backed assets. Let’s understand how:

Step 1: Property Identification and Legal Structuring

The process starts with choosing real estate assets such as an apartment, office building, or piece of land. After choosing the property, the actual process begins; this property will typically be placed under a legal structure like an LLC or SPV. This legal entity is mandatory to provide investors with legal ownership rights and a digital connection with digital tokens.

Step 2: Token Creation on Blockchain

Once the property is legally structured, its total value will be summarized into multiple parts. Here, each part will be represented as a digital token on a blockchain. This is where developers build real estate tokenization, ensuring tokens work like digital certificates of ownership, making it simple for investors to own a fraction of the property rather than purchasing the whole asset.

Step 3: Smart Contracts Integration

Once the tokens are built on the blockchain, the smart contract will be automatically programmed into the blockchain. Meanwhile, these are self-executing agreements that typically manage all the crucial tasks, like ownership transfers, rent distributions, and others, without intermediaries. However, with the use of smart contracts, this process becomes faster and more transparent.

Step 4: Investor Participation

Once the tokens are created, investors are able to purchase them using their traditional money or cryptocurrencies. This lowers the entry barrier, making real estate investment more affordable even for people with minimal capital. Instead of needing millions, you can easily start purchasing a property with just a few tokens.

Step 5: Trading and Liquidity

Now, coming towards the trading of tokens, unlike traditional real estate, which is tough and time-consuming to sell, tokenized real estate offers liquidity. Here, tokens can easily be traded on approved digital platforms. With this result, investors are able to easily sell their shares, often within a day, rather than waiting for months or years.

Step 6: Income & Profit

Lastly, during the time you own that property, if the property has generated rental income, then it will automatically be distributed among the token holders, based on the number of tokens they own. Additionally, if the property’s value increases, then tokens become more valuable, giving investors the chance to earn profits when they sell their tokens.

Challenges & Risks

Same as any investment, tokenization also has certain drawbacks, such as

- Profitability Risks: Compared to other investments, in real estate tokenization, income may be lower than expected. Reasons behind it are non-payments, rental vacancies, unforeseen expenses, and others.

- Unreliable Platforms: While making an investment, if you choose a platform without guarantees, then you might face fraud or hacks.

- Uncertain Legal Framework: Today also, there are several countries where regulations are still unclear and under development.

- Technical Complexity: Before making the investment, if you don’t have knowledge about tokens or digital wallets, then you can even make costly mistakes.

Conclusion

After reading in-depth information related to real estate tokenization, if you’re still confused about whether to invest or not, then you should know that investment in tokenized estate offers many possibilities. Comparatively, it is more accessible, secure, and efficient than real estate outright.

At present, with few consolidated platforms, it is still an emerging alternative. But talking about its future potential, it is enormous.

Lastly, the process of building a real estate tokenization platform is not easy; it generally requires expert assistance and strong technical foundations. Choosing Technoloader over others is an ideal choice. With a track record of successful projects, we will help you improve your system excellently.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com