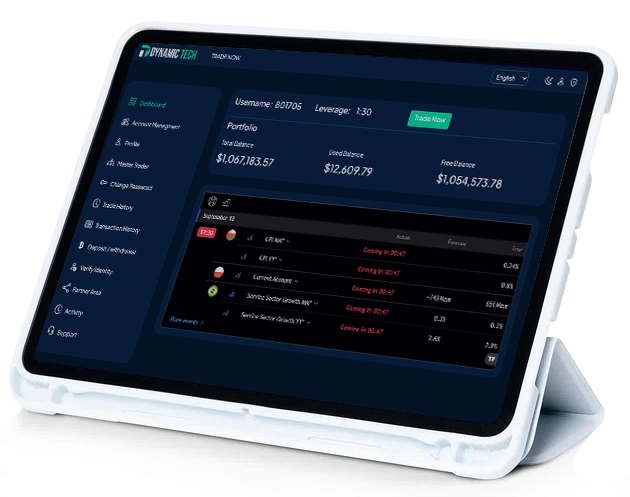

DynamicTech

DynamicTech is a multi-asset trading platform that supports crypto, forex, and equity trading within a unified ecosystem. With advanced margin trading capabilities, it enables users to enhance investment exposure while operating in a secure, efficient, and performance-driven financial trading environment.

Client Requirements

- Build a multi-asset trading platform supporting crypto, forex, and equity trading within a single system.

- Develop a complete crypto exchange module with margin trading, token listing, and order execution using Binance liquidity.

- Integrate Forex trading through PrimeXM and multiple brokers with pure A-Book order routing.

- Enable equity margin trading with access to Hong Kong, Indian, and US stock markets via integration.

- Implement an advanced risk management system with configurable risk parameters.

- Provide customizable UI/UX with drag-and-drop layout control based on client preferences.

- Add spread management across supported asset classes.

- Support multi-asset wallets and unified trading accounts.

- Integrate a secure payment gateway for deposits and withdrawals.

- Enable multi-language support for global user accessibility.

- Integrate TradingView charts for real-time market analysis.

- Create a structured admin hierarchy with role-based access, including:

Super Admin Admin IB Sub-IB End Users

Purpose of the Platform

DynamicTech aimed to unify traditional and digital markets into a single and high-performance trading ecosystem. The main objectives were:

Real-Time Trading

Designed to execute market, limit, and conditional orders instantly with minimal latency across all supported asset classes.

Multi-Asset Coverage

Enables seamless trading of cryptocurrencies, forex, equities, and commodities through one unified trading system.

Scalability

Built to support high-frequency trading and huge price updates without affecting performance during peak activity.

Automation

Uses event-driven systems to automate order processing, price distribution, and real-time market data streaming.

Risk Management

Imposes dynamic exposure limits and automated stop mechanisms to protect traders and maintain regulatory compliance.

Copy Trading

Allows users to follow and automatically copy strategies of experienced traders with transparent performance tracking.

Challenges Faced & Solutions Implemented

Building a multi-asset trading platform introduced several technical and operational challenges that required careful architectural planning and execution. The challenges that came in our way and the solutions that we implemented are:

Handling real-time data from crypto, forex, and equity markets with different tick speeds, liquidity sources, and execution rules.

Built a unified margin trading framework supporting crypto, forex, and equities through asset-agnostic models under a single execution layer.

Maintaining sub-50ms trade execution while processing thousands of orders and continuous market data streams.

Adopted event-driven processing, in-memory execution paths, and non-blocking I/O to ensure consistently low-latency trade execution.

Designing infrastructure capable of scaling during peak traffic without downtime, performance drops, or data inconsistencies.

Designed horizontally scalable services for pricing, matching, and risk to handle peak volatility without performance degradation.

Applying consistent daily and monthly risk limits across diverse asset classes with varying leverage and volatility profiles.

Implemented a centralized risk engine enforcing leverage, margin, liquidation, and asset-specific rules consistently across markets.

Securely connecting multiple liquidity providers, KYC, and payment gateways within a modular architecture.

Standardized integrations using adapter layers to connect exchanges, liquidity providers, and brokers without affecting core trading logic.

Supporting broker, MIB, IB, and user hierarchies while ensuring commissions and maintaining system performance.

Developed a multi-tenant architecture enabling configurable branding, commissions, leverage, and risk controls for brokers and IBs.

System Architecture

Below is the system architecture of DynamicTech that was designed to support a scalable, low-latency, and multi-asset trading platform, which enables seamless integration, real-time processing, and robust risk management.

Frontend Applications

- Client Panel (Web & Mobile) – Traders can view live charts, execute trades, manage positions, and monitor P&L.

- Admin Panel – Broker and admin-level control for users, liquidity, risk, spreads, and commissions.

- Risk Panel – Real-time monitoring of user exposure, leverage, and emergency controls.

Data Flow (Real-Time Pipeline)

- LP Subscriptions (Crypto, Forex, Equities).

- Data → Kafka Streams (segmented by broker/shared).

- Redis for low-latency caching.

- WebSocket broadcasting to end users.

- Client UI renders real-time market depth and spreads.

Backend Microservices

- Crypto Server / FX Server / Equity Server – Connects to LPs and streams live prices to Kafka topics.

- Price Feed Consumer – Normalizes data, applies throttling (for forex & equities), and pushes to Redis.

- Order Management System – Executes market, limit, stop-loss, and take-profit orders in real time.

- Risk Admin Server – Manages stop-loss triggers, risk notifications, and exposure checks.

- Cron Server – Automates commission distribution and scheduled order executions.

- Public API Layer – Provides connectivity for prop trading firms and third-party apps.

User Roles & Hierarchical Model

The platform follows a structured, role-based hierarchy to ensure clear operational control, scalable partner management, and transparent commission distribution.

Super Admin

Full platform control, global configurations, and system oversight.

Admin

Manages brokers, permissions, and reporting across assigned regions.

Broker

Onboards MIBs, IBs, and Sub-IBs and oversees trading client activities.

MIB (Master Introducing Broker):

Refers IBs and Sub-IBs while earning structured commission revenue.

IB (Introducing Broker)

Refers Sub-IBs, trades actively, and earns commissions based on performance.

Sub-IB/User

Trades on the platform, manages accounts, and can upgrade to IB.

Results & Impact

The outcomes of the project highlight how DynamicTech delivered measurable performance, scalability, and business growth across its multi-asset trading ecosystem.

Low-Latency Execution

Orders were processed in under 50ms for crypto and forex, enabling fast and reliable trade execution.

Scalability Achieved

The platform successfully handled over 10 million tick updates daily with zero downtime.

Risk Protection

DynamicTech enforced daily and monthly drawdown rules reduced trader liquidations by 40%.

Multi-Asset Adoption

Unified access to crypto, forex, equities, and commodities increased overall user engagement by 65%.

Seamless Integrations

Automated KYC, payment, and liquidity integrations reduced user onboarding time by 70%.

Broker Expansion

The white-label model enabled the onboarding of 50+ brokers within six months of launch.

Building the DynamicTech platform was a milestone we achieved. We designed a unified broker layer that supports forex, crypto, and equity segments on a shared margin and risk engine. Overcoming real-time data synchronization and cross-asset execution challenges resulted in a low-latency and scalable system with consistent margin rules and automated risk control.

Conclusion

Dynamic Tech successfully delivers a unified and multi-asset trading platform that combines security, performance, and flexibility. By supporting crypto, forex, equity, and margin trading within a single ecosystem, the solution helps users to execute informed trades while enabling businesses to scale confidently in a competitive financial market.