GreenCryptoX

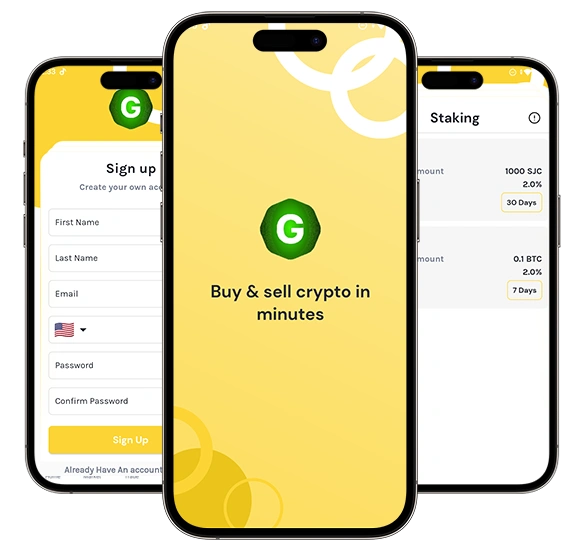

Green Crypto Exchange is a modern digital asset trading platform, especially built to support spot and market trading with both crypto and fiat pairs. This exchange leverages Binance liquidity while maintaining internal order execution flexibility through the A-Book and B-Book model. Additionally, the platform was engineered with a strong focus on operational control, security, and regulatory readiness.

Client Requirements

- Build a crypto exchange that supports easy spot and market trading.

- Connect with the Binance API to ensure live prices and deep liquidity.

- Offer both A-Book and B-Book execution models for flexible trade handling.

- Allow businesses to list new tokens directly on the platform.

- Support trading in both INR and USD pairs.

- Integrate a reliable third-party KYC service for user verification.

- Enable deposits across multiple blockchains for greater flexibility.

- Maintain high security and full admin control to manage and protect the exchange.

Project Key Details

While scrolling down the platform's key functions and innovations, let's uncover some key information you must be aware of about GreenCryptoX.

Platform Type

A modern cryptocurrency exchange designed to provide secure, reliable, and user-friendly trading for both retail and professional users.

Trading Types

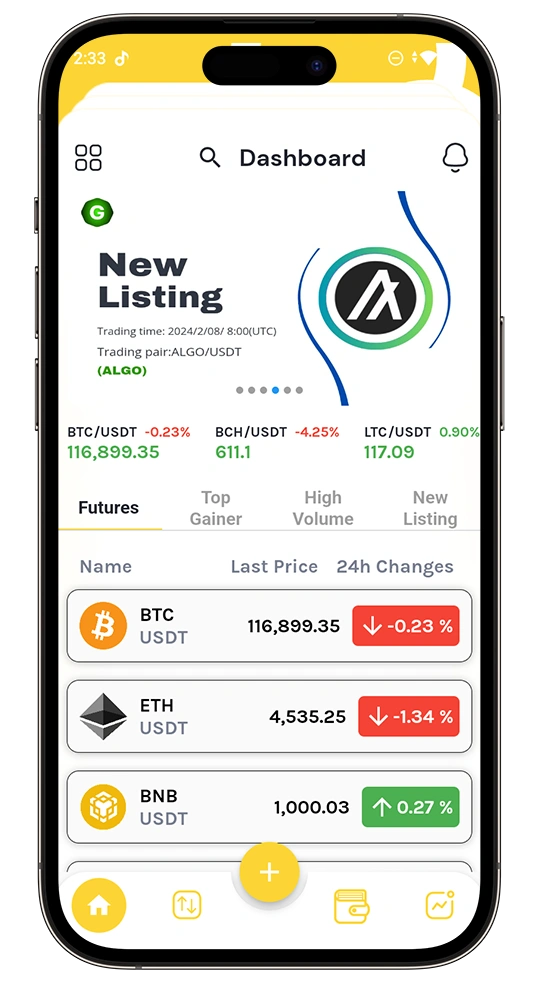

Supports both spot and market trading, enabling users to execute instant or advanced orders seamlessly across all assets.

Liquidity Source

Connected with the Binance API to provide deep market liquidity, real-time prices, and smooth trade execution for all users.

Execution Models

Offers A-Book and B-Book execution, giving the platform flexibility to handle internal trades and external liquidity efficiently.

Fiat Pairs Supported

Supports major fiat trading pairs, including INR and USD, making it accessible to both local and international traders.

Blockchain Networks

Integrates three blockchains to allow multi-currency deposits and withdrawals, ensuring flexibility and cross-chain transaction support.

Compliance

Incorporates a trusted third-party KYC provider to verify users, ensuring regulatory compliance without affecting user experience.

Security Layer

Uses an enterprise-grade Key Management System (KMS) to protect wallets, private keys, and sensitive user assets securely.

Development Scope & Key Features

This exchange platform brings together essential trading features, strong security measures, and powerful admin tools under one roof. Which includes:

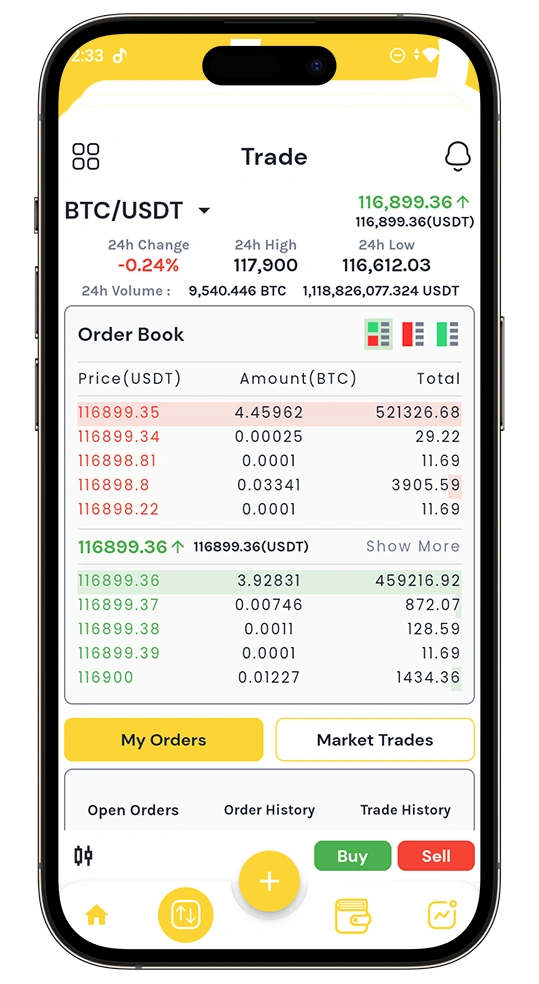

Spot & Market Trading Engine

A power trading engine enables smooth spot and market trades backed by Binance liquidity to ensure accurate pricing and fast order execution.

A-Book & B-Book Trade Execution

The platform supports both A-Book and B-Book execution models, giving users complete control over how trades are routed and managed.

Token Listing Management

A dedicated token listing module allows new digital assets to be onboarded quickly and securely on the exchange.

Modular-Blockchain Deposit Support

The system integrates three different blockchains, enabling users to deposit multiple cryptocurrencies seamlessly.

Fiat Trading Pair Support

Users can trade cryptocurrencies against both INR and USD, making the platform accessible to local and global audiences.

Secure Key Management System

A robust KMS protects wallets and private keys, ensuring high-level security for all digital assets.

Admin-Controlled Withdrawals

All withdrawals are handled through an admin approval system, adding an extra layer of protection against unauthorized transactions.

Centralized Admin Dashboard & Reports

A unified admin panel provides detailed insights and reports on deposits, withdrawals, trades, and user activity, enabling better monitoring, faster decision-making, and smooth operations.

Project Challenges

While developing GreenCryptoX, we have several technical and operational challenges, such as

Balancing External Liquidity with Internal Execution

Managing trades across external liquidity providers and internal order flow required precise control to avoid slippage and execution delays.

Ensuring Secure Asset Custody

Protecting user funds and private keys was very difficult, especially while handling high-volume transactions.

Regulatory Onboarding for Fiat Users

Onboarding fiat users involved meeting compliance requirements without affecting the user experience.

Preventing Unauthorized Withdrawals

Unauthorized or suspicious withdrawals posed a major security risk to the platform.

Handling Multiple Blockchain Deposits

Supporting deposits from different blockchains increased operational and wallet management complexity.

Solutions

Each challenge was addressed with carefully designed solutions resulting in platform stability, security, and scalability.

Smart Liquidity Routing

Implemented intelligent routing between Binance liquidity and internal trade execution to ensure straightforward order fulfillment.

Enterprise-Grade Key Management

Integrated a secure Key Management System (KMS) with encrypted key storage and restricted access controls.

Flexible KYC Integration

Adopted a third-party KYC solution designed to meet regulatory standards while keeping onboarding simple.

Admin-Controlled Withdrawal Security

Introduced an admin approval mechanism to review and authorize withdrawals before processing.

Unified Multi-Blockchain Wallet System

Built a centralized wallet architecture capable of managing deposits across multiple blockchain networks efficiently.

Results & Impact

The project delivered strong results by enhancing platform stability, execution speed, security, compliance readiness, and overall operational efficiency.

Stable & Scalable Platform Delivery

Successfully delivered a robust crypto trading platform designed to scale smoothly as user activity grows.

High-Speed Trade Execution

Enabled fast and reliable order execution through a hybrid A-Book/B-Book trading model.

Enhanced Platform Security

Strengthened asset protection using enterprise-grade key management and secure wallet infrastructure.

Regulatory Readiness Achieved

Ensured compliance by integrating a trusted third-party KYC solution for smooth user onboarding.

Improved Operational Efficiency

Streamlined platform management with centralized admin controls and detailed reporting.

Reliable Crypto & Fiat Trading Experience

Delivered a seamless and trustworthy trading environment for both crypto and fiat users.

Green-Cryptox was an engaging project that focused on delivering a modern crypto trading platform with strong performance and security foundations. Aligning advanced trading features with real-world compliance and operational needs, we delivered a reliable, scalable exchange within tight timelines, which further made the collaboration both successful and professionally enriching.

Conclusion

GreenCryptoX successfully brings together speed, security, and flexibility in the modern crypto trading platform. By combining Binance liquidity with A-Book and B-Book execution models, the exchange delivers smooth trading for both crypto and fiat users while maintaining strong operational control.

However, with advanced security measures, regulatory-ready KYC integration, multi-blockchain support, and an advanced admin system, this platform is well-suited for long-term growth. The platform offers a reliable, scalable, and compliant trading environment designed to meet the evolving needs of global digital asset markets.