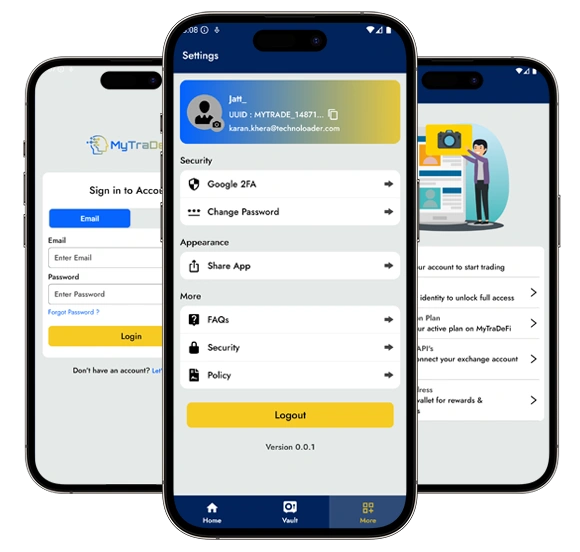

Development of a Copy Trading Platform

A Copy Trading Platform allows users to follow skilled traders and automatically copy their trades in real time. It removes the need for constant monitoring, offers secure fund handling and risk controls, and provides clear performance insights, making crypto trading simpler and more accessible for both beginners and experienced traders.

Client Requirements

- Develop a copy trading platform that allows users to mirror trades from expert traders automatically.

- Deliver real-time trade execution with ultra-low latency.

- Support multiple followers for each master trader.

- Ensure secure fund management with transparent trade tracking.

- Provide detailed profit/loss insights, trade history, and performance reports.

- Enable both manual and automated controls, including pause, stop, and risk limits.

- Build a scalable architecture capable of handling high-frequency trading activity.

Project Key Details

We designed a web-based and admin-controlled Copy Trading Platform with the following objectives:

Architecture

Designed with an event-driven architecture, the platform enables real-time execution of trades. Each trade event is instantly processed and shared across the system to ensure fast, accurate, and low-latency performance.

Framework

The React.js frontend delivers a responsive dashboard with analytics and control features, while the Node.js backend manages trade orchestration, executes risk checks, and ensures smooth platform operations.

Technology Ecosystem

The solution integrates with EVM-compatible chains and centralized exchanges via APIs, allowing seamless trade execution across both decentralized and centralized crypto trading environments.

Data Layer

A combination of MySQL for persistent data storage and Redis for caching and queues ensures high performance, reliability, and efficient handling of real-time trading activity.

Security

Security is enforced through encrypted key management and role-based access control, protecting sensitive credentials and ensuring only authorized actions across the platform.

Execution Model

The platform follows a master→followers execution model, where trades are copied using proportional allocation, ensuring fair and balanced execution for all followers.

Risk Management

- Set maximum drawdown limits for each user to control overall risk exposure

- Apply per-trade and daily loss limits to prevent excessive losses

- Enable capital allocation controls using fixed amounts or percentage-based models

- Automatically pause or stop copy trading when risk thresholds are breached

- Validate slippage and leverage levels before trade execution to ensure safer trades

Challenges Faced & Solutions Delivered

While building the platform, we encountered key challenges that required practical and effective solutions.

Replicates master traders to followers in real time. Executes parallel follower orders without errors or delays.

Event-driven, WebSocket-based system allows real-time trade replication. Queue-based workers process multiple follower trades in parallel.

Calculates proportional trade sizes based on balance and risk. Maintains accuracy during high-frequency and leveraged trading activity.

Automatically scales trades by balance, leverage, and risk. Precision logic prevents rounding errors during rapid executions.

Calculates profits and losses fairly across multiple followers. Manages performance fees and commissions with full transparency.

Calculates real-time profits and losses for each follower. Applies performance fees and commissions transparently and accurately.

Enforces drawdown limits, daily loss caps, and auto-stop. Prevents excessive losses during volatile and fast markets.

Enforces drawdown limits, daily loss caps, and auto-stop. Validates leverage, slippage, and trade size before execution.

Provides complete oversight without disrupting automated trade execution. Monitors failed trades, retries, and system exceptions live.

Dashboard enables monitoring, pausing, and exception handling. Provides audit logs and real-time operational analytics.

Processes trades with low latency for large user volumes Supports fault tolerance, retries, and rollback under load.

Redis queues ensure low-latency and reliable trade execution. Fault-tolerant mechanisms support stability under heavy load.

Protects private keys, API credentials, and sensitive data. Ensures encrypted storage and a controlled in-memory decryption process.

AES-256-GCM encryption protects private keys and credentials. Role-based access prevents unauthorized system and API usage.

Executing master trades across several follower accounts is delayed by order placement latency because of network problems, API limitations, and sequential processing. Results in price slippage, partial fills, and inconsistent PNL during high market volatility.

Parallel order execution with WebSocket-based signal listening for real-time trade replication. Smart order batching with pre-validation, rate-limit handling, and priority-based retries to ensure faster and reliable execution.

Key Features

Some of the standout features that make this platform unique are:

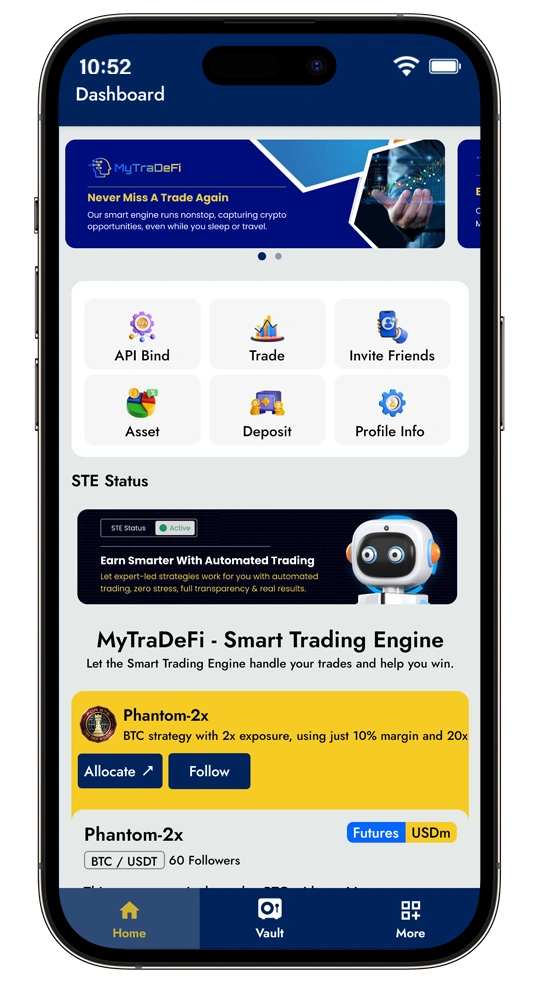

Automated Copy Trading

Automatically follow expert traders and copy their trades in real-time.

Multi-Exchange Integration

Trade seamlessly across multiple centralized and EVM-compatible exchanges from one platform.

Proportional Trade Allocation

Trades are scaled fairly based on each user's balance and risk settings.

Profit Distribution System

Profits, losses, and fees are calculated accurately with complete transparency for users.

Advanced Risk Management

Built-in controls help limit losses and protect users during volatile market conditions.

Admin Control Tools

Admins can monitor, manage, and control the platform actively without disrupting trading.

High-Performance Architecture

Designed to handle fast trade execution even during high traffic and heavy loads.

Security-First Design

Strong encryption and access controls keep funds, data, and credentials secure.

Real-Time Analytics & Reporting

Live dashboards provide clear insights into trades, performance, and profit trends.

Scalable & Fault-Tolerant System

The system scales smoothly and remains stable even under extreme trading demand.

Results & Impact

The developed platform successfully delivered the following business and technical objectives:

Real-Time Trade Replication

Trades from master traders are copied instantly, ensuring followers never miss opportunities.

Accurate Profit Distribution

Profits, losses, and fees are calculated fairly and transparently for every participant.

Enhanced Security

Strong encryption and access controls protect user funds, data, and trading credentials.

Operational Control

Admins maintain full visibility and control without interrupting live trading operations.

High Performance & Scalability

The platform handles high trading volumes smoothly as users actively grow.

Risk Management Effectiveness

Smart risk controls help minimize losses during market volatility and abnormal conditions.

Developed a secure and scalable copy trading platform by integrating BingX and Binance APIs for real-time cross-exchange trade replication. We even architected a unified execution and risk management layer with consistent margin rules and leverage controls. This project allowed us to address low-latency synchronization challenges and implement OWASP security best practices.

Conclusion

This project delivers a reliable and easy-to-use copy trading platform designed for speed, security, and growth. Using this platform, users can follow expert traders, copy trades in real-time, and track performance with complete transparency.

Built-in risk controls help protect users during market volatility, while real-time analytics improve confidence and clarity. Furthermore, the scalable architecture ensures smooth performance even with heavy user trading activity. With strong security and admin controls, the platform creates a safe, efficient, and trustworthy trading experience for all users.