Arab Global Exchange Platform

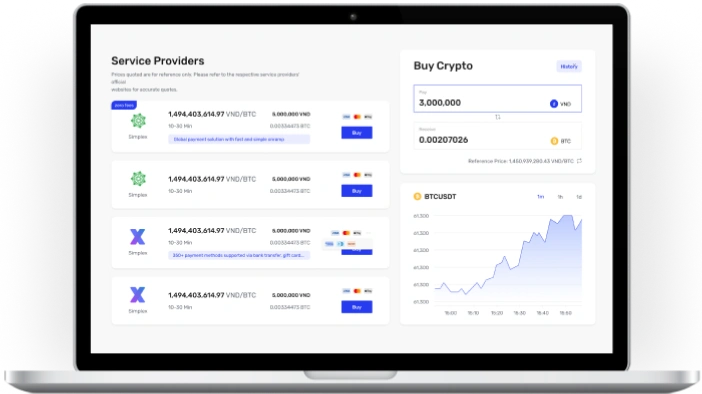

Arab Global Exchange is a full-scale cryptocurrency trading platform built for global markets. It supports spot, future, and option trading, along with multiple fiat currencies, making it perfect for both retail and professional traders. The platform connects with leading external exchanges like Deribit to ensure deep derivatives liquidity while using an in-house A-Book and B-Book execution model for efficient trade handling. Designed with strong security, regulatory readiness, and scalability at its core, this exchange delivers a smooth and reliable trading experience worldwide.

Client Requirements

- Built a unified crypto exchange supporting spot, futures, and option trading.

- Integrated Deribit and multiple exchange APIs to ensure strong derivatives liquidity.

- Implemented A-Book and B-Book execution models across all trading markets.

- Enabled multiple order types, including Limit, Market, Stop-Limit, and Stop-Market.

- Supported INR and global fiat trading pairs for wider market access.

- Implemented national and international KYC with AML compliance.

- Ensured high security, instant withdrawals, and full admin-level control.

Project Key Details

Before exploring Arab Global Exchange’s features, first, let’s understand the technical foundation that ensures a secure, scalable, and efficient trading ecosystem.

Spot and Derivatives Trading

Trade crypto easily with spot, futures, and options markets, plus limit, market, stop orders, and automated trading bots.

Wallet & INR Settlement

Deposit or withdraw INR via UPI/NEFT, keep separate crypto and INR wallets, and check balances on a clear dashboard.

Security Considerations

Keep your account safe with 2FA, anti-spam measures, locked balances during orders, and protection against DDoS attacks.

Admin Panel Features

Admins can manage trading pairs, set fees, monitor trades, freeze suspicious accounts, and see top liquidity providers.

Key Features

Our crypto exchange platform is built with powerful features to make trading, wallet management, and administration simple, secure, and flexible for every user. Some of the great features implemented in this platform include:

Trading Engines

Supports spot, futures, and options trading with access to external liquidity for smooth order execution.

Flexible Execution

Admins can switch between A-Book and B-Book execution for each trading pair.

Multiple Order Types

Place trades using limit, market, stop-limit, or stop-market orders.

Futures & Options Integration

Seamless trading with the Deribit API for futures and options markets.

Token Listing & Rewards

Easily list new tokens and offer staking and referral rewards to users.

Multi-Blockchain Support

Trade and deposit across 6 blockchains, supporting multiple cryptocurrencies.

Instant Withdrawals

Withdraw funds instantly with automated risk checks for safety.

Wallet & Key Security

Integrated Key Management System (KMS) ensures secure wallets and private keys.

KYC & AML Compliance

Supports national and international KYC and AML regulations.

Fiat Currency Support

Users can trade and deposit in USD, EUR, AED, GBP, and INR.

Customizable User Settings

Set individual trading fees, withdrawal fees, and leverage limits per user.

Admin Controls

Admins manage pairwise A/B book switching and create contract margins easily.

Challenges & Solutions

While developing Arab Global Exchange, we have faced multiple challenges, but our experts have overcome those challenges with our comprehensive solutions, including:

Managing spot, futures, and options trading in one system while ensuring performance, stability, and shared risk controls.

Built modular trading engines with centralized risk management and scalable system architecture.

Ensuring smooth liquidity flow across external exchanges without execution delays or pricing mismatches.

Implemented smart order routing between Deribit and internal order books for optimal execution.

Managing A-Book and B-Book exposure dynamically across volatile trading pairs and market conditions.

Enabled admin-level, pairwise A/B book switching with real-time execution control.

Adapting to varying regulatory requirements across regions while onboarding diverse user bases.

Integrated flexible KYC and AML workflows for both national and international compliance.

Processing large, instant withdrawals securely without increasing fraud or operational risks.

Build automated validation, limit enforcement, and real-time monitoring systems.

Protecting user funds and private keys from unauthorized access and security breaches.

Deployed enterprise-grade KMS with encryption, restricted access, and strict key management controls.

Results & Impact

After the completion of the project, here's the core outcome for our Arab Global Exchange platform.

Multi-Market Trading Capability

Delivered a multi-asset, multi-market exchange designed for professional and high-volume trading.

High-Speed Trade Execution

Enabled faster order execution through hybrid liquidity integration and intelligent execution models.

Advanced Risk Management

Strengthened risk control using configurable A-Book and B-Book execution across trading pairs.

Global Compliance Readiness

Achieved regulatory preparedness with seamless national and international KYC and AML integration.

Scalable Platform Architecture

Enhanced scalability through multi-blockchain infrastructure and broad multi-currency support.

Operational Efficiency & Control

Improved operational efficiency with advanced admin controls, analytics, and detailed reporting systems.

Arab Global Exchange was a highly rewarding project where we built a secure and scalable digital trading platform for global markets. This project allowed us to work closely on complex trading workflows, risk management, and enterprise-grade security. And, we successfully transformed client’s requirements into a stable and high-performance digital exchange.

Conclusion

Arab Global Exchange is a secure, user-friendly cryptocurrency platform designed for traders of all levels. From spot and futures to options trading, it connects with global liquidity sources to ensure smooth and fast execution.

With multi-currency support, robust wallet security, instant withdrawals, and compliance with KYC and AML regulations, it provides a safe trading environment. Its flexible system and powerful admin controls make managing trades and risk easy, while scalable architecture ensures it can grow with users’ needs worldwide.