Table of Contents

Blockchain neo banks are digital-first financial platforms that use blockchain technology to deliver faster, borderless, and low-cost banking services without relying on traditional banking infrastructure. They enable instant settlements, transparent transactions, smart contract–based automation, and seamless crypto–fiat integration. By removing intermediaries, blockchain neo banks improve efficiency, security, and global financial accessibility.

Banking wasn’t always meant to be slow, expensive, or limited by borders. But, over time, that’s exactly what it became.

Waiting days for transfers, paying high fees for cross-border payments, and relying on outdated systems still feels normal to many of us. Yet, in a world where everything else is instant and digital, finance is finally catching up.

That’s where blockchain neo banks step in! it combine the simplicity of modern digital banking with the power of blockchain technology. This offers faster transactions, greater transparency, and more control over money. Well, this also means no physical branches, no unnecessary intermediaries, and no delays.

As we move towards 2026, blockchain neo banks are no longer just an idea for crypto enthusiasts. In 2021, neobank Chime was named one of the top 10 banks in the US with more than 20 million customers. Today, it has more than 21 million users.

Want to explore this further? Here’s a blog for you!

What Are Neo Banks?

Neo banks are basically digital-only financial technology companies that provide banking services entirely online through mobile apps. They focuses on user-friendly experiences, lower fees, and tech-driven solutions for users and businesses.

They are also known as “challenger banks” as they disrupts traditional banking with seamless digital tools for spending insights, easy transfers, and personalized financial management. This attracts younger and tech-savvy users.

What Are Blockchain Neo Banks?

Blockchain neo banks are digital-first financial platforms that combine the ease of modern neo banking with the power of blockchain technology. They use decentralized infrastructure to deliver faster, more transparent, and more flexible financial services.Unlike traditional banks or even standard neo banks that rely on centralized databases, use blockchain networks and smart contracts to process transactions.

This means:

- Payments can settle in minutes or seconds.

- Transactions are transparent and traceable.

- Rules can be automated using smart contracts.

- Users can have greater control over their funds.

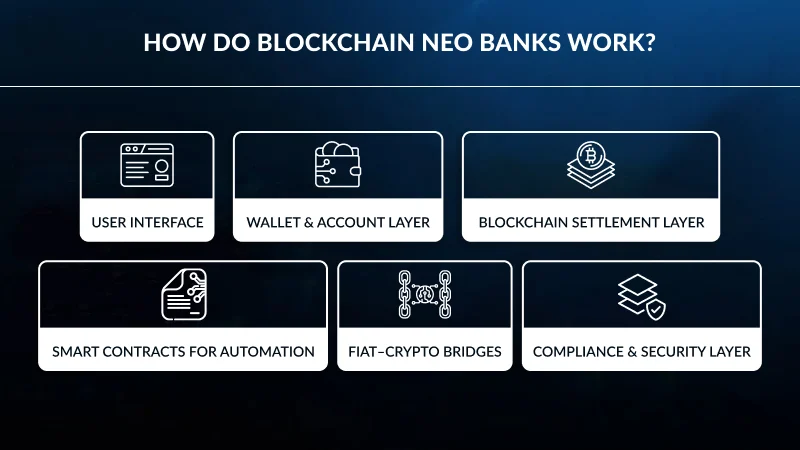

How do Blockchain Neo Banks Work?

Now, let’s have a look at how they work in a simple and step-by-step way!

User Interface

Everything starts with a mobile or web app. It is very similar to a regular neo bank; thus, users don’t need deep blockchain knowledge to get started.

From the user’s point of view, you can:

- Open and manage an account digitally

- View fiat and crypto balances in one place

- Send and receive payments

- Convert between fiat and crypto

- Track transactions in real time

Wallet & Account Layer

Behind the app is the wallet infrastructure, which can work in different ways:

- Custodial wallets: The platform manages keys on behalf of users (simpler UX)

- Non-custodial wallets: Users fully control their private keys

- Hybrid models: A balance between user control and ease of use

This flexibility allows blockchain neo banks to serve both beginners and advanced users.

Blockchain Settlement Layer

This is where blockchain makes the biggest impact. Instead of relying on multiple banks, clearing houses, and batch settlements, blockchain neo banks use blockchain networks to record and settle transactions.

As a result:

- Payments settle faster

- Cross-border transfers don’t need intermediaries

- Transactions are transparent and verifiable

Smart Contracts for Automation

Smart contracts act like self-executing rules written into code. They can automate payments and transfers, interest calculations, lending and borrowing logic, compliance checks, and scheduled or conditional transactions.

This reduces manual processing, errors, and delays, which makes financial operations more efficient.

Fiat–Crypto Bridges

Blockchain neo banks connect the traditional financial world with blockchain through on-ramps and off-ramps.

This allows users to:

- Deposit fiat money into their account

- Convert fiat to crypto or stablecoins

- Withdraw crypto back to fiat seamlessly

Compliance & Security Layer

Even though blockchain neo banks use decentralized technology, they still operate within regulatory frameworks.

This layer includes: KYC and AML checks

- Transaction monitoring

- Fraud detection

- Encryption and security controls

Key Features of Blockchain Neo Banks

By 2026, blockchain neo banks will no longer be just “digital banks with crypto support.” They represent a new financial model. Below are the key features!

Unified Fiat & Crypto Accounts

Blockchain neo banks allow users to manage traditional currencies and digital assets within a single account. Instead of juggling multiple platforms, users can view balances, transfer funds, and convert between fiat, crypto, and stablecoins seamlessly. This unified experience is powered by secure wallet infrastructure, where robust cryptocurrency wallet development plays a critical role in enabling safe asset storage, real-time balance management, and seamless conversions. As a result, users get a smooth, secure, and fully integrated financial experience tailored for modern digital banking.

Instant & Borderless Payments

By using blockchain settlement layers, neo banks can process payments almost instantly, even across borders. Transactions no longer depend on slow intermediaries or bank hours. This makes global payments as easy as domestic transfers.

Stablecoin-Based Transactions

To combine speed with price stability, blockchain neo banks rely heavily on stablecoins. These assets maintain a consistent value while offering the efficiency of blockchain transfers. Stablecoins are widely used for everyday payments, remittances, and business transactions, which benefits users from faster and more cost-effective settlements.

Smart Contract–Powered Automation

Smart contracts enable blockchain neo banks to automate financial operations that once required manual processing. Payments, interest calculations, compliance checks, and conditional transfers can execute automatically based on predefined rules.

Self-Custody & User Control

Many blockchain neo banks offer custodial, non-custodial, or hybrid custody models, which give users greater ownership over their funds. Instead of relying entirely on the institution, users can retain control of private keys while still enjoying a smooth banking experience.

Real-Time Transparency

Blockchain-based transactions are recorded on immutable ledgers, which makes them transparent and traceable in real time. Users can verify transfers instantly. This transparency builds trust, reduces disputes, and strengthens fraud prevention.

API-First & Embedded Finance Capabilities

Blockchain neo banks are built on API-first architectures, which enable seamless integration with external platforms. Businesses can embed payments, crypto wallets, or lending services directly into their applications. This flexibility allows banking services to function as modular components.

Global Reach with Local Compliance

Blockchain neo banks can also adapt to local regulatory requirements. Region-specific KYC, AML, and reporting standards are integrated into the platform. This allows users to benefit from borderless finance while ensuring compliance with legal frameworks across different jurisdictions.

Blockchain Neo Banks vs Traditional Banks

Here’s a table that highlights how blockchain neo banks differ from traditional banks, which will make it clear why they are gaining momentum in 2026!

| Factor | Traditional Banks | Blockchain Neo Banks |

| Infrastructure | Centralized legacy systems | Blockchain-based, decentralized or hybrid infrastructure |

| Physical branches | Required | No physical branches |

| Account opening | Slow, paperwork-heavy | Fully digital, fast onboarding |

| Transaction speed | Hours to days (especially cross-border) | Near-instant or same-day settlement |

| Cross-border payments | Expensive and slow | Faster with lower fees |

| Operating hours | Limited to banking hours | 24/7 availability |

| Transparency | Limited visibility into transactions | Real-time, verifiable transaction records |

| Fees | Higher due to intermediaries | Lower due to automation and fewer intermediaries |

| User control over funds | Bank-controlled custody | User-controlled or hybrid custody models |

| Automation | Mostly manual processes | Smart contract–based automation |

| Innovation speed | Slow due to legacy systems | Fast, technology-driven iteration |

| Global accessibility | Restricted by geography | Borderless by design |

The End Note

That brings us to the end of this blog!

As we have seen, blockchain neo banks are changing the entire financial experience by removing unnecessary delays, cutting down costs, and giving users more control over their funds.

We have just stepped into 2026, and this year marks that blockchain neo banks are one of the best financial tools. They are built for a world where payments are global, businesses are digital-first, and users expect instant access to their money.

If you are a business, startup, or an entrepreneur exploring this next wave of finance, having the right technology partner makes all the difference. Technoloader helps turn these ideas into real and scalable blockchain solutions.

This way, you are not just keeping up with the future of banking, but building it. So, get in touch with us now!

FAQ’s

A blockchain neo bank is a digital-first financial platform that combines neo banking services with blockchain technology. It offers features like instant payments, crypto and fiat accounts, smart contract automation, and greater transparency, without relying on physical branches or slow legacy systems.

No, not at all! Most blockchain neo banks are designed to feel like regular digital banking apps. Users can send money, check balances, and make payments without understanding the technical details of blockchain.

Yes! One of their main features is the ability to manage fiat currencies, cryptocurrencies, and stablecoins in a single account. This makes it easier for users to move between traditional finance and digital assets without using multiple platforms.

Absolutely! Blockchain neo banks are well-suited for businesses that need fast payments, global access, automated workflows, and API-based integrations. Many platforms are designed specifically to support startups, enterprises, and Web3 companies.

By 2026, users expect instant payments, global accessibility, transparency, and digital-first experiences. Blockchain neo banks are built to meet these expectations, which makes them a key driver of the next generation of financial systems.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com