Table of Contents

Crypto markets move fast, and they never pause. Prices change around the clock, opportunities appear and disappear within minutes, and keeping up manually can be exhausting.

That’s why many traders today rely on automated crypto trading bots!

Cryptocurrency trading bots are programs that automatically place buy and sell orders based on predefined rules or strategies. Instead of reacting emotionally, traders use bots to follow the market with speed, consistency, and discipline.

However, not all bots work the same way. Some are designed for sideways markets, others focus on trends, while some aim to profit from price differences across cryptocurrency exchanges. Choosing the wrong type of bot or using one without understanding how it works can lead to poor results.

Well, that’s what this blog is for!

In this blog, we’ll talk about the different types of crypto trading bots so that you understand which option fits your trading goals and risk level.

Without further delay, let’s quickly get started!

What is a Crypto Trading Bot?

A crypto trading bot is basically a software program that is designed to automate the process of trading cryptocurrencies. They analyze market data, identify trading opportunities based on predefined strategies, and execute trades accordingly. These operate continuously, which enables traders to capitalize on market movements 24/7.

Well, the concept of crypto trading bots is not new. They gained popularity in the traditional financial market, and as the demand for cryptocurrencies rose, these were used to cater to the specific demands of digital assets. And now, these play an important role in the crypto space, which attracts both individual traders and experienced investors.

With crypto trading bots explained above, now let’s move on to how they work!

How do Crypto Trading Bots Work?

Crypto trading bots work on three basic functions, which include:

Signal Generator

It is a function that helps make predictions and track the most profitable trades based on technical indicators and market data. Depending on the data it gathers, the crypto trading bot generates a buy or sell signal.

Risk Allocation

It is a function that actually takes the buy or sell signal from the signal generators and decides how much to buy or sell. It helps make these decisions based on a particular set of parameters and rules.

Execution

This function conducts the actual buying and selling of your crypto assets. It converts signals into API key requests that exchanges can understand and process.

Why Traders Use Crypto Trading Bots?

Crypto trading is fast and often unpredictable. For many traders, keeping up manually becomes a tedious task. That’s why crypto trading bots have become a practical tool for traders looking to trade smarter. Here are more reasons why traders choose to use them:

24/7 Market Coverage

Cryptocurrency markets operate around the clock, unlike traditional financial markets. These bots can monitor price movements and execute trades continuously without breaks, which ensures that opportunities are not missed due to time zones, sleep, or availability.

Faster & More Accurate Execution

Trading bots can analyze data and place orders within milliseconds. This speed helps traders enter and exit positions more efficiently, especially in volatile markets where prices can change rapidly. Faster execution often leads to better trade efficiency compared to manual trading.

Emotion-Free Trading

Emotions such as fear, greed, and hesitation often lead to poor trading decisions. These follow crypto bot trading strategies and remove emotional bias from the process. This helps traders stick to their strategies even during sudden market swings.

Strategy Automation

Once a strategy is defined, a bot can execute it repeatedly without any interruption. This ensures consistent application of automated crypto trading strategies across multiple trades and market conditions. This is something that is difficult to achieve manually over long periods.

Ability to Trade Multiple Markets at Once

Bots can monitor and trade multiple pairs, exchanges, or strategies at a particular time. This allows traders to diversify their approach and manage several opportunities at the same time without constant manual supervision.

Backtesting & Optimization

Some of the best crypto trading bots allow strategies to be tested on historical data before real funds are used. This helps traders evaluate performance, identify weaknesses, and refine their strategies, which leads to more informed trading decisions.

Better Risk Management

Crypto trading bots can be programmed with risk controls such as stop-losses, position sizing, and exposure limits. These built-in protections help manage downside risk and protect capital, especially during highly volatile market conditions.

Want to automate your crypto trading strategies and never miss market opportunities?

Crypto Trading Bot Types: Comparison Table

Before we move on to the details of each crypto trading bot type, let’s have a glance at each!

| Bot Type | Primary Strategy | Best Market Condition | Risk Level | Ideal User |

| Arbitrage Bot | Exploits price differences across exchanges or trading pairs | Low to moderate volatility with pricing inefficiencies | Low to Medium | Advanced traders, professional desks |

| Trend-Following Bot | Enters trades in the direction of an established trend | Strong uptrend or downtrend | Medium | Intermediate traders |

| Market-Making Bot | Places buy and sell orders to earn the bid-ask spread | Stable, high-liquidity markets | Medium to High | Professional traders, exchanges |

| Scalping Bot | Executes frequent trades for small profits | Highly liquid and volatile markets | High | Advanced traders |

| Grid Trading Bot | Buys and sells at fixed price intervals | Sideways or range-bound markets | Medium | Beginners to intermediate traders |

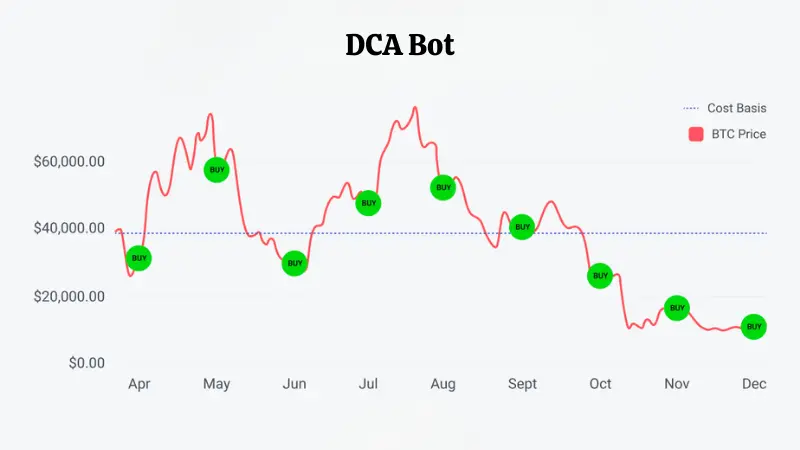

| DCA Bot | Gradually buys or sells assets over time | Volatile or long-term bullish markets | Low | Beginners, long-term investors |

| AI Trading Bot | Uses data analysis or machine learning models to adapt trades | Changing or complex market conditions | Medium to High | Advanced traders, quant users |

| Copy Trading Bot | Automatically copies trades of experienced traders | Stable markets with proven traders | Medium | Beginners, passive traders |

Types of Crypto Trading Bots: In-Depth Analysis

Now that we have compared crypto trading bot types above, let’s take a closer look at each one in detail!

Arbitrage Bot

An arbitrage crypto trading bot is a program that identifies arbitrage opportunities in the crypto market. These bots analyze vast amounts of market data across exchanges to detect opportunities and extract profits from them. It offers speed and efficiency that can’t be matched by a human. By removing delays and errors associated with manual trading, arbitrage crypto bots allow traders to seize opportunities instantly.

Pros:

- 24/7 Automation: Arbitrage bots can continuously scan markets and execute trades 24/7 without human interruption. This ensures no opportunity is missed.

- High Speed Execution: Bots can identify and act on price differences in milliseconds. It is a speed that is impossible for a human trader to match.

- Emotion-Free Trading: The arbitrage crypto bots follow predefined rules. This helps eliminate impulsive decisions that are driven by fear, greed, or hesitation.

- Passive Income Potential: Once configured, a bot can generate profits with minimal oversight. This offers a potential source of income to traders.

- Scalability: Arbitrage bots can monitor price differences across several exchanges and trading pairs. This boosts the chance of finding profitable trades.

Cons:

- Small Profit Margins: Arbitrage bots typically generate very small returns per trade.

- High Fees: Several costs, such as trading fees, withdrawal fees, gas fees, and bot subscription fees, can erase small profit margins.

- Execution Risks & Delays: The price gap can disappear before a trade is completed due to network congestion or processing delays, which results in losses.

- Technical Risks: The crypto trading bot software is susceptible to malfunctions, API glitches, exchange downtime, or more, which can even lead to losses.

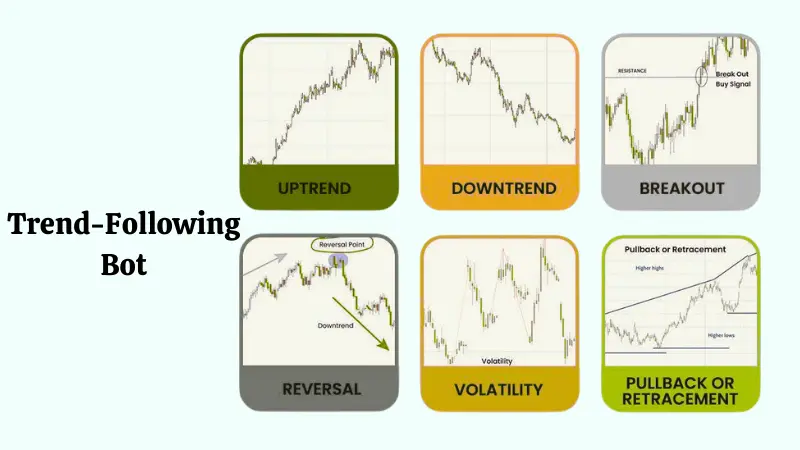

Trend-Following Bot

A trend-following crypto bot is an automated program that helps traders capitalize on market trends. It enables them to make data-driven decisions and execute trades efficiently. These basically follow the momentum of price differences, buying when prices are trending upwards and selling when they are falling. Also, these can monitor the crypto market 24/7 and execute trades based on predefined rules without any supervision.

Pros:

- Emotion-Free Trading: The trend-following bots follow predefined rules and indicators, which remove impulsive decisions that are driven by fear or greed.

- 24/7 Operation: The crypto market never stops or closes. A bot can monitor and execute trades 24/7 and seize opportunities that a human trader might miss.

- Speed & Efficiency: Trend-following bots can analyze huge chunks of market data and execute trades in milliseconds.

- Potential for Huge Gains: This type of crypto trading bot aims to gain profits by riding the momentum of major market shifts. This can lead to profits during bull or bear markets.

- Scalability: A bot can seamlessly manage several trading pairs across various crypto exchanges. This is something that is nearly impossible for any human trader.

Cons:

- Poor Performance in Sideways Markets: Trend-following bots typically struggle in choppy markets, where prices move without a clear direction.

- Technical Risks: These bots are vulnerable to software bugs, API glitches, or system crashes. It can lead to unintentional trades or missed trades, which result in losses.

- Requires Human Oversight: These possess automated trading risks, as human traders need to monitor the bot’s performance regularly.

- Security Concerns: Bots require API key access to your exchange accounts. If not managed securely, like using robust security measures like 2FA, this poses a hacking risk.

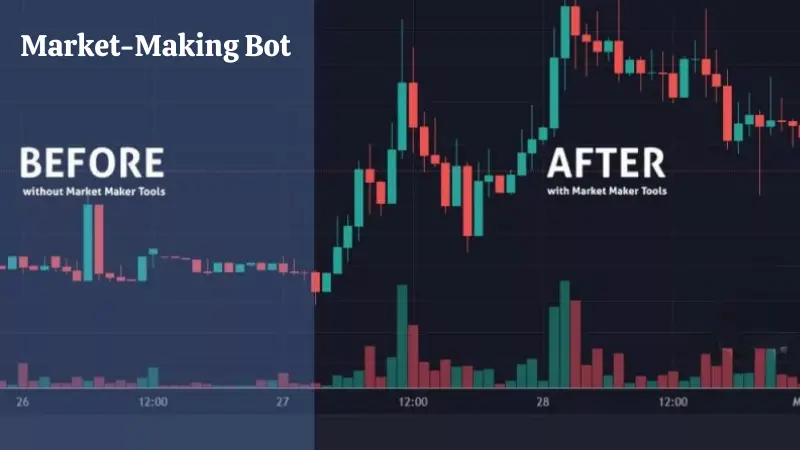

Market-Making Bot

A market-making crypto bot is an automated program that executes the buying and selling of cryptocurrencies without any need for human intervention. The main aim of this type of crypto trading bot is to generate as much profit as possible by executing orders that are driven by a set of predetermined rules. It makes money by capturing the small difference between the highest buy order (bid) and the lowest sell order (ask).

Pros:

- Eliminated Emotional Decisions: Bots follow a pre-programmed strategy, which removes human emotions from the scale, such as fear, greed, or overconfidence.

- High Speed & Efficiency: Bots can place, manage, and cancel orders in milliseconds. This allows them to capitalize on opportunities and react quickly to market shifts.

- Scalability: A single bot can easily manage market-making strategies across several trading pairs and exchanges, which boosts efficiency and potential profits.

- Continuous Liquidity Provision: Market-making bots ensure that there are always buy and sell orders available in the order book, which makes it easy for other traders to enter and exit positions.

- Reduced Volatility: The constant presence of buy and sell orders helps to narrow the bid-ask spread and smooth out price fluctuations.

Cons:

- Technical Risks: Like other bots, these are susceptible to software bugs, API glitches, and more. These can lead to unintended trades, missed opportunities, or losses.

- Requires Human Oversight: These need regular human monitoring as market changes, a bot’s strategy may become ineffective or can yield losses.

- Costs Can Erase Profits: Various costs, such as exchange trading fees, bot subscription fees, or more, can eat into the profit margins.

- Market Unpredictability: Bots operate on preset programs and can’t adapt to sudden events such as news announcements, regulatory changes, or exchange hacks. This can cause huge losses.

Scalping Bot

A crypto scalping bot is a type of high-frequency trading bot that yields profits from small crypto price changes. It automates several trades using rules based on indicators such as RSI or grids, which offer speed and consistency beyond human ability. However, it requires careful setup and trading bot risk management for volatile crypto markets. It helps traders gain profits from small price fluctuations by making many trades, which adds up over time.

Pros:

- Potential for Compounded Profits: By making numerous small profits throughout the day, these gains can compound over time, which leads to returns from minor price changes.

- Reduced Overnight Risk: Positions are typically opened and closed quickly, which limits exposure to sudden and large market movements that can occur overnight.

- Backtesting & Optimization: Strategies can be tested against historical market data to refine and optimize performance before risking real capital.

- Emotion-Free Trading: The crypto scalping bot follows a predefined strategy based purely on logic and data, which eliminates impulsive decisions by humans.

- 24/7 Operation: Unlike humans, bots don’t require rest and can continuously monitor the crypto market, which operates 24/7.

Cons:

- High Trading Fees: The strategy involves a high frequency of trades, and the transaction and exchange fees can quickly erase the slim profit margins.

- Vulnerability to Sudden Market Volatility: Bots operate on set rules and may struggle to adapt to unexpected events, which can trigger losses.

- Intense Competition: Crypto scalping bots compete with sophisticated institutional high-frequency trading (HFT) firms, which makes it difficult for average users to gain profits.

- Requires Constant Oversight: While these bots are not a “set and forget” solution, they need regular monitoring and adjustment by humans to remain effective.

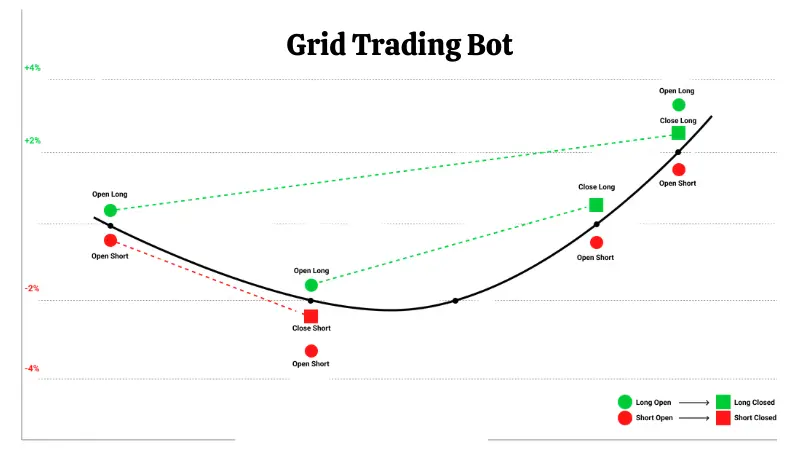

Grid Trading Bot

A grid crypto trading bot is basically an automated software that executes buy and sell orders at regular intervals within a predefined price range to gain profits from market volatility. It involves creating a “grid” of orders on a price chart, where the bot automatically buys the asset as the price drops to a lower grid level and sells it when the price rises to a higher level. The bot repeatedly works in grids to capture small profits from every minor change.

Pros:

- Profit from Volatility: Grid trading bots survive best in sideways markets by executing buy and sell orders within a particular price range.

- Emotion-Free Trading: It operates on predefined rules, which further eliminate impulsive decisions driven by human emotions.

- Risk Management Tools: Most crypto bot platforms offer features like stop-loss orders and the ability to define specific price ranges. This allows traders to set limits on potential downside risk.

- 24/7 Automation: The crypto market is always open. A bot can monitor the market and execute trades around the clock without human intervention.

- Simplicity & Consistency: The core strategy of this bot revolves around buying low and selling high repeatedly, which is relatively easy to understand and implement.

Cons:

- Requires Careful Configuration: Grid trading bots require careful initial parameter settings and ongoing monitoring to ensure they function properly.

- Ineffective in Strong Trends: They perform poorly in markets with strong trends. If the price moves outside the defined grid range, the bot will stop trading, which leads to missed profits or unnecessary losses.

- Capital Lockup: Some amount of capital is needed to set up grid levels. This capital is locked in open orders and cannot be used for other opportunities.

- Risk of Large Losses: If the price breaks below the lower limit of the grid, the bot may be left holding assets, which leads to unrealized losses.

DCA Bot

A DCA (Dollar-Cost Averaging) crypto trading bot is a preset program that automates the buying of cryptocurrencies at particular intervals, regardless of price. This helps average the purchase costs of cryptocurrencies and reduces market volatility, which makes it perfect for long-term investors who can’t watch markets constantly. These types of bots are available on several exchanges, such as Bybit and KuCoin, as they allow users to set parameters and execute trades at any hour of the day.

Pros:

- Mitigates Market Timing Risk: Instead of finding the perfect entry or exit, this bot spreads purchases over time. This helps lower the average cost per unit, and traders don’t need to invest a large sum at a market peak.

- Removes Emotional Bias: The bot follows a predefined plan regardless of fear, greed, or FOMO, which helps prevent poor decisions that are often made by human traders.

- Ideal for Beginners: DCA is a simple strategy that is well-suited for beginners who want to build a portfolio steadily without deep market knowledge.

- 24/7 Automation: DCA bots can execute trades automatically at set intervals. This saves time and effort for human traders.

Cons:

- Higher Transaction Costs: DCA bot conducts numerous small trades, which can result in higher transaction and network fees, potentially eating profits.

- Does Not Assure Profit: It does not protect against overall market risk or guarantee a profit.

- Requires Human Oversight: Crypto market conditions evolve rapidly, and the bot’s parameters need regular monitoring and adjustments to remain effective and secure.

- Security Risks: Bots are vulnerable to technical glitches, software bugs, or API connectivity issues, which can affect security risks if the platform is compromised.

AI Trading Bot

An AI crypto trading bot is basically an automated software that uses a combination of artificial intelligence and machine learning to analyze market data, identify opportunities, and execute trades 24/7. It aims to make profits by removing human emotion and acting on complex patterns faster than any human could ever do. Other than that, AI-powered bots offer varying levels of complexity for beginners to pros.

Pros:

- Speed & Efficiency: AI trading bots can process huge chunks of data and execute trades in milliseconds. This allows traders to capitalize on opportunities that humans would miss.

- Emotion-Free Decisions: Bots strictly follow predefined strategies, which remove impulsive decisions driven by fear, greed, or overconfidence.

- 24/7 Market Coverage: AI crypto bots work around the clock, which ensures that no potential trading opportunity is missed.

- Data-Driven Insights: They can analyze diverse data sources, including price history, trading volume, news headlines, and more, which helps bots make more informed decisions.

- Backtesting & Optimization: Strategies can be tested against historical data to refine and optimize performance. This gives traders confidence in their approach before risking real capital.

Cons:

- Complexity & Cost: Setting up, programming, and maintaining advanced AI systems requires technical expertise and computational resources.

- Risk of Overfitting: One of the biggest challenges AI bots face is that they can be overly optimized to perform well on historical data. It can fail due to unpredictable live market conditions.

- Lack of Human Judgement: They lack human intuition and contextual understanding and may struggle to adapt to sudden events.

Copy Trading Bot

A copy trading crypto bot basically involves mirroring a successful trader’s actions. This lets traders automatically replicate profitable trades by tracking an expert trader’s crypto wallets or strategies. Some confuse copy trading bots with AI trading bots, but they are different. The first one relies entirely on the human intelligence and decisions of an experienced master trader, and the latter uses ML and AI to analyze massive amounts of market data to execute trades.

Pros:

- Easy for Beginners: Copy trading is perfect for new traders as it does not require extensive prior knowledge or experience in market analysis.

- Time-Saving & Convenience: Once set up, the bot automatically mirrors the expert’s trades, which saves you time and effort that would otherwise be spent on market research and analysis.

- Access to Expert Strategies: You can utilize the knowledge and understanding of experienced traders who have a proven track record.

- Portfolio Diversification: By copying multiple traders with different strategies and asset focuses, you can diversify your portfolio and spread risk across various approaches.

- Passive Income Potential: If you select a successful trader, the bot can generate a source of passive income with minimal daily oversight.

Cons:

- Dependence on Other Traders: Your success is heavily dependent on the performance of the trader you copy. You have limited control over trade decisions.

- Risk of Losses: If the copied trader makes a poor move or hits a losing streak, you will lose money too.

- Hidden Fees: Some platforms or master traders charge performance fees, commissions, or a cut of your profits, which can impact your overall returns.

- Limited Skill Development: Relying entirely on others can hinder your own development of independent trading skills and market understanding, which creates a dependency on other traders.

Which Crypto Trading Bot Is Best for You?

There is no best crypto trading bot that works for everyone. The right choice depends on several factors. Understanding these will help you choose a crypto trading bot that fits your trading style:

If You Are a Beginner

If you are new to crypto trading or automation, simplicity and risk control should be your priority. DCA bots, grid trading bots, and copy trading bots are generally easier to understand and manage. They require less technical knowledge and help reduce emotional decision-making.

If You Are an Intermediate Trader

Traders with some experience may prefer bots that offer more control and flexibility. Trend-following bots and arbitrage bots can be effective once you understand indicators, market structure, and execution timing. These bots allow you to refine strategies while still benefiting from automation.

If You Are a Professional Trader

Experienced traders often use market-making bots, scalping bots, and AI-based trading bots. These require strong technical understanding, advanced risk management, and reliable infrastructure.

Wrapping Up

Crypto trading bots have transformed the way traders interact with the market. From arbitrage and grid trading to AI-driven and copy trading bots, each type serves a specific purpose and works best under certain market conditions.

The key to success is not choosing the “most advanced” bot but selecting the one that aligns with your trading goals, risk tolerance, and experience level.

While automation can improve speed, discipline, and efficiency, crypto trading bots are not a shortcut to guaranteed profits. They require the right strategy, proper risk management, continuous monitoring, and a clear understanding of how the market behaves.

If you are looking to go beyond off-the-shelf solutions and build a crypto trading bot tailored to your strategy, Technoloader is your go-to partner! We are a well-known custom crypto trading bot development company that helps traders and businesses turn automated trading ideas into trading bots for real-world markets.

So, get in touch with us now!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com