Table of Contents

Decentralized Finance (DeFi) is one of the most transformative innovations in the blockchain space, redefining how individuals and businesses interact with financial systems.

By removing intermediaries and enabling peer-to-peer financial interactions through smart contracts, DeFi empowers global users with more open, inclusive, and efficient access to financial services.

Initially known for disrupting traditional banking and investing, DeFi’s scope now spans across multiple industries. From real estate and gaming to healthcare and logistics, decentralized finance is unlocking new value propositions, driving innovation, and solving long-standing problems in centralized infrastructures.

In this blog, we’ll explore the most promising DeFi use cases across industries, highlighting how startups and enterprises alike are leveraging its power to create decentralized, user-centric solutions.

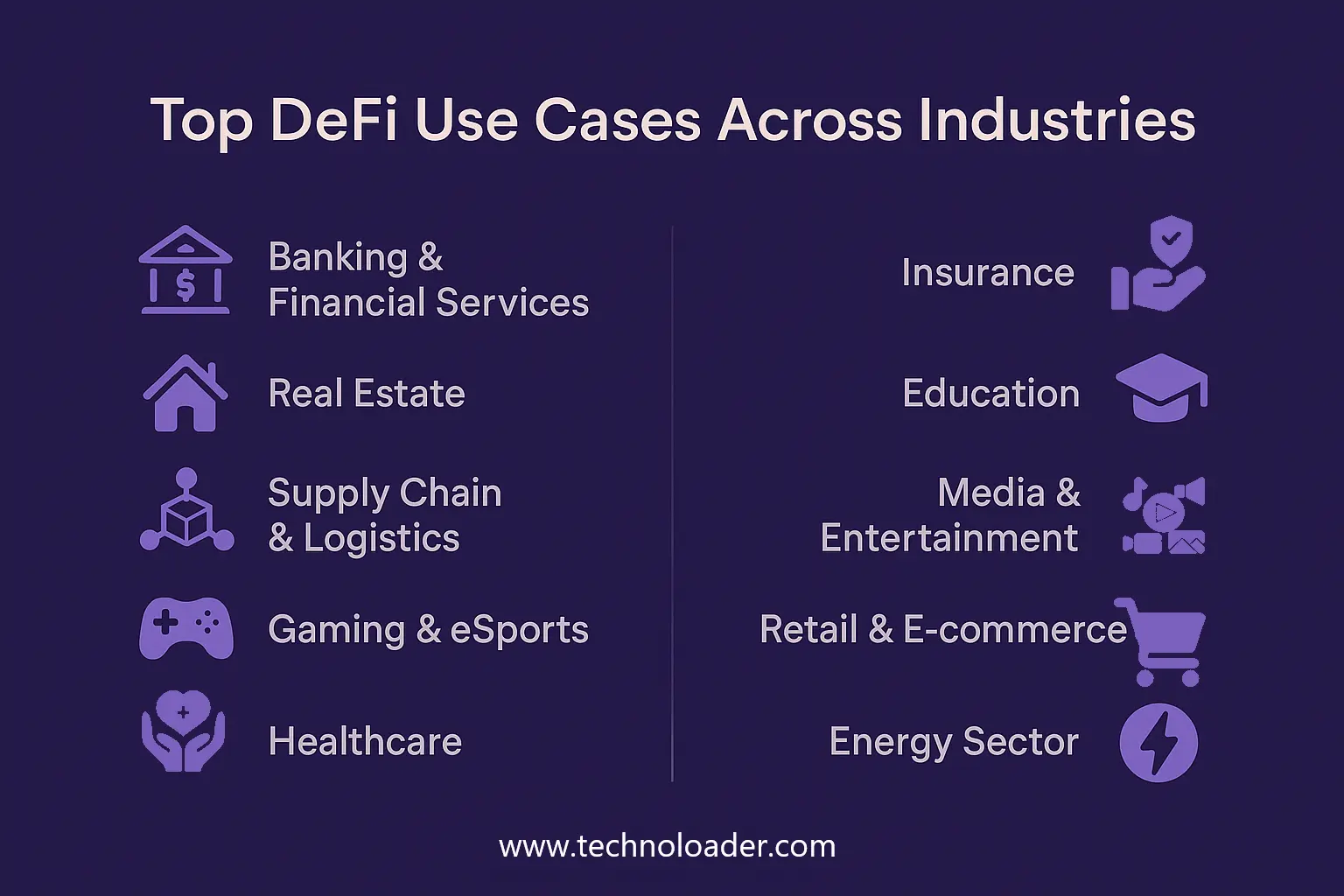

DeFi Use Cases Transforming Different Industries

The utility of DeFi extends far beyond token swaps and crypto lending. It is rapidly becoming a cross-industry force, driving new business models and enabling financial inclusion at scale. Here’s how different sectors are adopting and benefiting from DeFi:

Banking & Financial Services

DeFi’s most direct impact is in the traditional banking sector, where it offers alternatives to legacy systems. DeFi platforms allow users to lend, borrow, trade, earn interest, and insure assets, all without needing banks.

Protocols like Aave and Compound enable decentralized lending and borrowing, while decentralized exchanges (DEXs) like Uniswap facilitate trading without custodial risk.

In emerging markets, DeFi offers a lifeline to the unbanked population. With just a smartphone and internet access, users can gain access to savings, loans, and payment services through DeFi apps, bypassing the need for a physical bank or credit history.

Real Estate

The real estate industry has long struggled with inefficiencies such as high transaction fees, lack of liquidity, and limited accessibility. DeFi solves these issues through tokenization and decentralized finance protocols.

Real estate assets can be tokenized and fractionalized, allowing investors to purchase shares in properties via tokens.

These tokens can be traded on DeFi platforms, adding liquidity to an otherwise illiquid market. Platforms like RealT are already enabling token-based real estate investments, where ownership and rental income distribution are managed via smart contracts.

Additionally, DeFi lending protocols can facilitate mortgage issuance or real estate-backed loans in a permissionless, trustless environment, reducing paperwork and lowering entry barriers.

Also Read: Top 10 Must-Have Features in a DeFi Platform

Supply Chain & Logistics

Supply chain systems often suffer from transparency and financing challenges. DeFi brings real-time tracking, trustless financing, and payment automation into the mix.

By integrating DeFi protocols, suppliers and manufacturers can access working capital through decentralized loans or invoice financing, without relying on banks.

Moreover, smart contracts can automate payments upon delivery confirmation, reducing delays and disputes. Combining blockchain with DeFi also helps build trust among ecosystem participants by making all financial flows and asset movements visible on-chain.

Gaming & eSports

The rise of play-to-earn (P2E) models and GameFi platforms is one of the clearest examples of DeFi’s penetration into the gaming industry. Games like Axie Infinity and DeFi Kingdoms integrate decentralized economies that allow players to earn tokens, stake assets, and participate in governance.

Gamers can trade in-game assets as NFTs, provide liquidity, or stake tokens to earn passive income—all within a DeFi-powered infrastructure. This not only democratizes revenue generation in games but also creates real-world economic opportunities for users in developing countries.

DeFi also enables decentralized prize pools, tournament funding, and player rewards in the eSports ecosystem, making it fairer and more inclusive.

Healthcare

In the healthcare industry, DeFi is beginning to emerge as a solution for transparent and automated insurance, patient financing, and health record monetization.

Patients can access microloans for medical treatment using DeFi protocols, with repayments governed by smart contracts. Additionally, decentralized health insurance models powered by DeFi pools are enabling collective coverage and faster claim settlements without intermediaries.

Further, as patients start to own their health data, DeFi-based marketplaces could allow them to lease this data securely in return for tokens, offering a new monetization stream and supporting medical research efforts.

Insurance

The insurance industry is traditionally slow, opaque, and laden with administrative costs. DeFi introduces decentralized insurance platforms where users can purchase, underwrite, and claim policies using smart contracts.

Platforms like Nexus Mutual and InsurAce offer decentralized coverage for events such as smart contract exploits, exchange hacks, or protocol failures. Users can stake capital to back insurance pools and earn rewards for providing liquidity.

This peer-to-peer model increases transparency, reduces fraud, and makes coverage more accessible to DeFi users and institutions.

Education & Certification

DeFi is creating new funding models for education through decentralized scholarships and student loans. Token-based fundraising enables community-driven support for learners, and repayment can be automated via smart contracts linked to income-sharing agreements.

Moreover, educational institutions can issue credentials as NFTs, while DeFi tokens may be used to pay for course access or incentivize learning through rewards.

This model empowers self-directed learners, democratizes access to education, and creates verifiable digital proof of learning.

Media & Entertainment

Artists, content creators, and musicians can now bypass intermediaries and monetize directly through DeFi-enabled platforms. Whether it’s streaming royalties, direct fan contributions, or tokenized ownership of digital content, creators can earn in real-time via decentralized payment systems.

Platforms like Audius allow artists to share music and receive tokens instantly from fans. Content creators can also launch their tokens to build communities, raise funds, and reward loyal followers.

DeFi further enables revenue-sharing models and decentralized rights management, making the entertainment ecosystem more equitable.

Retail & E-commerce

Retailers are integrating DeFi protocols to offer crypto payments, loyalty rewards, buy-now-pay-later (BNPL) models, and even supplier financing. Smart contracts can automate discounting, commissions, and inventory restocking.

Retail platforms can launch their tokens to incentivize purchases, create staking opportunities for customers, and enhance brand loyalty. These tokens can also be traded on DEXs, adding financial value for shoppers.

DeFi reduces dependency on credit card processors, lowers transaction fees, and expands access to global crypto-native audiences.

Energy Sector

The energy industry is exploring DeFi for trading energy credits, financing renewable projects, and incentivizing green energy usage. Tokenized energy credits allow peer-to-peer trading of excess solar or wind energy among households and businesses.

DeFi platforms can fund clean energy startups through token sales or decentralized crowdfunding. Smart contracts can also automate payouts for carbon offset achievements or sustainable behaviour.

This approach not only promotes energy equity but also accelerates the global transition to clean energy by making financing more accessible and transparent.

Final Thoughts

The impact of DeFi is not confined to financial services it is reshaping entire industries with its transparent, trustless, and inclusive infrastructure. From real estate tokenization to decentralized insurance and GameFi ecosystems, DeFi is enabling more democratic, secure, and efficient operations across the board.

Startups and enterprises looking to innovate and scale in the Web3 era must begin exploring DeFi-powered solutions tailored to their industry. With the right strategic partner, navigating this space becomes faster, safer, and more rewarding.

Technoloader, a trusted DeFi development company, offers end-to-end solutions from smart contract development and wallet integration to DeFi platform launch and token creation. Whether you’re a startup or an enterprise, their expertise can help you capitalize on the next wave of digital transformation.

Looking to build your own DeFi product? Contact Technoloader to unlock decentralized innovation for your industry.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com