Table of Contents

The global tokenization market is estimated to reach at 6.10 billion in 2025 to 28.97 billion by 2033 growing at a CAGR of 21.33 %.

Gold tokenization has emerged as a revolutionary concept, blending the stability of precious metals with the efficiency of blockchain. It allows investors to own fractional gold assets backed by real-world reserves through digital tokens.

By leveraging blockchain’s transparency, security, and immutability, businesses can offer a more liquid and accessible way of gold investment. If you’re looking to create a gold tokenization platform, this guide will walk you through the entire process from core concepts and technical steps to benefits and challenges.

Let’s explore how Technoloader, a leading blockchain development company, can help you launch your own tokenized gold platform.

What is Gold Tokenization?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain. Each token represents a certain quantity of real gold (e.g., 1 gram or 1 ounce), stored securely by a custodian. Token holders effectively own a piece of this real-world asset and can trade it on digital platforms.

These tokens maintain a 1:1 value ratio with the gold they represent, ensuring trust and value stability. By eliminating intermediaries, tokenization allows global access to gold trading, faster settlement times, and lower costs.

Why Build a Gold Tokenization Platform?

Developing a gold tokenization platform opens up a new era of investment possibilities. Below are the major reasons to develop gold tokenization platform as your upcoming business project.

Fractional Ownership

Gold tokenization allows users to invest in smaller units of gold, removing the need to purchase full bars or coins. This feature democratizes gold investment, making it accessible to retail investors who can start with minimal capital while still gaining asset exposure.

Global Access

With a blockchain-based platform, users from any location can buy, sell, or trade gold-backed tokens 24/7 using just an internet connection. This borderless investment model eliminates traditional geographic limitations, expanding gold’s reach to underserved markets and international retail investors alike.

Increased Liquidity

Unlike physical gold, which requires storage and verification for trade, tokenized gold can be instantly transferred between wallets. This transforms a traditionally illiquid asset into a highly liquid one, allowing users to convert gold into cash or other assets quickly and efficiently.

Reduced Costs

By digitizing gold ownership, tokenization cuts out intermediaries such as banks, brokers, and vault operators. This significantly reduces transaction and storage fees, enabling more cost-effective trading and management of gold assets while ensuring better returns for investors and platform operators.

Transparency & Security

Blockchain technology provides a transparent ledger where all token transactions and reserve audits are recorded immutably. Investors can verify the gold backing in real time, ensuring trust, reducing fraud risks, and fostering accountability between token issuers, custodians, and end-users.

Future-Ready Business

Gold tokenization aligns with the growing digital asset trend, preparing businesses for a future where tokenized real-world assets dominate financial markets. With the market expected to surpass $16 trillion by 2030, early adopters can gain a competitive advantage and long-term profitability.

Real-Life Examples of Gold Tokenization

Let’s take a look at some real-world examples that are leading the way in gold tokenization!

Tether Gold (XAUt)

Tether Gold (XAUt) is a digital token backed by physical gold that is stored in secure Swiss vaults. Each XAUt represents one troy ounce of gold. These tokens can be traded on several cryptocurrency exchange platforms and provide investors with both liquidity and security.

Paxos Gold (PAXG)

Paxos Gold (PAXG) is a highly regulated gold-backed token issued by Paxos Trust Company. Each PAXG token is backed by one fine troy ounce of London Good Delivery gold bar. Token holders own the underlying physical gold. PAXG allows easy access to gold investments without the hassle of storage or transport.

Digix (DGX)

Digix (DGX) was one of the first projects to tokenize gold. Each DGX token represents one gram of physical gold that is stored in secure vaults in Singapore. The gold is fully audited and verifiable and even offers complete transparency and security to investors. Digix allows users to invest in smaller quantities of this traditional asset.

GoldMint (MNTP)

GoldMint (MNTP) tokenizes gold and streamlines its trading, lending, and storage. Its GOLD token is backed by physical gold. GoldMint offers Custody Bot, a proprietary storage and verification solution for physical gold. The MNTP token also aims to create a comprehensive ecosystem for gold-based crypto finance.

AurusGOLD (AWG)

AurusGOLD (AWG) is a gold-backed token issued by Aurus, where each AWG token represents ownership of one gram of 99.99% gold. AWG is part of a decentralized ecosystem that enables anyone to tokenize and trade gold securely. Aurus provides its revenue-sharing model, where stakeholders earn a portion of transaction fees, which makes it both an investment and a passive income source.

Core Features of a Gold Tokenization Platform

A gold tokenization platform requires essential features like asset backing, smart contracts, real-time audits, secure wallets, and KYC/AML compliance. These features ensure transparency, trust, and efficient management of digital gold assets on blockchain networks.

User Registration & KYC

Implement secure user onboarding using government-issued ID verification and automated KYC processes. Integrate AML checks to prevent fraud and money laundering. This builds a compliant, trustworthy platform while ensuring only legitimate users participate in gold token transactions.

Gold Reserve Integration

Connect the platform to real-world gold reserves managed by reputed third-party custodians. This ensures each token is genuinely backed by physical gold, allowing users to verify holdings in real time. Such integration is vital for transparency and maintaining token value parity.

Token Generation Engine

Use smart contracts to automatically mint gold-backed tokens when physical gold is deposited and burn them upon withdrawal. This ensures a 1:1 token-to-gold ratio at all times, maintaining the platform’s credibility and aligning digital assets with physical reserves seamlessly.

Wallet Integration

Integrate non-custodial or custodial crypto wallets to enable secure storage, sending, and receiving of gold tokens. This provides users full control of their digital assets, supporting fast, low-cost transfers while maintaining robust encryption and multi-layer authentication for maximum security.

Trading & Exchange Module

Facilitate peer-to-peer token trades within the platform or integrate with external crypto exchanges for broader liquidity. This feature empowers users to buy, sell, or swap gold tokens efficiently, enhancing usability and positioning the platform as a viable trading ecosystem.

Compliance & Audits

Conduct regular third-party audits of gold reserves and publish public proof of holdings. Integrate compliance protocols such as FATF guidelines to build investor confidence, reduce regulatory risks, and ensure long-term sustainability of the tokenized gold ecosystem.

Real-time Price Tracking

Embed live gold pricing data with historical charts and conversion tools directly into the platform. This allows users to monitor market conditions, make informed investment decisions, and stay updated on the current valuation of their tokenized gold assets.

Mobile App Support

Develop cross-platform mobile apps for Android and iOS to provide users with on-the-go access to token balances, trading features, and price alerts. A mobile-first approach enhances convenience, improves user engagement, and supports the growing trend of digital investment management.

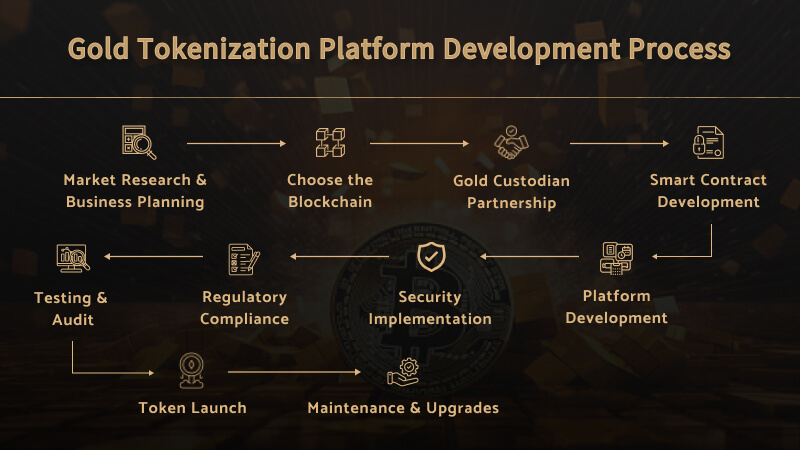

Steps to Create a Gold Tokenization Platform

Building a gold tokenization platform involves several stages: defining compliance needs, integrating blockchain technology, creating smart contracts, securing gold reserves, enabling wallet infrastructure, and launching the platform with proper testing and regulatory approval to ensure security and usability.

Market Research & Business Planning

Conduct in-depth research to assess global gold demand, evolving regulations, and digital competition. Define whether your platform will enable trading, investment plans, or only storage. Strong planning ensures strategic positioning and smooth integration into the digital asset market.

Choose the Blockchain

Select a blockchain that balances speed, scalability, and cost. Ethereum ensures smart contract maturity, while BSC and Polygon offer lower fees. Your choice directly impacts performance, user experience, and compatibility with DeFi protocols or third-party exchanges.

Gold Custodian Partnership

Partner with a reputed and insured custodian who provides vault storage and regular audits. This guarantees the token’s 1:1 backing with physical gold, reassuring users about asset integrity and enabling compliance with financial and commodity regulations.

Smart Contract Development

Develop secure smart contracts to mint or burn tokens when gold is deposited or withdrawn. Include clauses for ownership, transaction history, and legal compliance to enable trustless execution and automatic validation of gold-backed digital transactions.

Platform Development

Create a feature-rich platform with an intuitive admin dashboard, investor interface, wallet, and robust KYC/AML modules. Support crypto and fiat payments to cater to diverse users. A well-structured backend improves operations, while a clean UI enhances usability.

Security Implementation

Embed multi-layered security: SSL encryption, DDoS protection, 2FA, and biometric logins. Ensure safe user onboarding, transaction validation, and data protection. Strong security builds user confidence and shields both tokenized assets and sensitive information from potential breaches.

Regulatory Compliance

Adhere to all relevant laws, including AML/KYC, securities regulations, and commodity trade standards. Ensure global scalability with local compliance frameworks, protecting the business from penalties and building long-term legitimacy for cross-border digital gold operations.

Testing & Audit

Conduct rigorous QA testing, smart contract audits, and security reviews to identify and resolve vulnerabilities. This ensures the platform performs optimally, minimizes bugs, and aligns with security benchmarks, enhancing reliability before token launch.

Token Launch

After verifying stability and security, launch the gold-backed token (e.g., GLD). Start with a limited release to test user feedback, then scale publicly. A phased launch strategy builds momentum while controlling early-stage risk and user load.

Maintenance & Upgrades

Continuously refine the platform with new features, security patches, and compliance updates. Adapt to regulatory shifts and market feedback. Ongoing improvements ensure operational longevity, user satisfaction, and competitive edge in the tokenized asset landscape.

Benefits of a Gold Tokenization Platform

Gold tokenization offers increased liquidity, 24/7 trading, fractional ownership, global accessibility, and enhanced security. It eliminates traditional barriers to gold investment, making it easier for both retail and institutional investors to participate in the digital gold economy.

Increased Investment Access

Tokenization enables fractional ownership, allowing investors to buy gold in small amounts. This democratizes gold investment, welcoming retail investors who were previously excluded due to high capital requirements in traditional bullion markets.

Faster Settlements

Digital gold transactions settle almost instantly on blockchain networks. This eliminates long processing times and bureaucracy associated with physical gold trading, streamlining operations and enhancing user experience for both buyers and sellers.

Improved Transparency

All token activities—minting, burning, and transfers—are permanently recorded on the blockchain. This auditability reduces fraud risks, increases accountability, and builds investor trust through real-time traceability and publicly verifiable data trails.

Enhanced Liquidity

Gold tokens can be instantly traded on centralized or decentralized exchanges. Unlike physical gold, they’re not constrained by storage or delivery logistics, providing users with faster access to buy or liquidate their holdings.

24/7 Trading Capability

Unlike conventional gold exchanges with fixed hours, tokenized gold can be traded 24/7. This flexibility is ideal for global users and ensures round-the-clock accessibility to investments, irrespective of time zones or regional holidays.

Global Outreach

Tokenized gold platforms can serve users worldwide without requiring physical shipping. This removes geographical limitations and offers a borderless investment option, opening gold markets to users across emerging and developed economies alike.

Lower Storage Costs

Gold tokens reduce storage complexity by consolidating large gold reserves with certified custodians. Shared custodial arrangements lower per-unit storage fees, making gold investment more efficient and cost-effective for platform operators and users.

Trust & Security

Blockchain technology ensures immutable records, while trusted custodians guarantee physical gold backing. Together, they create a secure environment where users can confidently transact, knowing their digital tokens are tied to real, verifiable gold assets.

Use Cases of Tokenized Gold

Tokenized gold has diverse applications including digital savings, DeFi collateral, cross-border payments, institutional trading, and inflation hedging. It bridges traditional asset value with modern financial ecosystems, making gold investment more flexible, accessible, and technologically advanced.

Digital Gold Investment Platforms

Enable users to invest in gold through web or mobile apps with real-time tracking and easy token management. These platforms combine traditional assets with blockchain benefits, offering a secure and accessible investment option.

DeFi Collateralization

Allow gold tokens to serve as collateral in decentralized finance protocols. Investors can borrow crypto or earn yield without selling their gold holdings, combining stability with the liquidity and innovation of decentralized markets.

Cross-border Payments

Use gold tokens for fast, low-fee international transfers. Their value stability makes them ideal for remittances and B2B transactions, reducing currency risk and bypassing traditional banking systems and their high transaction fees.

Savings & Pension Funds

Offer stable, gold-backed tokens as an investment option in long-term savings or retirement portfolios. They provide inflation resistance and asset security, especially in volatile economic conditions or developing financial ecosystems.

Micro-investment Apps

Incorporate gold tokens into micro-investing apps, allowing users to invest spare change into gold. This encourages saving habits and makes digital gold ownership accessible even with minimal daily investments.

How Much Does It Cost to Build a Gold Tokenization Platform?

Here is a table outlining the estimated cost to build a Gold Tokenization Platform based on different project scales.

| Platform Type | Description | Estimated Cost |

| MVP (Basic Platform) | Basic functionality with gold token minting, KYC, wallet, and minimal UI. | $25,000 – $40,000 |

| Mid-Scale Platform | Includes smart contracts, exchange module, mobile app, and enhanced security. | $50,000 – $80,000 |

| Enterprise-Grade Platform | Advanced features like multi-custodian support, DeFi integration, and compliance suite. | $100,000+ |

Conclusion

Gold tokenization is redefining the investment landscape, merging the reliability of gold with blockchain’s innovation. By creating a gold tokenization platform, you can offer users a secure, scalable, and modern way to invest in precious metals.

With the right strategy, technology, tokenization platform development company and compliance, your platform can attract a global investor base and revolutionize digital asset ownership.

Technoloader can be your ideal partner in building this next-gen financial ecosystem with custom development, smart contract expertise, and blockchain strategy.

FAQs

- What is a gold tokenization platform?

A gold tokenization platform allows users to invest in blockchain-based tokens that are backed by physical gold, offering fractional ownership, liquidity, and security.

- Are gold tokens legally compliant?

Yes, if developed with proper KYC/AML procedures and in accordance with asset-backed token regulations in respective jurisdictions.

- How is gold stored in such platforms?

Gold is stored by certified custodians in secured vaults and is audited regularly to ensure that each token is fully backed.

- Which blockchain is best for tokenized gold?

Ethereum, Polygon, Binance Smart Chain, and Avalanche are commonly used due to their smart contract capabilities and liquidity.

- Can I integrate gold token trading into my crypto exchange?

Yes, gold tokens can be listed on your exchange or integrated with decentralized exchanges (DEXs) for trading.

- Is it possible to convert tokens back into physical gold?

Yes, platforms can offer a redemption feature where users can exchange tokens for equivalent gold weight.

- How long does development take?

Building a full-featured platform typically takes 3–6 months depending on complexity and compliance needs.

- Does Technoloader offer post-launch support?

Yes, we offer continuous maintenance, feature upgrades, and regulatory updates after deployment.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com