Table of Contents

With the growing volatility and round-the-clock nature of cryptocurrency markets, automated trading bots have become essential tools for traders and businesses. A crypto trading bot executes trades using predefined algorithms, enabling faster execution, reduced risk, and consistent performance. In this guide, we’ll explain how to build a crypto trading bot from scratch, its features, development cost, and real-world use cases.

These bots execute trades faster, more accurately, and without emotional bias. As demand rises for intelligent automation, many businesses and traders are now exploring how to make a crypto trading bot that’s efficient and secure.

What is Crypto Trading Bot?

A crypto trading bot is a software program that automatically buys and sells cryptocurrencies based on predefined algorithms. These bots analyze market data, execute trades, and manage portfolios without human intervention.

When you use a crypto trading bot, it helps reduce emotional decision-making and enhances precision. Many bots are configured to perform actions like arbitrage, market making, or technical analysis-based trading.

Today, traders rely on automated systems to optimize performance, especially in high-frequency trading environments. By integrating APIs from exchanges like Binance or Coinbase, users are now deploying trading bots that work in real time.

Why use Automated Trading Bot?

Crypto trading bots offer traders the advantage of instant decision-making based on data-driven algorithms, eliminating emotional biases and delays.

These bots operate round-the-clock, allowing for uninterrupted trading and the ability to capitalize on opportunities even during off-hours. They can simultaneously manage multiple trading pairs, monitor markets, and execute complex strategies with precision.

Additionally, backtesting capabilities enable users to test strategies on historical data, refining them before live deployment. Crypto trading bots, it brings consistency, scalability, and adaptability key benefits in the fast-paced and volatile world of cryptocurrency trading.

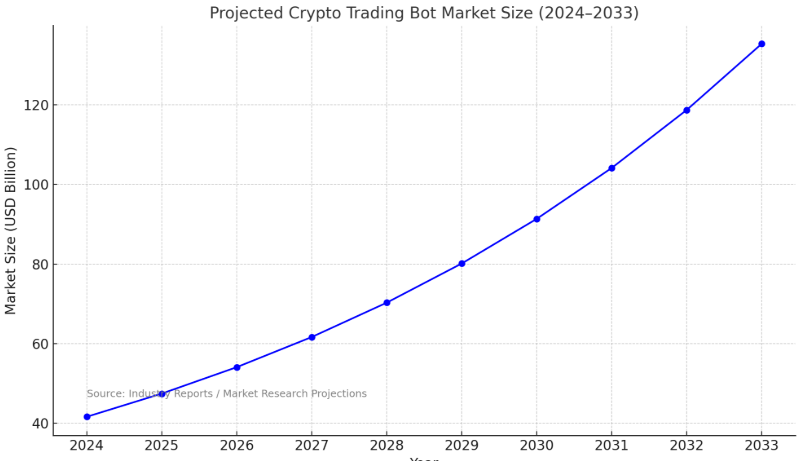

Crypto Trading Bot Global Market Size

The crypto trading bot market was estimated at around USD 41.61 billion in 2024 and is projected to reach USD 154 billion by 2033, with a CAGR of approximately 14% from 2025 to 2033.

This impressive growth is driven by the rising popularity of automated, self-service trading solutions among both retail and institutional investors, who are increasingly embracing technology to streamline and optimize their trading activities.

How to Build a Crypto Trading Bot From Scratch?

Crypto trading bot should be developed with a proper process to ensure the better functionality and to achieve expected outcomes. Here’s a step-by-step guide on how to make a crypto trading bot from scratch.

Step 1: Define Trading Strategy

Start by deciding your bot’s core strategy arbitrage, scalping, or swing trading. This ensures that your crypto bot works in alignment with your financial goals.

Step 2: Choose a Programming Language

Popular languages include Python and JavaScript for their flexibility and exchange API compatibility. They are beginner-friendly and ideal to building crypto trading bots scripts.

Step 3: Select Crypto Exchange and Integrate API

Pick reputable exchanges like Delta Exchange, Coinbase, or Kraken. Use their APIs to feed real-time data to the bot and allow it to execute trades securely.

Step 4: Develop Core Bot Architecture

Design modules for market analysis, trade execution, portfolio tracking, and risk management.

Step 5: Back testing and Optimization

Before going live, run simulations using historical market data. Backtesting ensures your strategy is viable and reduces the risk of loss in real-world conditions.

Step 6: Deployment and Monitoring

Deploy the bot on a secure cloud or server. Monitor its activity regularly to ensure it functions correctly and adapts to market changes effectively.

Features to Incorporate in Crypto Trading Bot

Incorporating essential features is key to maximizing performance, security, and user experience. These functionalities empower the bot to execute trades efficiently, manage risks smartly, and adapt to market trends with minimal human intervention.

1. Real-Time Market Data Analysis

The bot must continuously analyze real-time market data from multiple exchanges. This allows it to react instantly to price movements, volume changes, and trading signals resulting in smarter decisions, better timing, and optimized trade executions in highly volatile crypto markets.

2. Automated Trade Execution

Automatically executing buy/sell orders based on predefined rules reduces latency and removes emotional trading errors. This feature ensures timely responses to market events, allowing users to maintain consistent strategies and leverage quick shifts in the crypto market for optimal profitability.

3. Custom Strategy Builder

Allow users to design, test, and implement unique trading strategies without coding. This feature is ideal for both beginners and professionals learning how to make a crypto trading bot tailored to their risk tolerance, technical indicators, and financial objectives.

4. Backtesting Tools

Backtesting enables users to simulate their trading strategies on historical market data. It helps identify weaknesses, refine parameters, and verify profitability before deploying the bot live. This reduces risks and improves performance.

5. Risk Management Controls

Integrate advanced features like stop-loss, take-profit, and trailing stop orders. These automatically secure profits or limit losses, ensuring capital protection. Essential for crypto in unpredictable markets with rapid price fluctuations and high volatility.

6. Multi-Exchange Support

Enabling connections to multiple exchanges diversifies trading opportunities and reduces dependency on a single platform. It enhances liquidity access, allows arbitrage strategies, and gives traders broader reach when using or attempting to build for scaling.

7. User Dashboard and Analytics

An intuitive dashboard provides real-time insights into trades, performance, portfolio status, and bot activity. Advanced analytics help users identify profitable strategies and optimize performance, making it easier to monitor progress.

8. Security and Encryption

Implementing two-factor authentication, encrypted API keys, and secure login protocols is critical for protecting assets. These features are non-negotiable that handle sensitive data, private keys, and real-time transactions across various exchanges.

Cost to Build Crypto Trading Bot

The cost depends on various factors such as complexity, features, technology stack, and the development team’s expertise. On average, a basic trading bot with standard functionalities may cost between $10,000 to $19,000, while advanced bots with real-time analytics, AI integration, and multi-exchange support will cost more.

Choosing customized solutions over pre-built ones may involve higher costs but delivers better long-term performance and flexibility for traders with specific needs and strategies.

In the table below, we have listed different phases of a basic app along with its estimated cost.

| Component | Estimated Cost (USD) |

| Strategy Design & Research | $1,000 – $2,000 |

| Bot Architecture Development | $2,000 – $4,000 |

| Exchange API Integration | $1,000 – $2,000 |

| Backtesting Module | $1,500 – $3,000 |

| Dashboard UI/UX | $1,500 – $2,500 |

| Security & Compliance Features | $2,000 – $3,500 |

| QA, Testing & Deployment | $1,000 – $2,000 |

| Total Estimated Cost | $10,000 – $19,000 |

Use Cases of Crypto Trading Bot

Crypto trading bots are versatile tools that automate various trading activities. It can serve multiple use cases tailored to different trading goals and strategies.

1. Arbitrage Trading

Take advantage of price differences between exchanges. This strategy is ideal for focused on profit margins.

2. Portfolio Rebalancing

Maintain an ideal asset allocation automatically. The bot periodically adjusts holdings to match predefined investment ratios.

3. High-Frequency Trading

Execute thousands of trades per second to capitalize on minor price movements. Essential when you building with speed in mind.

4. Market Making

Place both buy and sell orders to earn spreads. A popular strategy among those learning for continuous activity.

5. Trend Following

Use technical indicators to identify market trends. Bots enter trades in the direction of the trend and exit during reversals.

6. Stop-Loss Management

Automatically exit losing positions at a predetermined price. Reduces emotional interference and protects capital.

Final Thoughts

Crypto trading automation is revolutionizing the way traders operate in the digital asset space. Understanding these aspects allows for tailored, efficient, and secure trading operations.

By incorporating essential features and following the right development approach, you can make solutions that cater to both individual and enterprise needs. Businesses looking for automated trading bot for crypto should prioritize reliability, speed, and security.

Crypto Trading Bot Related FAQs

It typically takes 4–8 weeks, depending on features, exchange integrations, and security layers. Fast delivery is possible with an experienced agency.

Yes, using no-code platforms or hiring a firm, you can make with minimal technical knowledge.

Yes, if developed with strong encryption and APIs. Make sure you are using secure cloud hosting and API key management.

Strategies include arbitrage, scalping, trend following, and market making. Choose one that suits your trading goals and risk tolerance.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com