Table of Contents

Choosing the optimal business model is important, but choosing the best tech stack for your crypto exchange platform is mandatory!

Wondering why? Because your tech stack affects everything, whether it is exchange, security, or scalability.

However, the question arises: How to create a cryptocurrency trading platform, and what tools, technologies, and methods should you use?

Particularly, the answer lies in your exchange’s unique needs. What are the features you’re likely to add to your crypto exchange? So, to streamline your development and ensure you have an amazing user experience, here is a detailed breakdown of building scalable crypto exchanges.

What is a Crypto Exchange?

Before developing a cryptocurrency exchange platform, you must know what it is.

So, basically, these exchanges are platforms that allow users to trade cryptocurrencies. It comes in two different types: centralized exchanges and decentralized exchanges, enabling users to buy, sell, and trade digital assets safely.

In contrast to it, the crypto exchange tech stack is a combination of tools that are typically used to create a secure and fast crypto exchange, depending on the user’s requirements. These tech stacks cover various aspects, like databases and network frameworks that are truly meaningful for the developers launching the exchange.

So, if you’re clear about the crypto exchange, then it’s time to unwind some core information related to its challenges, strategy, and others.

Core Challenges in Developing a Scalable Exchange

Over time, the popularity of cryptocurrencies has increased to another level. However, while developing this high-tech platform, developers also have to face some challenges. Which includes:

1. Handling High Trading Volumes

As we know, crypto markets can see sudden surges in activity, especially during price swings. So, a scalable exchange should be able to handle thousands of transactions per second without facing any delays or failures. Meanwhile, poor handling can cause order mistakes, slow withdrawals, and other challenges that push users towards faster and more reliable competitors.

2. Ensuring Robust Security

Exchanges are the primary target of hackers, so protecting your funds requires multi-layered security, including cold and hot wallet separation, multi-signature transactions, encryption, and regular monitoring. Thus, if somehow a single breach occurs, then it might lead to a massive loss and permanently harm trust.

3. Technical Challenges

Another challenge faced by crypto exchanges is the system design, scalability, and performance. Due to this technical aspect, the platform might not be able to handle high trading volume, along with the cost to develop a crypto exchange. So, to minimize and ensure a seamless user experience, the platform should include real-time trading and hassle-free processing of a large amount of data.

4. Staying Updated with Regulations

Crypto exchanges operate regularly. From KYC to AML requirements, compliance processes must be built into the platform without creating friction for users. However, balancing legal obligations with a smooth onboarding experience is a major challenge for developers.

5. Maintaining 24/7 Uptime

The crypto market never stops; it means an exchange has to stay operational around the clock. This requires resilient infrastructure, backup systems, and proactive monitoring to prevent downtime. Any period of unavailability can lead to lost revenue, panic among users, and a ruined brand image.

Noteworthy Strategies for Scalability

To overcome the challenges, here are the top strategies that will help you in developing the best crypto exchanges with a bright interface:

1. Build Service-Oriented Design

Choose to design the exchange with separate modules, such as a trading engine, wallet system, and user authentication, so each of them can be lined up independently. With the help of this approach, users will be able to prevent bottlenecks and make it easier to upgrade or expand features without any disruption.

2. Adopt a Microservices Approach for Greater Agility

Instead of relying on a single massive codebase, consider breaking down the exchange into smaller, independent services. Herein, microservices will allow faster updates with a better interface and efficient scaling. With the help of this, the exchange will be able to handle heavy workloads in one part of the system, which doesn’t slow down the rest.

3. Optimize Database and Caching

Fast data access is critical in trading. Using high-performance databases like PostgreSQL or MongoDB, along with in-memory caching tools like Redis or Memcached, will reduce latency. This setup will help with rapid order matching, faster price updates, and smooth transaction history retrieval.

4. Implement Intelligent Load Distribution

To avoid the workload on any single server, consider distributing incoming requests across multiple servers. Load balancers also improve redundancy; if one server fails, then another takes over. This process will ensure uninterrupted performance even during unexpected spikes in user activity.

5. Prioritize Security at Scale

Scaling should never compromise safety. Use multi-factor authentication, cold and hot wallet separation, MPC wallets, and continuous monitoring. Regular drilling, testing, and real-time fraud detection systems keep the exchange secure as it grows.

Best Tech Stack For Developing a Crypto Exchange

A tech stack is a combination of technologies that typically includes programming languages, frameworks, databases, and tools. If you’re building scalable crypto exchanges, then these are some essential tech stacks for your project:

1. LAMP

LAMP stands for Linux, Apache, MySQL, and PHP. It is a popular open-source web development platform that is typically a collection of software components. Each of its components has a specific role that works together to build and develop the application.

2. MEAN

This is a JavaScript-based stack that is widely used for building dynamic web applications. Meanwhile, the acronym “MEAN” represented its four core components: M (MongoDB), E (Express.js), A (Angular), and N (Node.js).

3. MERN

Similar to MEAN, the MERN stack is a collection of JavaScript-based technologies that are used to build full-stack web applications. However, MERN stands for MongoDB, Express.js, React, and Node.js.

4. Full-stack Development

For building both the front-end and back-end, using full-stack development is a great choice for a web application. Here, “full-stack development” refers to the collection of technologies that can help you achieve this end-to-end development.

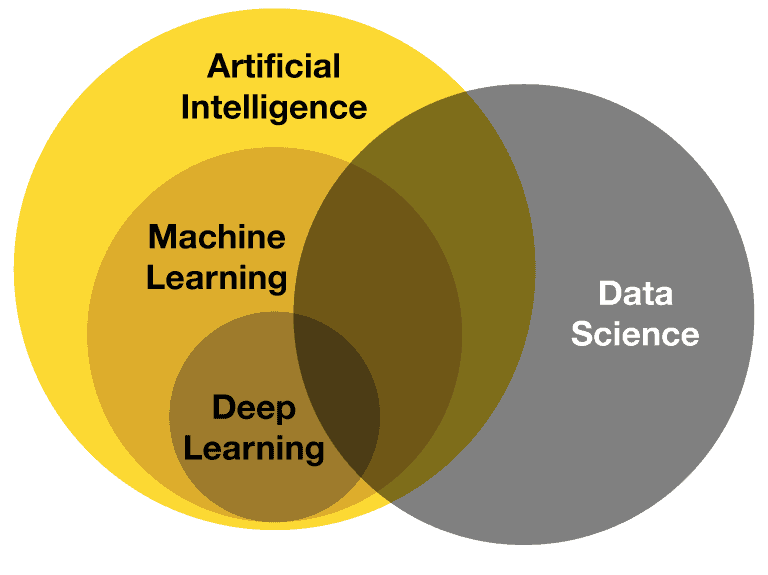

5. Data Science and AI

The Data Science and AI stack refers to the collection of tools, technologies, and platforms that are helpful to build, deploy, and manage AI-powered solutions. This stack encompasses the entire process from data collection to model training, evaluation, and deployment.

To Sum Up

Through this comprehensive guide, we have discussed in-depth information related to strategies and tech stacks for developing crypto exchanges. So, with the help of this information, choosing the right technology will significantly improve your cryptocurrency exchanges.

Lastly, to build a scalable crypto exchange, you’re required to connect with a leading cryptocurrency exchange development firm. In this segment, it’s very obvious that there are plenty of companies, but choosing the right one is a tough and necessary thing.

So, to streamline your overall development experience and provide you with end-to-end solutions, there is no better option than Technoloader. With an experienced team, robust security measures, and full-spectrum support, we’re happy to serve our clients with great outcomes.

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com