Table of Contents

The best 5 crypto arbitrage bots in 2026 are Pionex, Bitsgap, 3Commas, HaasOnline, and Cryptohopper, selected for their broad exchange support, fast order execution, and advanced automation. These platforms enable cross-exchange, triangular, and futures arbitrage with features like backtesting, smart order routing, and risk management. While they offer 24/7 automated trading and efficiency, users should consider subscription costs, API security risks, and lower profits during low-volatility markets.

If you have ever noticed that a crypto asset is priced slightly differently on two exchanges and thought, “Wait, can’t I make money from that?”. Well, you are thinking like an arbitrage trader.

Crypto arbitrage is one of the smartest ways to earn from the market without needing to predict wild price swings. It is all about spotting those little price differences across exchanges and acting fast.

But here’s the catch: speed matters. And that’s where crypto arbitrage bots come in! These crypto trading bots are smarter, faster, and more advanced than ever.

Looking for options? That’s what this blog is for!

In this, we’ll be talking about the top 5 crypto arbitrage bots, along with their pros and cons, so you can decide which one fits your strategy best.

Let’s have a look!

What is Crypto Arbitrage?

Before we get into bots that follow this trading strategy, let’s understand what exactly crypto arbitrage is!

In simpler terms, it involves a trading strategy where a trader buys and sells cryptocurrencies in several marketplaces to generate profits from price differences.

Let’s understand this with the help of an example!

There are two crypto exchange platforms, namely Exchange A and Exchange B. On Exchange A, the price of Bitcoin is $20,000, and on Exchange B, the same Bitcoin is trading at $20,500.

Identifying the profit potential, the trader quickly purchases one Bitcoin on Exchange A at $20,000 and sells it at a higher market price of $20,500 to Exchange B. This way, the trader earns a profit of $500.

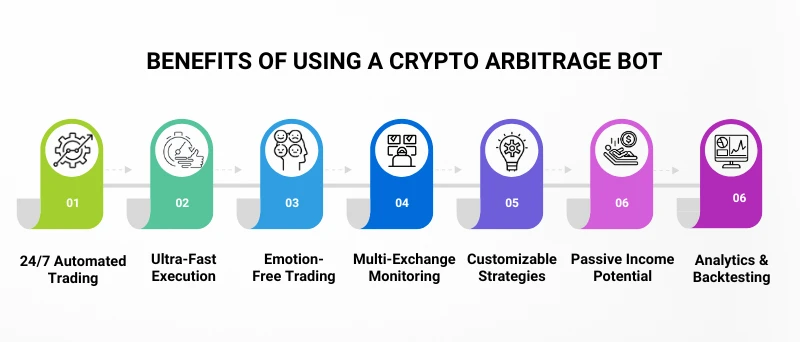

Benefits of Using a Crypto Arbitrage Bot

Here are the key advantages of using a crypto arbitrage bot:

24/7 Automated Trading

Arbitrage bots operate nonstop, continuously scan markets, and execute trades round-the-clock. Unlike human traders, they don’t sleep or get tired. This ensures you never miss a profitable opportunity at any hour of the day. This can give you a competitive edge in the crypto space.

Ultra-Fast Execution

Speed plays an important role in the crypto trading space. Bots have the potential to analyze multiple exchanges and complete trades in milliseconds, far faster than human reflexes. This rapid execution helps capture the price differences before they disappear. It can help you gain maximum potential profits.

Emotion-Free Trading

Emotions can affect judgment, especially in volatile markets. Arbitrage bots follow pre-defined rules and logics, which avoid fear, greed, or hesitation. This eliminates impulsive decisions and helps maintain a consistent trading strategy over time.

Multi-Exchange Monitoring

A good performing arbitrage bot simultaneously monitors price differences across dozens of exchanges. This broad visibility increases the chance of catching profitable trades and allows you to capitalize on global market inefficiencies that would otherwise go unnoticed.

Customizable Strategies

Most of the arbitrage bots offer flexible settings to match your risk-taking ability and trading goals. While you develop a crypto arbitrage bot, you can define trade limits, preferred exchanges, profit ability, and stop conditions. This ensures that your bot aligns with your unique strategy.

Passive Income Potential

Once you have defined the logics and rules, arbitrage bots become powerful tools to earn consistent micro-profits without daily oversight. These require minimal management, which makes them ideal for those looking to generate passive income through crypto.

Analytics & Backtesting

Some of the top arbitrage crypto bots provide detailed performance data, trade logs, and backtesting features. This helps you review past trades, refine strategies, and improve future performance based on real results. This way, you can optimize and adapt your trading approach with confidence.

Read Also: What is a Grid Trading Bot? Key Features and Benefits

Top 5 Crypto Arbitrage Bots in 2026

Now, let’s have a look at some of the best arbitrage bots that we have explained in detail below:

Binance

With almost 17% market share in the crypto space, Binance is a well-known platform that supports the best arbitrage trading bot. It uses the highly advanced delta-neutral approach, which makes it ideal for arbitrage trading.

The traders just need to fix their investment capital, and it starts observing the market automatically. Other than this, the platform also supports a wide range of arbitrage bot strategies, which include spot and futures grids, portfolio optimization, and more.

| PROS | CONS |

| Highest liquidity in the crypto market | Regulatory scrutiny in some regions |

| Supports spot, futures, and margin arbitrage | Complex interface for beginners |

| API access for custom bot integration | Requires coding or third-party bots for full arbitrage automation |

Bitsgap

Bitsgap has become a go-to platform for crypto arbitrage trading and offers an intuitive interface and access to 15+ exchanges. Its automated arbitrage bot scans market prices across multiple platforms in real-time, which helps users capitalize on price differences instantly.

With robust security protocols and features like demo trading and smart order routing, Bitsgap is a perfect platform for both beginners and pros. Indeed, it is a powerful tool for traders looking to automate profits without the hassle of manual monitoring.

| PROS | CONS |

| Connects to 15+ major exchanges for wide arbitrage coverage | Requires subscription for full bot functionality |

| User-friendly interface suitable for beginners | Arbitrage opportunities may be limited during low volatility |

| Smart order routing increases efficiency | Limited customization for advanced traders |

OKX

OKX is a globally recognized crypto exchange platform that offers one of the most efficient arbitrage systems. Its internal trading bot allows users to benefit from real-time price differences across exchanges.

With deep liquidity, high-frequency trading infrastructure, and low-latency execution, OKX supports fast and profitable arbitrage. If you want to utilize arbitrage with high execution speed, OKX stands out as the best platform.

| PROS | CONS |

| High-frequency trading infrastructure supports fast execution | Complex UI may overwhelm beginners |

| Deep liquidity across spot and futures markets | Regulatory limitations in some regions |

| Built-in bots require no third-party tools | Full bot functionality often requires manual setup or coding knowledge |

Pionex

Pionex is known for its wide range of built-in trading bots, and its arbitrage bot remains a standout in 2025. The bot automates cross-exchange strategies using price differentials, with zero extra fees on trades.

Designed for simplicity, it is ideal for beginners and pro traders who want to benefit from arbitrage without coding or complex setups. With 24/7 uptime, built-in exchange support, and low trading fees, Pionex helps generate passive gains from crypto arbitrage strategies.

| PROS | CONS |

| 16+ free built-in bots, including arbitrage | Limited to trading within the Pionex exchange |

| No extra fees for using bots | Less customizable than advanced bots |

| Good for low-risk, passive arbitrage strategies | Fewer supported assets compared to larger exchanges |

Coinrule

Coinrule is another crypto trading platform that allows users to design custom arbitrage strategies without coding. It supports over 10+ major exchanges and even offers powerful “if-this-then-that” automation.

With a strong focus on user control and strategy testing, Coinrule attracts users for its data-driven strategies who want to capture arbitrage profits without depending on rigid pre-set algorithms.

| PROS | CONS |

| No coding required; rule-based strategy builder | More setup time is required to create complex rules |

| Works across 10+ major exchanges | Arbitrage detection isn’t fully automated |

| Regularly updated with new features and integrations | Free tier has limited live trades and rule slots |

Comparison Table: At a Glance

Now, let’s have a sneak peek at each platform!

| Platform | Best For | Free Plan | Exchanges Supported | Open-Source | Ease of Use |

| Binance | Binance ecosystem users | Yes (limited) | Binance exchange only | No | Very Good |

| Bitsgap | All-around arbitrage trading | Yes | 15+ major exchanges | No | Very Good |

| OKX | Advanced traders on OKX | Yes | OKX exchange only | No | Very Good |

| Pionex | Built-in automated tools | Yes | Internal exchange only | No | Very Good |

| Coinrule | Beginners using templates | Yes | 10+ (via API) | No | Excellent |

How to Choose the Right Arbitrage Bot for You?

Considering the above-mentioned options, how would you choose the best one? Here are the tips that you can consider:

- Success Rate

Some of the trading platforms provide the success rate of their native bots as a percentage. It is important that you assess what period the mentioned rate is based on. You need to check if the bot performed well for months or has been active for a few days.

- Exchange Integration

To capture more profits, arbitrage crypto bots need to access several exchanges at the same time. Ensure that the bot you are choosing has wide exchange support, as it can help them capitalize on a higher number of profitable opportunities.

- Latency & Speed

Latency plays an integral role in generating profits from arbitrage bots. As price differences last for seconds or even milliseconds, even a slight delay between the bot and the platform can result in losing a deal. Thus, check the speed of the bot.

- Smart Order Routing

More advanced arbitrage bots utilize smart order routing to maximize the generation of profits and reduce price slippage. This allows dividing order values across two or more exchange platforms to ensure users get the best possible price.

- Free Trial

You must look for crypto arbitrage bots that offer free trials and paper trading facilities. This allows you to test-drive the algorithm before risking your funds. Also, ensure that the free trial offers a full customizability opportunity so that you can try all the available features.

- Community Reviews

The reviews are often one of the best ways to assess an arbitrage bot. You must check if the bot you are considering has great ratings and positive reviews.

The Bottom Line

That’s it for this blog!

Crypto arbitrage trading bots indeed provide a strategic advantage in the dynamic world of cryptocurrency trading. By automating the process of exploiting price differences across different exchanges, these bots help traders maximize profits.

As mentioned above, the best bots for arbitrage trading allow for generating profits with minor differences. So, are you looking to develop one? Look no further than the experts at Technoloader!

Get in touch with us now!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com