Table of Contents

DeFi staking has now become one of the most important building blocks of the decentralized finance ecosystem. What began as a simple way to encourage users to lock tokens has now evolved into one of the most popular revenue models for DeFi platforms.

The role of DeFi staking platforms has expanded over the years. Earlier, staking was limited to yield farming, where users chased short-term returns with a limited understanding of risk. Today, platforms are designing staking systems that prioritize stable returns, efficient capital usage, and transparency. This is what makes them attractive to both retail users and long-term investors.

This shift has increased the importance of well-structured staking platforms within the DeFi ecosystem. Also, investors are demanding more advanced features on the platform to make staking easier.

Before exploring the top features that users today demand in DeFi staking platforms, it’s important first to understand what DeFi staking actually is and why these are becoming a core revenue engine in 2026.

What Is DeFi Staking?

DeFi staking is a process where users lock their crypto assets into a decentralized protocol to support network operations or platform functionality, in return for earning rewards. Unlike traditional finance, where intermediaries manage deposits and payouts, DeFi staking is powered by smart contracts that automatically handle staking, reward distribution, and withdrawals.

Over time, DeFi staking has evolved beyond simple token locking. Modern staking platforms now support liquid staking, where users receive derivative tokens representing their staked assets. These tokens can be used elsewhere in DeFi while still earning staking rewards.

Why Are DeFi Staking Platforms Gaining Popularity in 2026?

DeFi staking has evolved rapidly, and 2026 is the year that makes it a mainstream revenue model. Let’s check out the core reasons behind its increasing popularity!

Reliable Source of Passive Income

DeFi staking platforms allow users to earn rewards by staking their digital assets, without the need for active trading. With rising demand for predictable returns, staking has emerged as a practical alternative to high-risk trading strategies and low-yield traditional savings instruments.

Flexibility Through Liquid Staking

Modern staking platforms now offer liquid staking, which allows users to earn staking rewards while retaining access to their assets. This improves capital efficiency by enabling users to participate in other DeFi activities without affecting staking income.

Rising Institutional & Long-Term Investor Participation

In 2026, staking is no longer limited to retail users. Both institutional investors and long-term holders are now adopting staking as a yield-generating strategy. Their participation further helps boost market confidence, DeFi platform stability, and ecosystem maturity.

Improved Security & User Experience

As the DeFi ecosystem matures, DeFi staking platforms in 2026 feature stronger security frameworks, audited smart contracts, and intuitive user interfaces. These improvements have reduced risk perception and increased trust among mainstream users.

Lower Entry Barriers & Global Accessibility

DeFi staking platforms are designed to be inclusive and accessible. Users can now easily participate with minimal capital, without intermediaries or complex onboarding processes. This ease of access has significantly expanded global adoption.

Governance Participation

Many DeFi staking platforms allow participants to engage in on-chain governance, which enables them to vote on protocol upgrades, reward structures, and strategic decisions. This encourages long-term participation and aligns user incentives with platform growth.

Integration with the Broader DeFi Ecosystem

Staking is increasingly integrated with lending, liquidity, and yield optimization services, which allows users to maximize asset utilization within a single ecosystem. This interconnected approach further boosts value creation without added complexity.

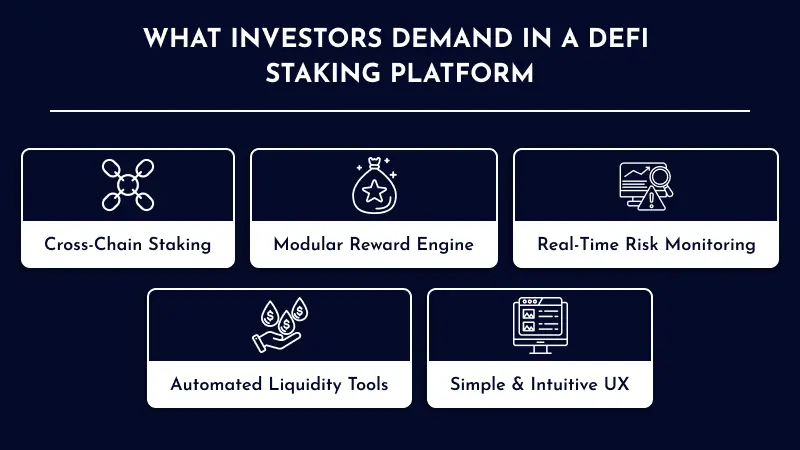

What Investors Demand in a DeFi Staking Platform

When you are planning to start your DeFi staking platform development journey, understanding these demands from modern-day investors plays an important role. Here are the features that matter most in 2026!

Cross-Chain Staking

Cross-chain staking allows users to stake assets across multiple blockchain networks from a single platform. Instead of being limited to one chain, investors can participate in staking opportunities in different ecosystems such as Ethereum, Solana, or BNB Chain.

This improves flexibility and helps users place their capital where conditions are most favorable. For platforms, cross-chain support increases liquidity and attracts a wider range of users.

Modular Reward Engine

A modular reward engine enables staking platforms to design and adjust reward structures without disrupting the entire system. This means rewards can be tailored based on staking duration, asset type, or market conditions.

Platforms can introduce new incentive models or fine-tune existing ones while maintaining stability. For investors, this results in more predictable and transparent rewards aligned with long-term sustainability.

Real-Time Risk Monitoring

Real-time risk monitoring provides continuous visibility into potential risks associated with staking. This includes tracking price movements, liquidity levels, and network-related risks such as slashing.

Instead of reacting after losses occur, users can see risk indicators and alerts as conditions change. This level of transparency builds confidence and helps investors make informed decisions about their staked assets.

Automated Liquidity Tools

Automated liquidity tools handle routine actions such as compounding rewards or rebalancing assets without requiring constant user input. These tools ensure that staking rewards are efficiently reinvested or allocated to maintain optimal returns.

By reducing manual effort, automation improves capital efficiency and makes staking more accessible, especially for users who prefer a hands-off approach.

Simple & Intuitive UX

A simple and intuitive user experience ensures that staking is easy to understand and use, even for non-technical users. Clear onboarding steps, straightforward dashboards, and transparent performance tracking help users feel confident in their actions.

A well-designed UX reduces errors, improves trust, and encourages long-term participation from both retail and institutional investors.

The End Note

That’s it for this blog!

As DeFi continues to mature, staking has become a core revenue pillar for modern DeFi platforms.

In 2026, successful staking platforms are those that go beyond basic reward distribution and focus on building systems that are secure, flexible, and transparent. Investors are looking for confidence, not complexity, and platforms that deliver clarity and control are earning long-term trust.

Features like cross-chain staking, modular reward engines, real-time risk monitoring, automated liquidity tools, and a simple user experience are no longer optional.

At Technoloader, we closely track these shifts in the DeFi ecosystem and help businesses design staking platforms that are built for scalability and long-term growth.

So, reach out to us now!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com