If you have been exploring crypto for a while, you would have heard the buzz around DeFi vs traditional finance. And clearly, DeFi wins the battle!

From earning passive income to borrowing without a bank, decentralised finance is reshaping how we interact with funds. But with so many DeFi platforms popping up, the real question isn’t just what’s trending. Well, it’s also about what’s trustworthy.

Choosing the right DeFi platform is also a critical decision. No matter whether you are a pro investor or just starting your DeFi journey, this guide breaks down the most trusted DeFi platforms in 2025 so you can grow your crypto portfolio with confidence.

Ready? But first, let’s begin with the basics!

What Are DeFi Platforms?

DeFi platforms, short for Decentralized Finance apps, are basically blockchain-powered platforms that offer traditional financial services, such as lending, borrowing, trading, and earning interest, without the need for banks or other centralized institutions.

They basically operate using smart contracts, which are self-executing programs on blockchain networks like Ethereum. These contracts automatically manage and enforce the terms of transactions, which allows users to interact directly with the platform using just a crypto wallet, without intermediaries or approvals.

Why Trust Matters in DeFi?

Trust is the core of the DeFi space. That’s because, unlike traditional banks, there is no central authority overseeing transactions or protecting users. DeFi platforms operate through smart contracts, which automatically manage funds and execute transactions.

According to a report by Chainalysis, over $2.2 billion was lost to DeFi hacks and scams in 2024 alone. This highlights how important it is to trust the security and integrity of the code before committing your assets.

Additionally, with several DeFi-based projects launched across various blockchains, the ecosystem is crowded with both reputable platforms and risky scams. This makes it important for users to rely on audited smart contracts, transparent development teams, and community trust. Without it, users may hesitate to participate, which may limit DeFi’s potential to reshape the future of finance.

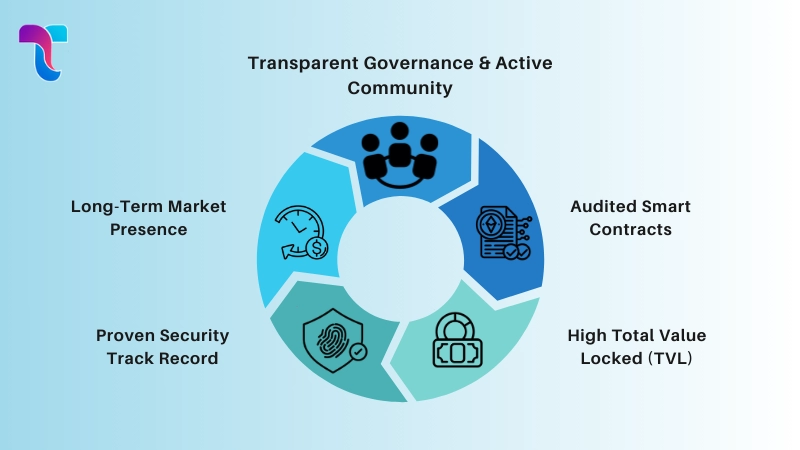

What Makes a DeFi Platform Trusted?

Now, let’s take a look at the key factors that make a DeFi platform trustworthy!

Audited Smart Contracts

A trusted DeFi platform always has its smart contracts audited by reputable cybersecurity firms. These audits check the code for bugs or vulnerabilities that could be exploited. Without audits, even a small coding flaw could lead to millions in losses.

High Total Value Locked (TVL)

TVL refers to the total amount of assets users have deposited into a platform. High-TVL DeFi platforms show a strong sign of trust, where users would not risk locking their funds into a platform unless they believed it was secure and reliable.

Transparent Governance & Active Community

Most DeFi projects are governed by their users through decentralized voting. When a platform allows token holders to vote on updates or changes, it shows a commitment that the project will follow all DeFi regulations in 2025. A strong and active community adds another layer of accountability and support.

Proven Security Track Record

Secure DeFi platforms that have operated for a long time without being hacked or exploited gain a strong reputation in this space. Surviving various market cycles and maintaining user funds safely shows that the platform’s infrastructure is well-built and secure.

Long-Term Market Presence

In a fast-moving industry like crypto, many projects come and go. A platform that has consistently delivered over several years and adapted to market changes is generally more trustworthy than a newly launched project with no track record.

Comparison Table: The Best DeFi Platforms in 2025

Before moving in-depth, let’s have a glance at the top DeFi platforms that are making waves!

| Platform | Main Feature | Best For | Why Trusted in 2025 |

| Uniswap (UNI) | Token swaps via AMM (DEX) | Traders & liquidity providers | Largest DEX, audited, huge liquidity pools |

| Aave | Lending & borrowing | Passive income seekers | Strong audits, transparent governance, high TVL |

| MakerDAO (DAI) | Collateral-backed stablecoin | Stable savings & payments | Longest-running DeFi project, reliable DAI |

| Curve Finance | Low-slippage stablecoin swaps | Stablecoin traders | Specialized liquidity pools, secure, massive adoption |

| Compound | Algorithmic lending market | Beginners in lending/borrowing | Early DeFi pioneer, consistent audits |

| Lido Finance | ETH staking with stETH | Ethereum holders | Leading ETH staking protocol, liquid staking leader |

| Balancer | Customizable liquidity pools | Advanced users & institutions | Flexible pools, multiple audits |

| SushiSwap | DEX + yield farming | Multi-feature DeFi users | Community-driven governance, strong ecosystem |

| PancakeSwap | DEX + staking + lottery + NFTs | BNB Chain users | Binance ecosystem support, wide adoption |

| Yearn Finance | Automated yield strategies | Yield farmers & investors | Transparent, decentralized governance |

Working with a trusted DeFi development partner can begin to incorporate security and governance that aligns with these trust factors from day one, as security and governance determine the success of projects.

Top 10 Most Trusted DeFi Platforms in 2025

Now, let’s discuss each of the best DeFi platforms in depth that are gaining widespread popularity in the crypto space!

Uniswap (UNI)

Uniswap is a leading DeFi platform that functions as one of the major decentralized exchanges (DEX) that allows users to swap Ethereum-based tokens seamlessly without intermediaries. It uses an automated market maker (AMM) model to provide liquidity and enable smooth and permissionless trading, which makes it a popular choice for decentralized token swaps.

| PROS | CONS |

| User-friendly interface | High Ethereum gas fees |

| Wide token selection | Vulnerable to impermanent loss |

| Decentralized and permissionless | Limited to Ethereum-based tokens |

Aave

Aave is a popular DeFi lending and borrowing platform where users can earn interest or borrow assets without traditional banks. It offers flexible loan terms and innovative features like flash loans, which make it a powerful tool for DeFi users.

| PROS | CONS |

| Supports multiple assets | Complex for beginners |

| Flash loans feature | Interest rates can be volatile |

| Strong security audits | Requires understanding of collateralization |

MakerDAO (DAI)

MakerDAO is the platform behind DAI, a stablecoin pegged to the US dollar. It allows users to lock collateral in smart contracts to generate DAI and provides a decentralized and stable asset for trading and lending within the DeFi ecosystem.

| PROS | CONS |

| Stablecoin reduces volatility | Collateral requirements |

| Decentralized governance | Complex for new users |

| Widely accepted in DeFi | Liquidation risk in volatile markets |

Curve Finance

Curve Finance is a decentralized DeFi platform that is optimized for stablecoin trading with low slippage and low fees. It specializes in efficient stablecoin swaps, which makes it ideal for users looking to trade stable assets or earn interest via liquidity provision.

| PROS | CONS |

| Low fees and slippage | Limited to stablecoins |

| High liquidity | The user interface is less intuitive |

| Optimized for stablecoin swaps | Less diverse asset options |

Compound

Compound is a decentralized lending protocol that allows users to earn interest or borrow cryptocurrencies by supplying collateral. It automates interest rates based on supply and demand and provides an efficient and transparent lending market.

| PROS | CONS |

| Easy to use | Gas fees on Ethereum |

| Transparent interest rates | Interest rates can fluctuate |

| Good liquidity | Limited asset support |

Lido Finance

Lido Finance offers DeFi liquidity pools for liquid staking solutions, which allow users to stake assets like ETH while retaining liquidity through tokenized staked assets. This is one of the top DeFi staking platforms that simplifies staking, which makes it accessible and flexible for DeFi users.

| PROS | CONS |

| Liquid staking increases flexibility | Centralization concerns |

| Widely supported across assets | Platform fees apply |

| Simplifies the staking process | Reliance on node operators |

Balancer

Balancer is a decentralized automated portfolio manager and liquidity provider. It allows users to create customizable pools with multiple tokens and varying weights, which enables more flexible and efficient liquidity provision.

| PROS | CONS |

| Flexible portfolio options | It can be complex for beginners |

| Earn fees as a liquidity provider | Higher gas fees on Ethereum |

| Supports multiple tokens | Limited adoption |

SushiSwap

SushiSwap is a decentralized exchange and AMM platform similar to Uniswap but with additional features like yield farming and staking. This is one of the best DeFi yield farming platforms that aims to provide more rewards and governance options for users.

| PROS | CONS |

| Yield farming opportunities | Past security issues |

| Community-driven governance | Lower liquidity than Uniswap |

| Multi-chain support | Complex for new users |

PancakeSwap

PancakeSwap is a popular decentralized exchange on Binance Smart Chain that offers fast and low-cost token swaps. It also includes yield farming, lotteries, and NFTs, which makes it a versatile DeFi platform.

| PROS | CONS |

| Low transaction fees | BSC centralization concerns |

| Fast transaction speeds | Limited to BSC tokens |

| Wide range of DeFi features | Smaller ecosystem than Ethereum |

Yearn Finance

Yearn Finance automates yield farming strategies to maximize user returns on deposited crypto assets. It simplifies complex DeFi investments by managing funds through vaults and strategies, and thus, it is widely known as the safest DeFi platform for beginners.

| PROS | CONS |

| Automated yield optimization | High fees during peak times |

| Simplifies DeFi for users | Limited asset options |

| Strong community | Some strategies carry risks |

Wrapping Up

That’s a wrap for this blog!

DeFi is revolutionizing the way we manage and grow our money. It even offers access, transparency, and control over financial assets.

However, with the rapid growth of the space comes the need to choose platforms that prioritize security, trust, and long-term stability. By focusing on the top DeFi platforms, you can easily maximize your crypto’s potential.

If you are inspired and want to build a secure and reliable platform with trusted DeFi protocols, Technoloader is here to help. Let’s build a robust DeFi solution that stands out in the market!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com