Table of Contents

Do you ever wish to take the emotion out of crypto trading and let a bot do the work for you, day and night? Well, that’s exactly what a grid trading bot does!

Be it you are new to automated trading or just exploring smarter ways to make a profit from market volatility, grid trading bots are the best way. It works on one simple strategy: buy low, sell high, and repeat.

And you are not alone in using crypto trading bots for automation. A recent report revealed that almost 70-80% of all trades in 2024 use trading bots to boost their efficiency and minimize emotional decisions.

Coming back to the point – grid trading bots. Do you want to learn more about it? That’s what this blog is all about.

Read it till the end!

What is a Grid Trading Bot?

Starting straight away, a grid trading bot is an automated program that helps traders capitalize on price fluctuations in the crypto space. It works by setting buy and sell orders at different price levels within a predetermined range.

These follow a grid trading strategy, as in when the price dips, the bot automatically buys the asset at a lower price. On the other hand, when the prices steadily rise, the grid bot crypto sells the asset at a higher price.

Most crypto traders consider it a buy-low, sell-high bot that aims to capture small profits from trades. Grid bots use a volatility trading strategy, where prices swing back and forth within a range.

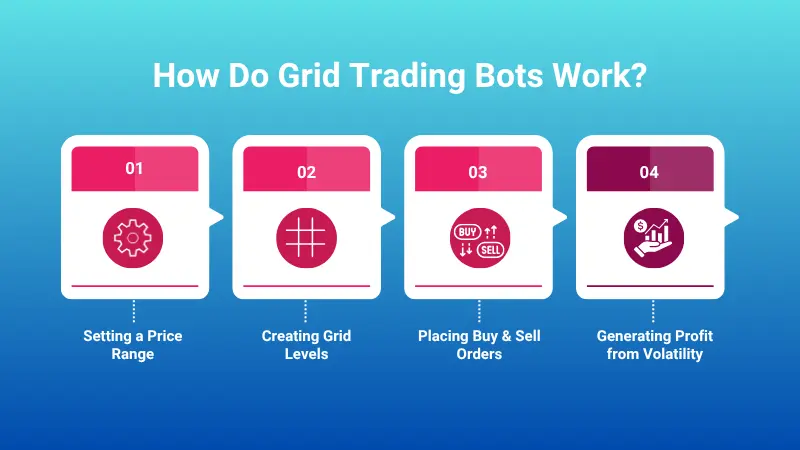

How Do Grid Trading Bots Work?

Now, let’s have a look at how grid bots work in simple terms:

Setting a Price Range

First, it requires defining the upper and lower limits of the price range where the bot will operate.

Creating Grid Levels

Next, you need to divide the price range into several levels or grids. For example, if your price range lies somewhere between $10,000 and $12,000 with 10 levels, each of the grid levels will be spaced $200 apart.

Placing Buy & Sell Orders

- When the price level drops to a particular grid level, the bot executes a buy order.

- When the price level rises to a particular grid level, the bot executes a sell order.

Generating Profit from Volatility

That’s how the grid bots earn small profits. They do so by repeating this process with the price fluctuations within the predefined range.

Still confused? Let’s understand this with a simple grid bot trading example:

If the price of a Bitcoin is $25,000 and the grid level of your bot that you have set is $24,000 (buy) and $25,500 (sell), the bot buys at $24,000 and sells at $25,500.

Key Features of Grid Trading Bots

Here are the key features that make grid trading bots a preferred choice for both beginners and experienced traders:

Automated Order Execution

Grid bots automatically place buy and sell orders at predefined intervals within a specified price range. This eliminates the need for manual trading and ensures timely execution based on market movements.

Customizable Grid Parameters

Users can configure key settings such as the number of grid levels, investment amount per order, and upper/lower price limits. This allows traders to tailor the bot to specific market conditions and trading strategies.

Quick Returns

One of the key features of grid bots is their performance in sideways markets. By continuously executing trades as prices fluctuate within a range, they can easily generate great returns without relying on long-term trends.

24/7 Non-Stop Trading

Unlike human traders, grid bots operate around the clock without emotional bias. They can respond to market changes instantly, which ensures no trading opportunity is missed, even in the middle of the night.

Performance Monitoring & Analytics

Most crypto trading bots that utilize a grid strategy come with built-in dashboards that provide real-time data, performance metrics, and historical trade logs. This helps traders make informed adjustments when needed.

Benefits of Using Grid Trading Bots

Here are some of the major benefits of using a crypto grid bot for automating your trading in the crypto space:

- Utilizes Best Trading Strategy

Grid bots have been around for quite a long time and use a sideways market strategy to generate profits. Professional crypto traders have also been using this approach for decades on different crypto platforms.

- Easy to Use

The strategy that grid trading bots use is easy to use and understand, as there are no sophisticated calculations involved or any specific kind of market indicators. This makes setting up the strategy of a grid trading bot for beginners easy and quick.

- Enhance Risk Management

Utilizing grid bots for trading in the crypto markets allows traders to control their risk and reward level more actively than other trading strategies. This enables traders to generate profits with almost little or no risk.

- Automates Trading

Grid trading uses an algorithmic trading system that automates traders’ actions. By using a grid trading strategy, a crypto trading bot helps traders generate profits quite effectively.

- Adaptability

Grid bots use the basic concept of buying low, selling high, and then earning through the difference. You can set the grids for short duration to generate profits from minor price fluctuations, or for the long-term by selecting grids and leaving them for months to gain profits.

Popular Platforms That Support Grid Bots

The below-mentioned are some of the most popular crypto platforms that support grid trading bots:

Pionex

Pionex is a crypto exchange platform with built-in trading bots, which means you don’t need external software or API connections. It is best for beginner-friendly traders and requires no technical setup.

Key Features:

- Free to use grid bots

- Spot and futures grid bots

- Preset strategies for beginners

- Mobile and web access

- 16+ different bot strategies (including DCA, Infinity Grid, and Leveraged Grid)

KuCoin

KuCoin is a major crypto exchange platform that integrates a wide range of trading bots, including grid bots. It combines a strong exchange reputation with robust bot tools.

Key Features:

- Grid bots for both spot and futures trading

- Strategy sharing and community signals

- AI-based parameter recommendations

- Backtesting tools and performance tracking

Binance

Binance is the world’s largest crypto exchange. It now offers built-in grid trading bots on both spot and futures. Binance’s grid bots are more flexible than others, but may be overwhelming for beginners.

Key Features:

- Manual or AI-optimized grid setup

- High liquidity across all pairs

- Cross and isolated margin options for futures grid bots

- Grid bot support in the mobile app

3Commas

3Commas is basically a third-party trading automation platform that connects to your exchange accounts via API. It is one of the most powerful bot platforms and works across your entire portfolio.

Key Features:

- Advanced customizable grid bots

- Support for many exchanges (Binance, KuCoin, Coinbase Pro, Bybit, etc.)

- Smart Trade features (TP, SL, DCA)

- Copy-trading and bot marketplace

Bitsgap

Bitsgap is another all-in-one trading and automation platform that focuses on grid and arbitrage bots. It is best for users who want a simple setup with powerful features and trade across different exchanges.

Key Features:

- Grid bots with built-in backtesting

- Connects to 15+ exchanges

- User-friendly drag-and-drop grid interface

- Portfolio tracking and unified trading terminal

When to Use a Grid Trading Bot

Grid trading bots are powerful tools that automate buying low and selling high within a specified price range. However, they perform best under specific market conditions and can fail if used blindly.

So, when exactly should you use a grid trading bot? Let’s check it out!

- In Sideways Markets

This is the ideal scenario for developing grid trading bots. When an asset is fluctuating, say somewhat in between $1,800 and $2,200, grid trading bots can then buy at low and sell at high. Since this bot thrives on price fluctuations, a sideways market offers maximum profit potential.

- During High Volatility

Markets that swing sharply up and down are another time to utilize grid bots. That’s because these take advantage of frequent price movements by executing buy-low and sell-high trades automatically.

- For Passive Income or Strategy Testing

Grid trading bots are often used by traders looking to generate passive income through regular small profits. Or, it can be used to test automated strategies without the need to monitor the market 24/7. Most of the platforms even offer backtesting tools to see how your set grids would have performed historically.

It’s a Wrap

This brings us to the end of this blog!

Grid trading bots offer a powerful and practical solution for traders looking to automate their strategies and profit from rapid market fluctuations, especially in volatile markets.

Be it you are a beginner looking for hands-free trading or an experienced investor willing to optimize your strategy for steady returns, grid bots can be a valuable addition to your crypto trading toolkit.

On the other hand, if you are ready to utilize the power of automated trading, Technoloader is here to help.

Reach out to us, and let’s build an automated trading bot that works for you!

+91 7014607737

+91 7014607737

info@technoloader.com

info@technoloader.com