With the enhancing popularity of crypto at the global level, the number of crypto exchange platforms has considerably increased. There are various types of crypto exchange platforms and one among them which is the talk of the town is the OTC Crypto Exchange Platform. Many of the entrepreneurs have shown keen interest in developing such crypto trading platforms for their businesses.

In the ever-evolving world of cryptocurrencies, Over-The-Counter (OTC) crypto exchange platforms have emerged as pivotal players. This blog will delve into the realm of OTC crypto exchanges and why Technoloader stands as the top choice for your crypto exchange development services.

Want to develop OTC Exchange Platform 🤔

Call/whatsapp : 👉 +91 7014607737 | Telegram : 👉 @vipinshar

Table of Contents

What is an OTC Crypto Exchange Platform?

An Over-The-Counter (OTC) crypto exchange platform is a specialized marketplace where big crypto traders, and institutional investors, can engage in the trading of bulk cryptocurrencies directly with one another. Unlike traditional exchanges, OTC platforms facilitate discreet and efficient transactions.

This unique environment allows investors to execute substantial orders without causing significant market price fluctuations. OTC crypto exchanges serve as intermediaries, connecting buyers and sellers of digital assets, offering privacy, reduced price impact, and access to a broader range of cryptocurrencies. These platforms have gained popularity for their ability to cater to the specific needs of sophisticated investors and institutions in the dynamic world of cryptocurrencies.

How Does OTC Crypto Exchange Work?

An Over-The-Counter (OTC) crypto exchange functions as a critical intermediary for facilitating large-volume cryptocurrency transactions. The process begins when a buyer or seller expresses their trade requirements to the OTC platform. These requirements typically include the desired quantity and price.

Subsequently, the OTC platform sources quotes from a network of liquidity providers and market makers to present the most favourable pricing options to the clients. The negotiation phase ensues, enabling the platform to facilitate price discussions between the involved parties, ensuring that both buyers and sellers reach an agreement that aligns with their respective terms.

Once an agreement is reached, the OTC platform takes charge of a secure and efficient settlement process. This includes the transfer of assets and the payment process, minimizing counterparty risk and ensuring transaction security. By orchestrating this comprehensive process, OTC exchanges enable large trades to be executed discreetly, efficiently, and without causing undue market volatility, making them a preferred choice for those navigating the dynamic realm of cryptocurrency trading.

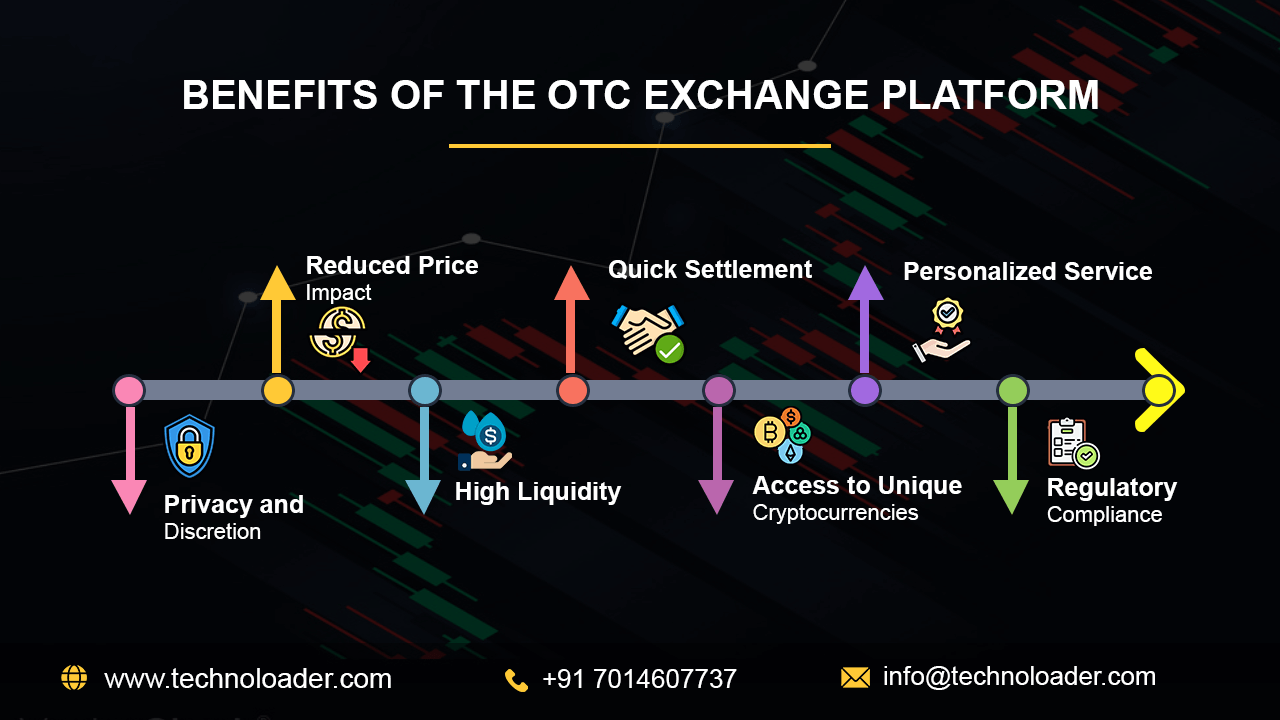

Benefits of the OTC Exchange Platform

After knowing about this trading software, let us explore the major benefits of the OTC Exchange Platform.

- Privacy and Discretion

OTC trading ensures a high level of privacy as transactions occur off the public order book. This protects sensitive information and maintains trader anonymity, a critical feature for many investors.

- Reduced Price Impact

One of the key advantages of OTC platforms is the ability to execute large trades without causing significant price fluctuations. This reduces the market impact, ensuring traders get better pricing options.

- High Liquidity

OTC markets offer substantial liquidity, making it easier to execute substantial trades efficiently. Liquidity providers and market makers contribute to a deep order book, enhancing trade execution.

- Quick Settlement

OTC exchanges often provide faster settlement times compared to traditional exchanges. This reduces counterparty risk and enhances transaction security, offering peace of mind to traders.

- Access to Unique Cryptocurrencies

OTC platforms provide access to a broader range of digital assets, including those not typically found on standard exchanges. This diversification of available assets can be a significant advantage for traders.

- Personalized Service

OTC providers offer a tailored and high-touch service, ensuring clients’ specific needs are met. Traders can benefit from dedicated assistance and a more customized trading experience.

- Regulatory Compliance

Many OTC platforms adhere to regulatory standards, which makes them a safer option for institutional investors and traders. These platforms often employ rigorous security measures and know-your-customer (KYC) processes, enhancing the overall safety and legitimacy of transactions.

Use Cases of OTC Crypto Exchange

OTC Crypto Exchange Platforms are being used by crypto traders in many aspects. We can have a brief overview of the key use cases of the OTC Trading Platform.

- Institutional Trading

OTC platforms are the preferred choice for institutional investors, allowing them to execute substantial cryptocurrency transactions without adversely affecting market prices.

- High-Net-Worth Individuals

Affluent individuals use OTC exchanges to discreetly acquire or liquidate significant cryptocurrency holdings, preserving their privacy.

- Token Sales

OTC markets are instrumental in token sales, allowing projects to distribute tokens in bulk to strategic partners or investors.

- Price Arbitrage

Traders use OTC platforms for arbitrage opportunities between exchanges, capitalizing on price differentials for profit.

- Custody Solutions

OTC exchanges often offer secure custody services, ensuring the safe storage of digital assets for their clients. These use cases collectively contribute to the growing significance of OTC platforms in the cryptocurrency ecosystem.

How Much Does it Cost to Develop OTC Crypto Exchange?

The OTC Crypto Exchange Development Cost can vary considerably, depending on the project’s complexity, required features, and customizations. Typically, the cost falls within the range of $10,000 to $50,000. For an accurate estimate tailored to your project, it is advisable to consult with experienced blockchain development companies.

Why Hire Technoloader as Your Crypto Exchange Development Company?

Technoloader is a top cryptocurrency exchange software development company for several compelling reasons. We boast a seasoned team of crypto exchange developers, with a proven track record of creating successful OTC exchange platforms. Their extensive experience ensures that your project is in capable hands.

We specialize in offering customized crypto exchange services, tailoring every aspect of the platform to meet your unique business requirements. Your platform will be meticulously designed to align seamlessly with your vision.

Regulatory compliance is paramount, and Technoloader excels in navigating the complex regulatory landscape, ensuring that your platform adheres to industry standards and stringent security measures. Technoloader provides dedicated, round-the-clock support, ensuring any issues are addressed promptly and effectively, guaranteeing the seamless and uninterrupted operation of your platform.

With competitive pricing and a commitment to delivering value for your investment, Technoloader is the partner of choice for your crypto exchange development project.

Quick Contact Us :

Call/whatsapp : 👉 +91 7014607737

Telegram : 👉 @vipinshar

Email : 👉 [email protected]

FAQ: Frequently Asked Questions

- What is the OTC Crypto Exchange Platform?

An OTC crypto exchange platform is a specialized market where substantial cryptocurrency trades occur directly, catering to high-net-worth individuals, institutional investors, and traders. In contrast to conventional exchanges, OTC platforms allow for large transactions without causing significant market price fluctuations, ensuring discretion and efficiency in trading activities.

- Which is the Best Crypto Exchange Development Company?

Technoloader can be regarded as the best crypto exchange development company for various reasons as it is having experience of more than 6 years in offering blockchain development solutions. Also, their team of blockchain professionals is highly skilled and experienced in providing custom crypto exchange development services.

- How Much Does it Cost to Create a Crypto Exchange Platform?

However, the crypto exchange platform development cost depends upon various factors such as the geographical location of your business, the complexity of the project, the feature you want to incorporate, the type of exchange and the crypto exchange developer you hire. However, the overall cost is anywhere between $10000-$50000.

- How Much Time Does it Take to Develop a Crypto Exchange Software?

The timeline to develop a crypto exchange platform depends upon various factors such as complexity and type of exchange you want to develop. Crypto exchange can be developed anywhere between 2 months to 12 months.